Enlarge image

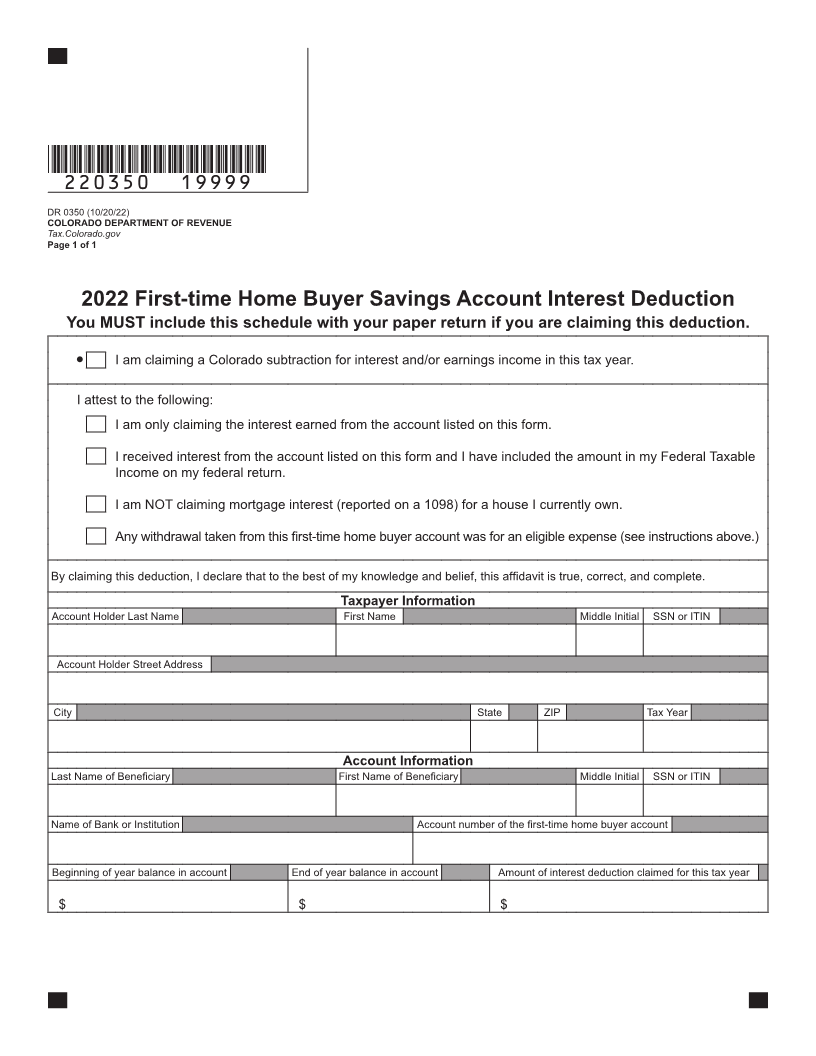

DR 0350 (10/20/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

Instructions for First-time Home Buyer Savings Account

Interest Deduction

You must complete this form annually and file it with your c. Expenses that would have qualified under

income tax return if you open and designate an account paragraphs 1 or 2 above, but the contract for

as a first-time home buyer account. Please carefully read purchase did not close;

all of the instructions, fully fill out the form, and submit d. As a transfer to another newly created first-

it with your income tax return with all of the requested time home buyer savings account; or

documentation for each first-time home buyer account

you designate. Keep all of your account statements for e. To pay a service fee that is deducted by the

the first-time home buyer account. financial institution.

If you are claiming a first-time home buyer savings account 2. I have not and will not claim any deduction for

interest deduction, check the applicable box at the top of interest or other income earned on contributions

form DR 0350. You must submit account statements AND a to my first-time home buyer savings account

1099 showing only the taxable interest and/or earnings exceeding $14,000 ($28,000 for account holders

on the account in the tax year claimed. Upon withdrawal, who file a joint return) for a taxable year or

you must also submit a real estate settlement statement that $50,000 for all taxable years.

shows that the withdrawal was used for an eligible expense. 3. The amount in my first-time home buyer savings

Eligible expenses are down payments or closing costs that account will not exceed $150,000.

are included on the settlement statement (including, but not

4. Money withdrawn from a first-time home buyer

limited to, appraisal fees, mortgage origination fees, and

savings account is subject to recapture and/or

inspection fees.)

penalty in the taxable year in which it is withdrawn

If claiming a deduction for multiple accounts, this form as explained in section 39-22-4705(2), (3), and

must be completed for each account. The total amount (4), C.R.S., if

of subtraction claimed from all first-time home buyer

a. At the time of the withdrawal, it has been less

savings accounts for this tax year should be transferred

than a year since the first deposit in the first-

to form DR 0104AD, line 19.

time home buyer savings account;

To support my claim for the first-time home buyer savings

b. The money is used for any purpose other than

account interest deduction, I attest:

those listed above; or

1. The money in my first-time home buyer

savings account 1will only be used for the c. The account holder(s) die.

following purposes, as provided by section 39-

1

22-4705, C.R.S.: A “first-time home buyer savings account” is an account with a financial

institution designated as such in accordance with section 39-22-

a. Eligible expenses related2 to a qualified 4704(1) § 39-22-4703(6), C.R.S.

beneficiary’s 3purchase of his or her primary 2 “Eligible expenses” are a down payment and any closing costs included

residence in Colorado on a real estate settlement statement, including, but not limited to,

appraisal fees, mortgage origination fees, and inspection fees. § 39-22-

b. Eligible expenses related to a qualified 4703(3), C.R.S.

beneficiary’s purchase of his or her primary 3 A “qualified beneficiary” is a first-time home buyer designated by an

residence in or outside the state, if the account holder for whom the money in a first-time home buyer savings

qualified beneficiary is active-duty military and account is or will be used for eligible expenses for the purchase of his or

was stationed in Colorado for any time after her primary residence in the state. § 39-22-4703(7), C.R.S.

the creation of the account;