- 10 -

Enlarge image

|

Page 10

Line 2 Other Income or (Loss) of the Internal Revenue Code because marijuana is a

Enter the total of all other income listed on federal Schedule controlled substance under federal law.

K. For partnerships, this is the total of the amounts entered

To calculate this subtraction, you must create pro forma

on lines 2, 3c, 4c, 5, 6a, 7, 8, 9a, 10 and 11 of federal

federal schedule(s) for Business Profit or Loss as if the federal

Schedule K (IRS form 1065). For S corporations, this is the

government would have allowed the expenditures from the

total of the amounts entered on lines 2, 3c, 4, 5a, 6, 7, 8a,

marijuana business. The Colorado subtraction is the difference

9 and 10 of federal Schedule K (IRS form 1120-S). Also

between the profit/loss as calculated on the ACTUAL

include any gain from the sale of assets subject to section

schedule(s) filed with the federal return and the pro forma

179 of the Internal Revenue Code that is not reported on

schedule(s) described above. You must include the pro forma

Schedule K. Enter income and gains as positive numbers;

schedule(s), the MED license number and the actual federal

enter losses and deductions as negative numbers. For

schedule(s) with your Colorado return to claim this subtraction.

paper returns, put negative amounts in parentheses, for

Show the subtraction on this line 6 as a positive number.

example, ($1,234).

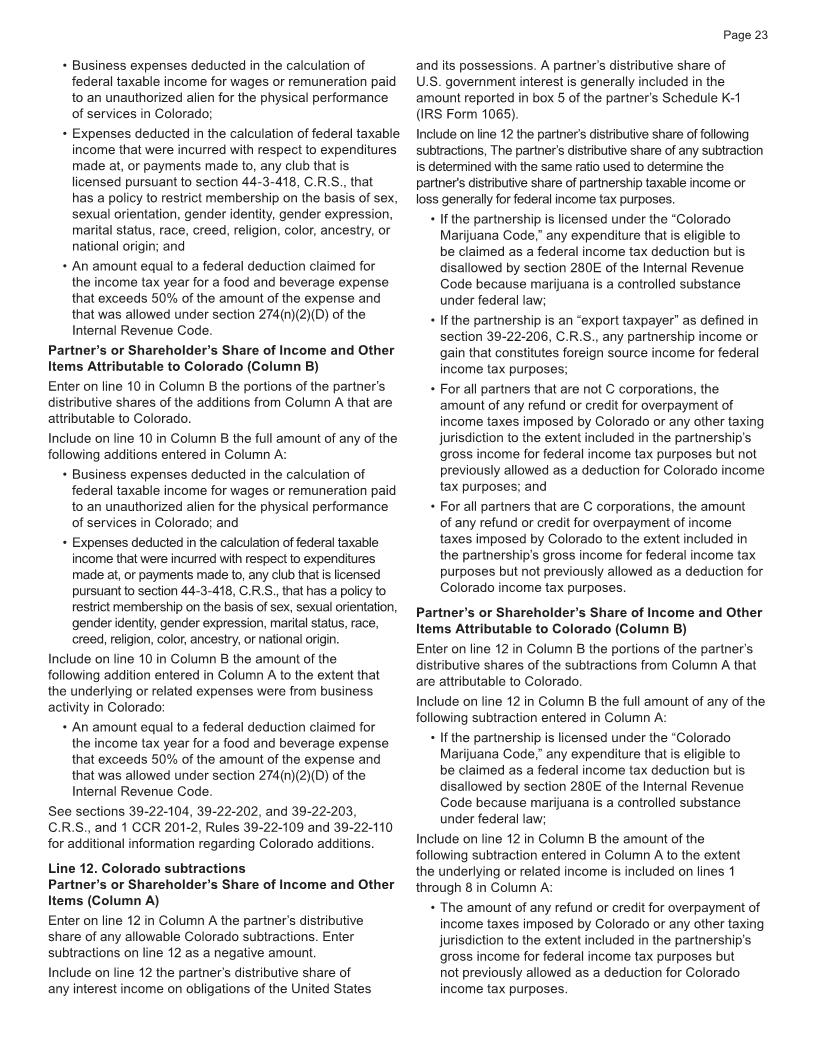

Line 3 Colorado Additions Line 7 Other Colorado Subtractions

To the extent excluded from federal taxable income on To the extent included in the federal taxable income

lines 1 and 2 of this form, enter the sum of the following on line 4 of this form, enter the sum of the following

Colorado additions on this line 3: Colorado subtractions on this line 7:

• Interest income (net of premium amortization) • Any interest income earned on obligations of the

from state or municipal obligations subject to United States government and any interest income

tax by Colorado. Do not include interest from earned on obligations of any authority, commission, or

obligations issued by the State of Colorado or a instrumentality of the United States to the extent such

subdivision thereof. obligations are exempt from state tax under federal law.

• Expenses deducted in the calculation of federal • For partnerships, the modification for foreign source

taxable income for wages or remuneration paid to an income of an export taxpayer. For purposes of this

unauthorized alien for the physical performance of modification, an "export taxpayer" means:

services in Colorado. 1.) any partnership which sells 50% or more of its

products which are produced in Colorado in states

• Expenses deducted in the calculation of federal taxable

other than Colorado, or in foreign countries; or2.) if

income that were incurred with respect to expenditures

the gross receipts of such partnership are derived

made at, or payments made to, any club that is

from the performance of services, such services are

licensed pursuant to section 44-3-418, C.R.S., that

performed in Colorado by a partner or employee of the

has a policy to restrict membership on the basis of sex,

partnership and 50% or more of such services provided

sexual orientation, gender identity, gender expression,

by the partnership are sold or provided to persons

marital status, race, creed, religion, color, ancestry, or

outside of Colorado. If a partnership qualifies as an

national origin.

export taxpayer, it may exclude for Colorado income tax

• An amount equal to a federal deduction claimed for purposes any income or gain which constitutes foreign

the income tax year for a food and beverage expense source income for federal income tax purposes.

that exceeds 50% of the amount of the expense and

• For S corporations, any portion of wages or salaries

that was allowed under section 274(n)(2)(D) of the

paid or incurred by the S corporation for the tax year, but

Internal Revenue Code.

which are not deductible for federal income tax purposes

• For S corporations, any income, war profits, or excess due to section 280C of the Internal Revenue Code.

profits taxes paid or accrued to any foreign country

Show the total subtractions on this line 7 as a positive number.

or to any possession of the United States deducted

by the S corporation on line 12 of IRS Form 1120-S Line 10 Colorado-Source Income

for the tax year. Partnerships

Line 4 Subtotal • If the partnership has no income from business activity

Sum of lines 1 through 3. outside of Colorado, mark the box indicating that all

income is Colorado income, and enter the amount from

Line 5 Federal Deductions

line 9 on this line 10.

Enter the allowable deductions from federal Schedule K. For

partnerships, this is the total of lines 12, 13a, 13b, 13c(2), • For a partnership with income from sources within and

and 13d of federal Schedule K (IRS form 1065); and for S outside of Colorado, refer to the general instructions for

corporations, this is the total of lines 11, 12a, 12b, 12c(2), Apportionment and Sourcing of Income to determine the

and 12d of federal Schedule K (IRS form 1120-S). Show the proper sourcing method.

total deductions on this line 5 as a positive number. • If the partnership is making an election under section

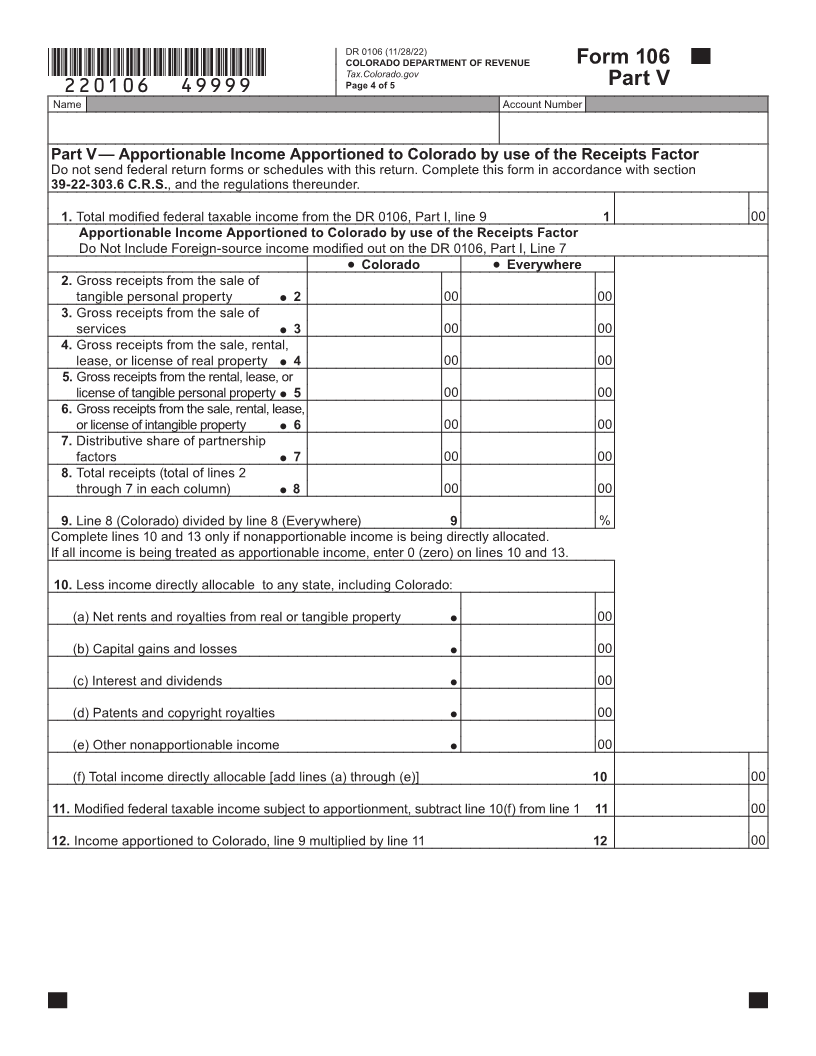

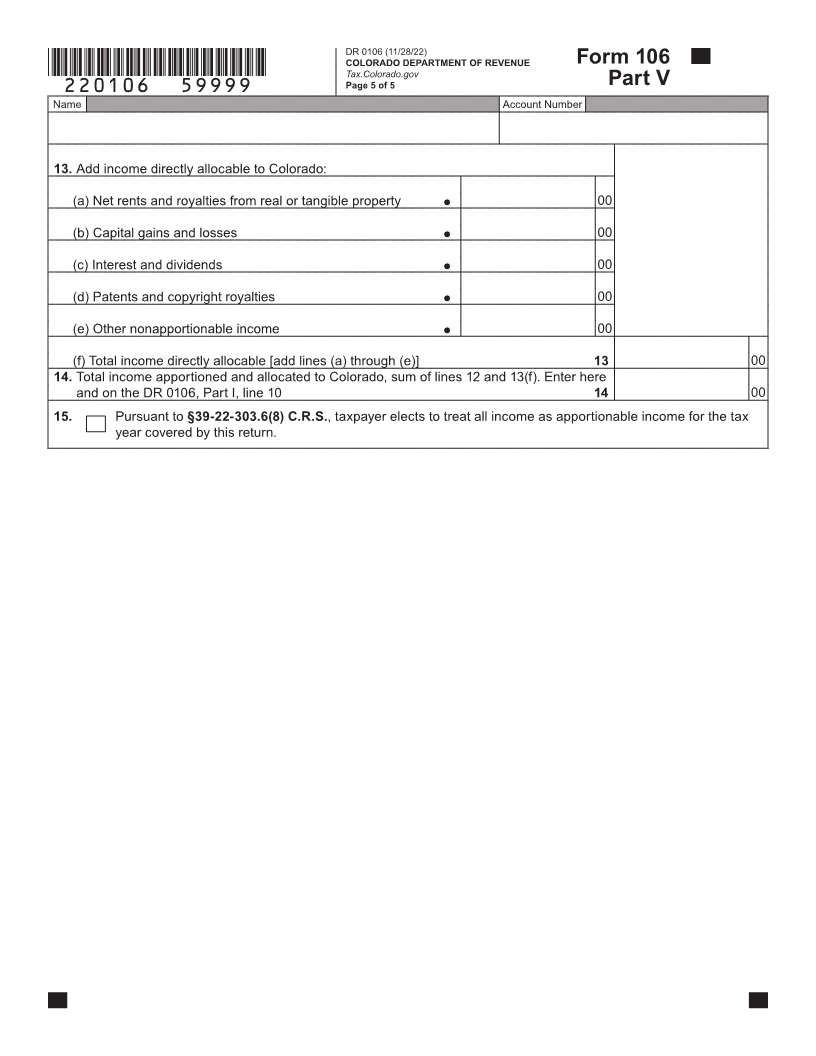

Line 6 Colorado Marijuana Business Subtraction 39-22-203(1)(a) to apportion or allocate income pursuant

For Colorado-licensed marijuana businesses, list any to section 39-22-303.6, C.R.S., mark the Part V box and

expenditure that is eligible to be claimed as a federal complete Part V of this form. Enter the result from line 14 of

income tax deduction but is disallowed by section 280E Part V of this form on this line 10.

|