Enlarge image

DR 1316 (11/15/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO

*131316==19999* Tax.Colorado.gov

Page 1 of 1

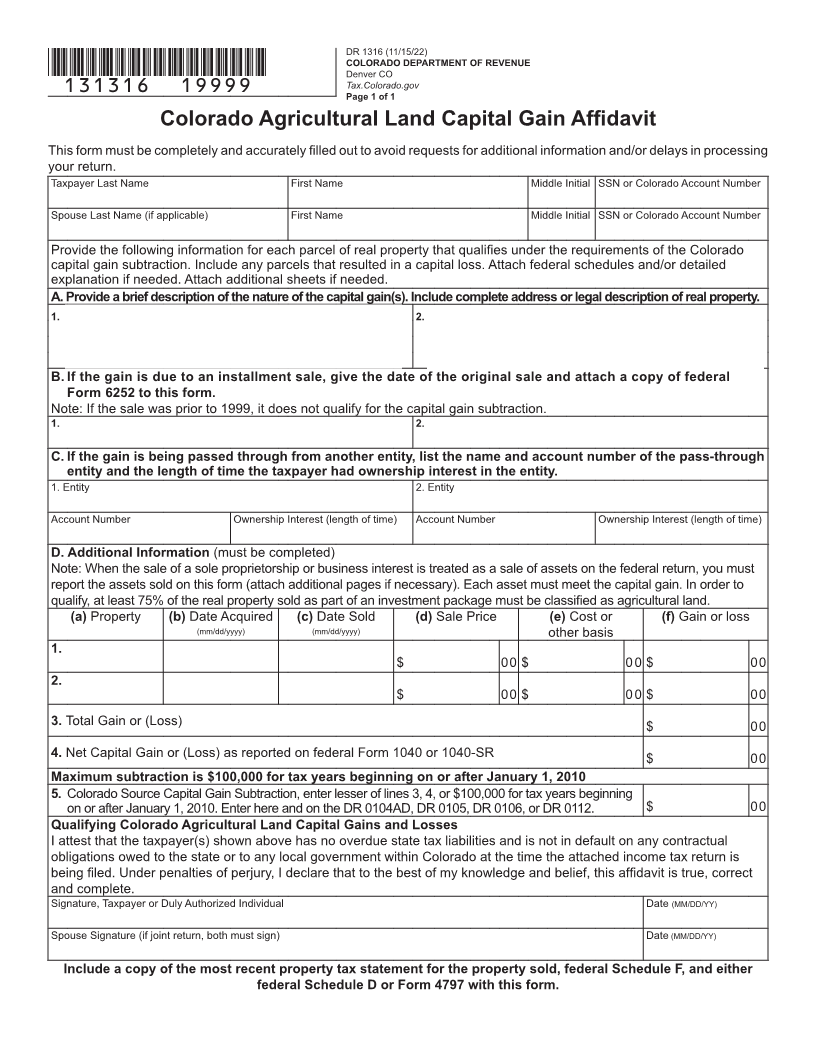

Colorado Agricultural Land Capital Gain Affidavit

This form must be completely and accurately filled out to avoid requests for additional information and/or delays in processing

your return.

Taxpayer Last Name First Name Middle Initial SSN or Colorado Account Number

Spouse Last Name (if applicable) First Name Middle Initial SSN or Colorado Account Number

Provide the following information for each parcel of real property that qualifies under the requirements of the Colorado

capital gain subtraction. Include any parcels that resulted in a capital loss. Attach federal schedules and/or detailed

explanation if needed. Attach additional sheets if needed.

A. Provide a brief description of the nature of the capital gain(s). Include complete address or legal description of real property.

1. 2.

B. If the gain is due to an installment sale, give the date of the original sale and attach a copy of federal

Form 6252 to this form.

Note: If the sale was prior to 1999, it does not qualify for the capital gain subtraction.

1. 2.

C. If the gain is being passed through from another entity, list the name and account number of the pass-through

entity and the length of time the taxpayer had ownership interest in the entity.

1. Entity 2. Entity

Account Number Ownership Interest (length of time) Account Number Ownership Interest (length of time)

D. Additional Information (must be completed)

Note: When the sale of a sole proprietorship or business interest is treated as a sale of assets on the federal return, you must

report the assets sold on this form (attach additional pages if necessary). Each asset must meet the capital gain. In order to

qualify, at least 75% of the real property sold as part of an investment package must be classified as agricultural land.

(a) Property (b) Date Acquired (c) Date Sold (d) Sale Price (e) Cost or (f) Gain or loss

(mm/dd/yyyy) (mm/dd/yyyy) other basis

1.

$ 0 0 $ 0 0 $ 0 0

2.

$ 0 0 $ 0 0 $ 0 0

3. Total Gain or (Loss) $ 0 0

4. Net Capital Gain or (Loss) as reported on federal Form 1040 or 1040-SR $ 0 0

Maximum subtraction is $100,000 for tax years beginning on or after January 1, 2010

5. Colorado Source Capital Gain Subtraction, enter lesser of lines 3, 4, or $100,000 for tax years beginning

on or after January 1, 2010. Enter here and on the DR 0104AD, DR 0105, DR 0106, or DR 0112. $ 0 0

Qualifying Colorado Agricultural Land Capital Gains and Losses

I attest that the taxpayer(s) shown above has no overdue state tax liabilities and is not in default on any contractual

obligations owed to the state or to any local government within Colorado at the time the attached income tax return is

being filed. Under penalties of perjury, I declare that to the best of my knowledge and belief, this affidavit is true, correct

and complete.

Signature, Taxpayer or Duly Authorized Individual Date (MM/DD/YY)

Spouse Signature (if joint return, both must sign) Date (MM/DD/YY)

Include a copy of the most recent property tax statement for the property sold, federal Schedule F, and either

federal Schedule D or Form 4797 with this form.