Enlarge image

DR 0106K (12/08/22) Page 21

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

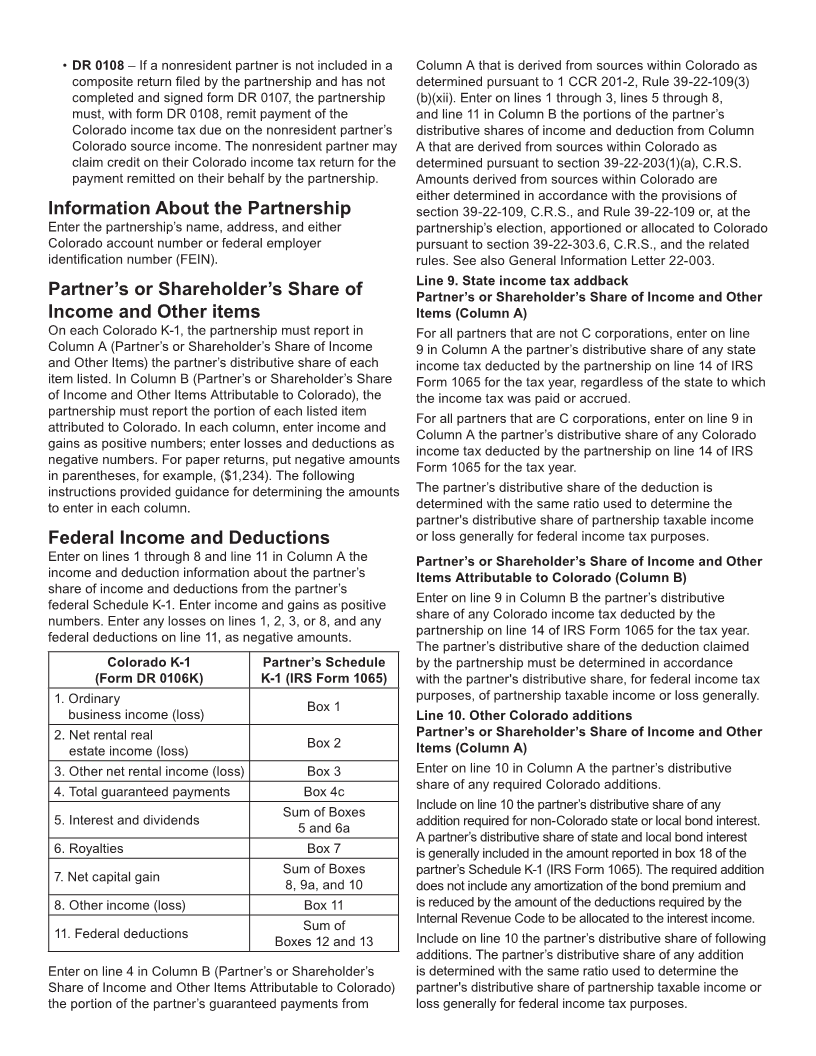

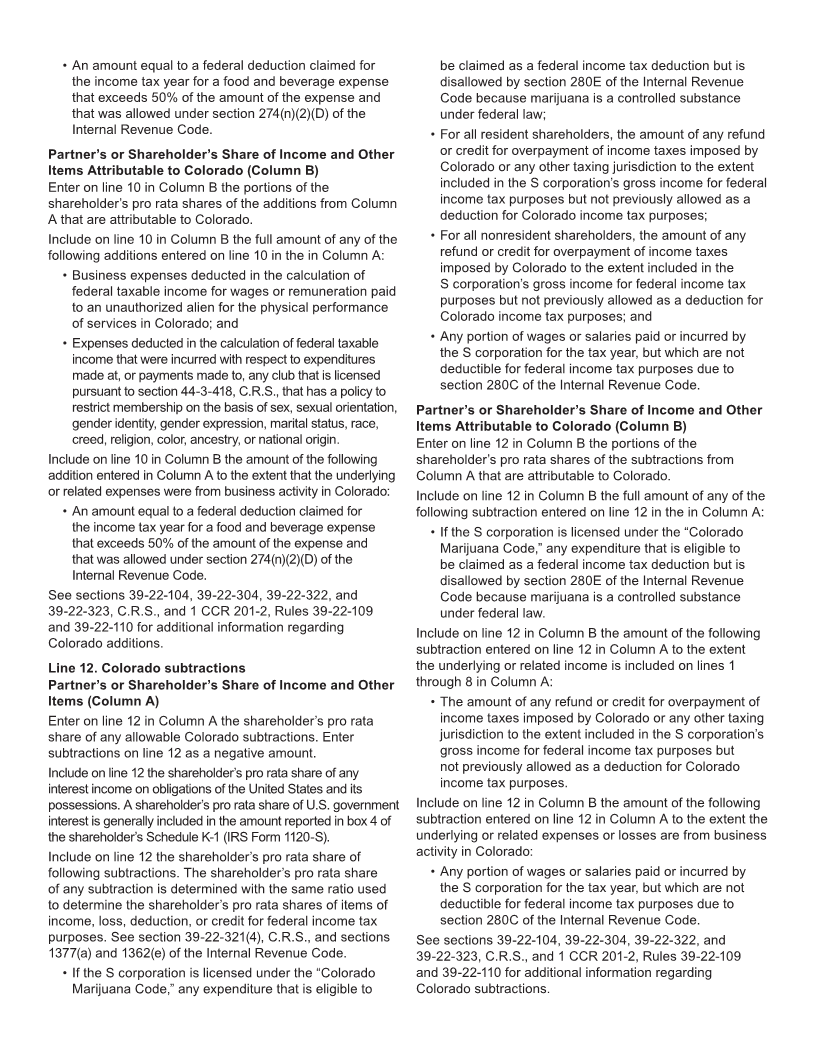

Partnership Instructions for Colorado K-1 (DR 0106K)

Partnerships must complete a Colorado K-1 (DR 0106K) Part-Year Residents & Nonresidents for additional

for each of its partners for each tax year. Completed assistance in determining Colorado residency

Colorado K-1s must be fi led with the Department, as for individuals.

described below. On or before the date the Colorado K-1s • An estate is a Colorado resident if it is the estate of a

are fi led with the Department, the partnership must furnish deceased person that is administered in Colorado in a

each partner with a copy of the Colorado K-1 reporting proceeding other than an ancillary proceeding.

their income, deductions, modifi cations, and credits.

• A trust is a Colorado resident if it is

administered in Colorado.

Due Dates

A C corporation that is a partner in a partnership

Colorado K-1s due to be fi led the fi fteenth day of the fourth is a Colorado resident partner if it is organized

month after the close of the tax year, or after the automatic under Colorado law.

six-month extension, if applicable. Colorado K-1s for

A partnership that is a partner in another partnership is a

calendar year 2022 are due on April 15, 2023. If the due

Colorado resident partner if it is organized under Colorado

date falls on a weekend or federal holiday, the Colorado

law. A limited liability company (LLC) that is treated as a

K-1s will be due the next business day.

partnership for federal income tax purposes is treated as a

partnership for Colorado income tax purposes.

Filing Colorado K-1s with the Department

Partnerships must submit a copy of each partner’s Colorado Part-Year Resident Partners

K-1 to the Department. These copies may be submitted in If a partner was a resident for only part of the tax year,

spreadsheet or XML form at Colorado.gov/RevenueOnline. check the box to indicate that they were a resident and

Partnerships may also enter the data manually at complete the Colorado K-1 for the partner following the

Colorado.gov/RevenueOnline. Finally, paper copies may instructions for resident partners.

be submitted with the Annual Transmittal of DR 0106K –

Colorado K-1 Forms cover sheet (form DR 1706) by mail to: SALT Parity Act Election

Colorado Department of Revenue If the partnership has made an election for the tax year

Denver, CO 80261-0006 pursuant to section 39-22-343, C.R.S., to be subject to tax

at the entity level, check the applicable box to indicate the

Do not submit the copies of the Colorado K-1s issued

SALT Parity Act election. A SALT Parity Act election made

to partners (or the DR 1706 transmittal form) as an

by a partnership is binding on all of its partners, regardless

attachment to the partnership’s income tax return.

of whether the partner is an individual, corporation, or other

legal entity, and regardless of whether the partner is a

Completing the Colorado K-1 resident or nonresident.

Fiscal Year Filers Nonresident Partners

If the partnership’s tax year is a fi scal year, enter the dates If the partnership did not make a SALT Parity Act election

the partnership’s fi scal year begins and ends. and the partner is a nonresident of Colorado, check the

applicable box to indicate whether the partnership is, with

Information About the Partner respect to the nonresident partner, fi ling a composite return,

Enter the partner’s name and address. fi ling a DR 0107, or remitting payment with a DR 0108.

Enter the partner’s applicable tax identifi cation number. • Composite Return – A partnership may fi le a

If the partner is an individual, enter the individual’s social composite return on behalf of one or more of its

security number (SSN) or individual taxpayer identifi cation nonresident partners, reporting and remitting the

number (ITIN). If the partner is an estate, trust, corporation, Colorado income tax due on the Colorado-source

partnership, or other legal entity, enter the partner’s federal income of the nonresident partner(s) included in the

employer identifi cation number (FEIN). composite return. If the nonresident partner has no

Check the applicable box to indicate whether the partner is other Colorado-source income, the composite return

a Colorado resident or nonresident. Check the applicable satisfi es their Colorado income tax fi ling obligation

box to indicate the partner is a resident if they were a for the tax year.

Colorado resident for the entire tax year or for any part • DR 0107 – A nonresident partner may complete and

of the tax year. sign form DR 0107 thereby agreeing to fi le a Colorado

• An individual is a Colorado resident if they are income tax return, make timely payment of the tax due,

domiciled in Colorado or if they maintain a permanent and be subject to personal jurisdiction in Colorado for

place of abode in Colorado and spend in the aggregate the purpose of income tax collection. The partnership

more than six months of the taxable year in Colorado. must submit a copy of the signed form DR 0107 with its

See Department publication Income Tax Topic: return (form DR 0106).