Enlarge image

DR 0113 (11/07/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

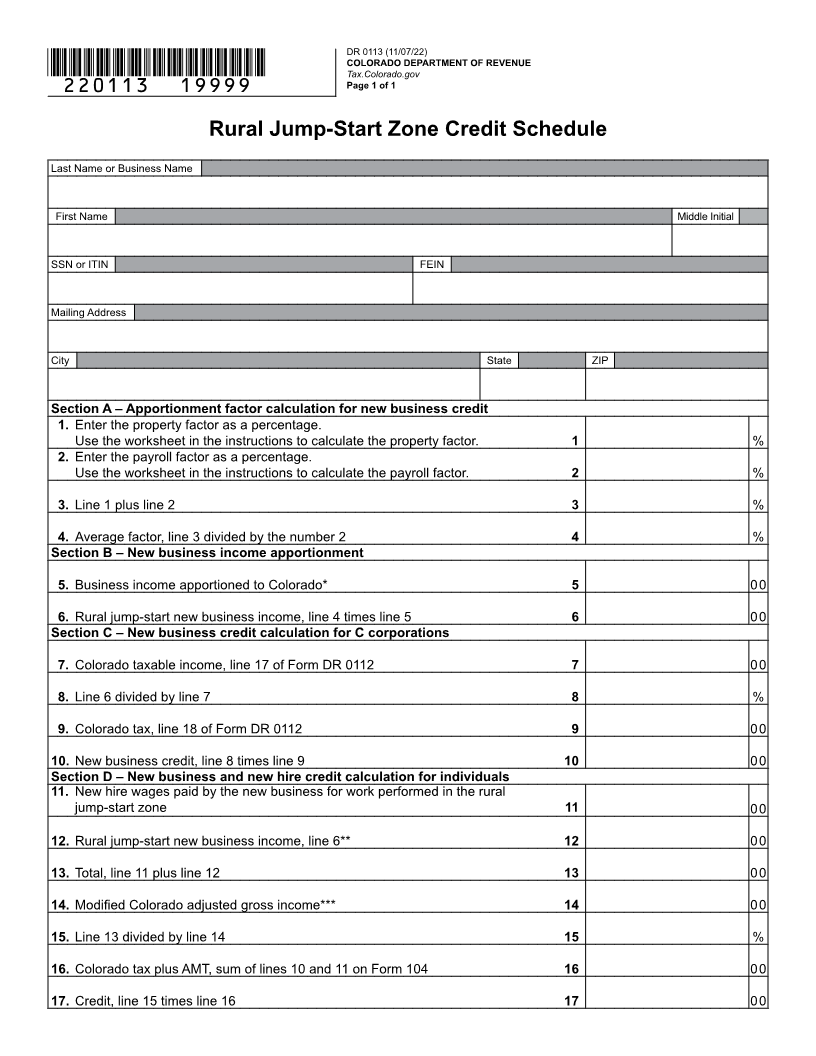

Rural Jump-Start Zone Credit Schedule

Instructions

Use this schedule to calculate and claim a Rural Jump- * For sole proprietorships of Colorado nonresident

Start Zone Credit. Round dollar amounts to the nearest individuals, new business income included in line 15 of

whole dollar. Calculate percentages to the fourth decimal DR 0104PN

place. Round to four significant digits, e.g. xxx.xxxx C corporations complete section C to calculate the amount

Complete Section A to determine your apportionment of new business income credit allowed. Transfer the amount

factor for the new business credit. This apportionment on line 10 of the DR 0113 to line 24 of the DR 0112CR.

factor applies if you conduct business both inside and Complete section D if you are an individual with eligible

outside of the Rural Jump-Start Zone boundaries. If new hire wages and/or new business income.

100% of your business property and payroll are within

Rural Jump-Start Zone boundaries, you may skip the ** To complete line 12, if the individual is a partner

worksheet, enter “100%” on line 1 and line 2 of the DR or shareholder, include on line 12 only the partner

0113 form, and continue to complete the form. or shareholder’s share of the rural jump-start new

business income calculated by the partnership or S

Complete Section B to calculate your Rural Jump- corporation.

Start Zone new business income using the income

apportioned to Colorado and the property and payroll *** To complete line 14 for resident individuals, federal

factor for the new business credit. To complete line 5, the adjusted gross income plus the sum of lines 3 through

business income that is apportioned to Colorado can be 6 of Form 104 (not including any charitable contribution

found on your return in the following locations: addback) minus all subtractions on Form DR 0104AD,

* For C corporations, line 12 of DR 0112RF except qualifying charitable contributions on Line 11.

* For S corporations and partnerships, line 11 of To complete line 14 for nonresident individuals, line 33 of

DR 0106 Part IV Form DR 0104PN.

* For sole proprietorships of Colorado resident Transfer the amount on line 17 of the DR 0113 to line 42

individuals, net profit or loss from line 31 of Federal of the DR 0104CR.

Schedule C

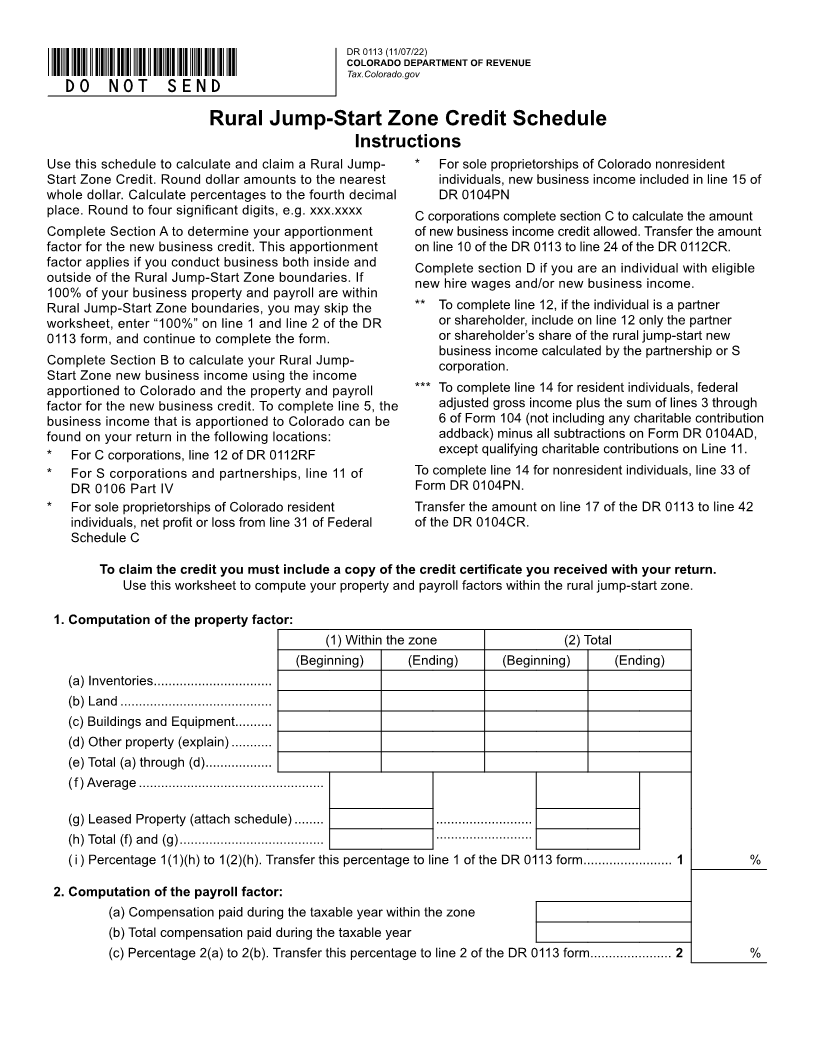

To claim the credit you must include a copy of the credit certificate you received with your return.

Use this worksheet to compute your property and payroll factors within the rural jump-start zone.

1. Computation of the property factor:

(1) Within the zone (2) Total

(Beginning) (Ending) (Beginning) (Ending)

(a) Inventories ................................

(b) Land .........................................

(c) Buildings and Equipment ..........

(d) Other property (explain) ...........

(e) Total (a) through (d) ..................

( f ) Average ..................................................

(g) Leased Property (attach schedule) ........ ..........................

(h) Total (f) and (g) ....................................... ..........................

( i ) Percentage 1(1)(h) to 1(2)(h). Transfer this percentage to line 1 of the DR 0113 form ........................ 1 %

2. Computation of the payroll factor:

(a) Compensation paid during the taxable year within the zone

(b) Total compensation paid during the taxable year

(c) Percentage 2(a) to 2(b). Transfer this percentage to line 2 of the DR 0113 form ...................... 2 %