Enlarge image

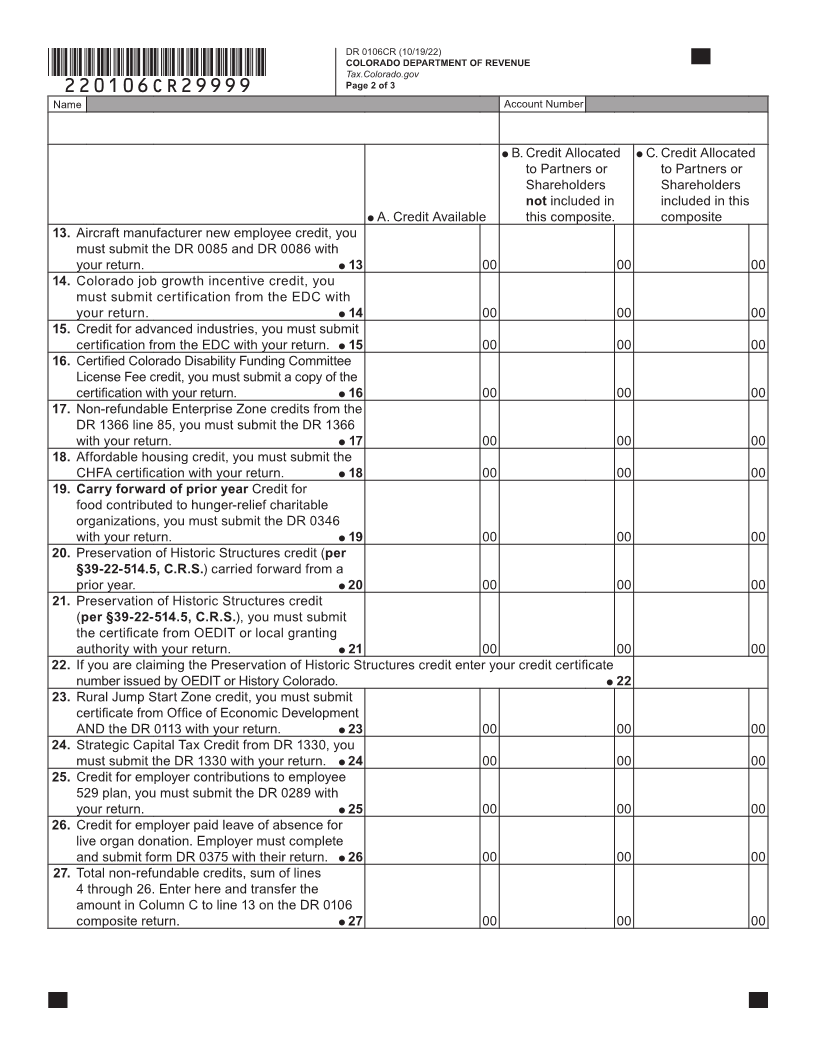

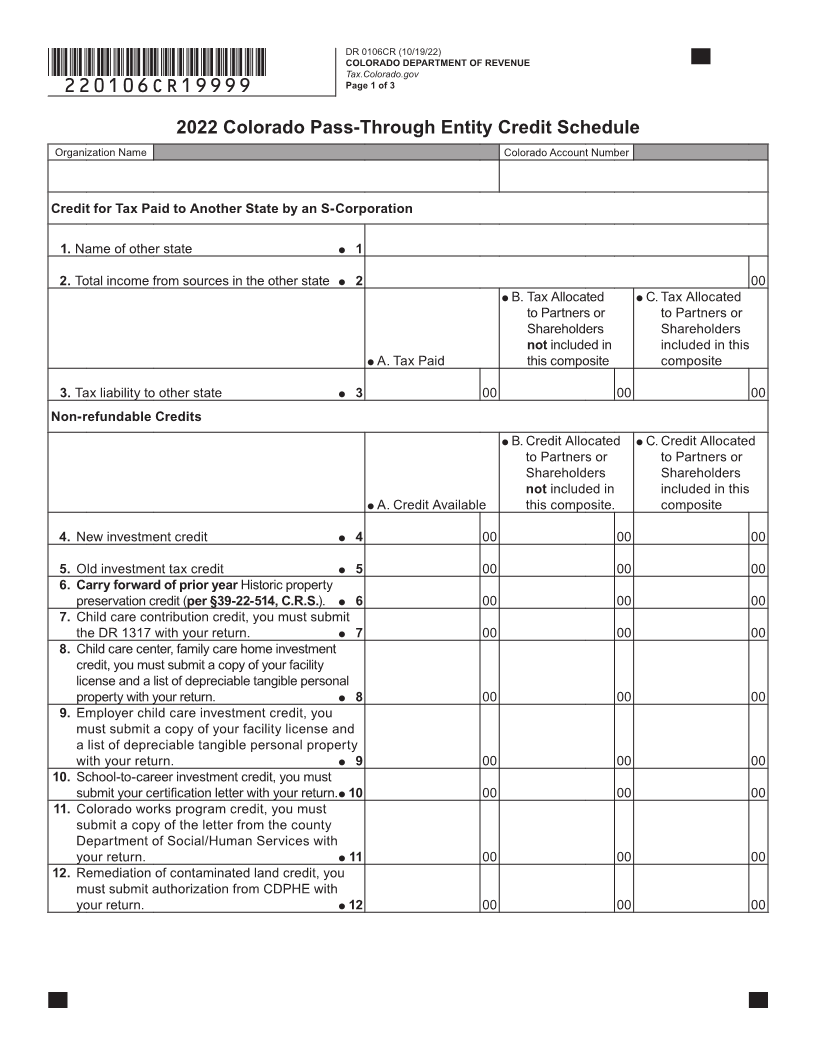

DR 0106CR (10/19/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*220106CR19999* Page 1 of 3

2022 Colorado Pass-Through Entity Credit Schedule

Organization Name Colorado Account Number

Credit for Tax Paid to Another State by an S-Corporation

1. Name of other state 1

2. Total income from sources in the other state 2 00

B. Tax Allocated C. Tax Allocated

to Partners or to Partners or

Shareholders Shareholders

not included in included in this

A. Tax Paid this composite composite

3. Tax liability to other state 3 00 00 00

Non-refundable Credits

B. Credit Allocated C. Credit Allocated

to Partners or to Partners or

Shareholders Shareholders

not included in included in this

A. Credit Available this composite. composite

4. New investment credit 4 00 00 00

5. Old investment tax credit 5 00 00 00

6. Carry forward of prior year Historic property

preservation credit (per §39-22-514, C.R.S.). 6 00 00 00

7. Child care contribution credit, you must submit

the DR 1317 with your return. 7 00 00 00

8. Child care center, family care home investment

credit, you must submit a copy of your facility

license and a list of depreciable tangible personal

property with your return. 8 00 00 00

9. Employer child care investment credit, you

must submit a copy of your facility license and

a list of depreciable tangible personal property

with your return. 9 00 00 00

10. School-to-career investment credit, you must

submit your certification letter with your return. 10 00 00 00

11. Colorado works program credit, you must

submit a copy of the letter from the county

Department of Social/Human Services with

your return. 11 00 00 00

12. Remediation of contaminated land credit, you

must submit authorization from CDPHE with

your return. 12 00 00 00