Enlarge image

DR 0617 (10/19/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

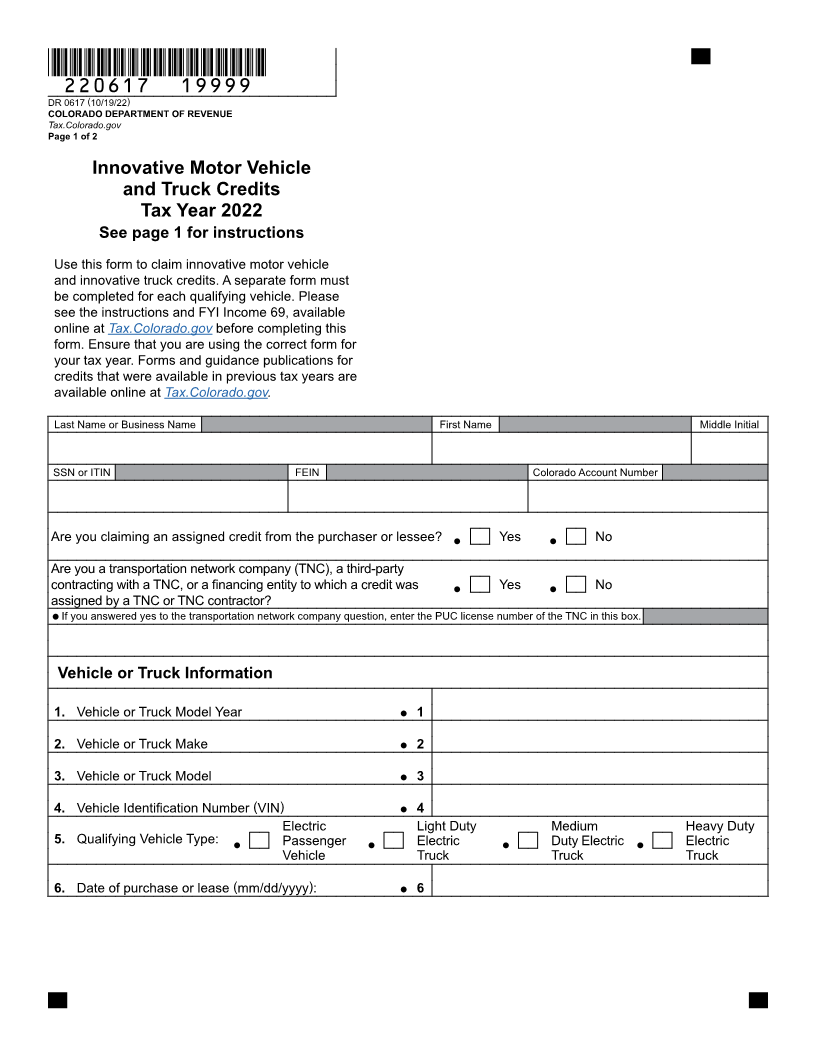

Innovative Motor Vehicle Credit and Innovative Truck Credit

Tax Year 2022 Instructions

Use this form to calculate the innovative motor vehicle and Vehicle Information

innovative truck credit available for the purchase or lease

Note: If ALL information is not completed in Vehicle

of a qualifying motor vehicle. Please visit Tax.Colorado.gov

Information, there will be delays processing your return

prior to completing this form to review our publications

and your credit may be denied. For trucks, the vehicle

about these credits.

weight rating is required in order to calculate the credit.

Complete Vehicle Information with the vehicle information

Lines 1-4. Enter the make, model, model year, and

for each vehicle before proceeding to Credit for Purchase

vehicle identification number (VIN) to identify the motor

or Lease of Qualifying Motor Vehicle or Truck. Credit for

vehicle or truck for which the credit is being claimed.

Purchase or Lease of Qualifying Motor Vehicle or Truck

Enter the complete and full manufacturer’s name of

shall be used for the purchase or lease of a qualifying

the vehicle make and model (for example, “Chevrolet”

motor vehicle or truck.

instead of “Chevy” or “Volkswagen” instead of “VW”.) If

No credit is allowed for CNG, LNG, and LPG trucks, multiple vehicles are eligible during this tax year, you

hydraulic hybrid conversions, idling reduction must complete a separate DR 0617 for each purchased

technologies, aerodynamic technologies, and clean fuel or leased vehicle or truck.

refrigerated trailers purchased, leased, or converted in

Line 5. Vehicle Type. Designate which type of vehicle

tax year 2022.

is being claimed. You may only mark one checkbox

You must complete a separate DR 0617 for each per form. Refer to FYI Income 69 available at

purchased or leased vehicle or truck. Tax.Colorado.gov for more information.

You must submit the completed form DR 0617, along • Passenger Motor Vehicle consists of a

with copies of the vehicle registration and vehicle invoice, private electric or plug-in hybrid electric

purchase agreement, or lease agreement with the income vehicle, including vans, capable of seating 12

tax form (DR 0104, DR 0112, etc.) on which you are passengers or less (e.g., Chevrolet Volt, Nissan

claiming the credit. If claiming a credit that was assigned to Leaf, Mercedes-Benz B250e), but does not

you by a purchaser or lessee, please check ‘Yes’ checkbox. include motorhomes or trucks (e.g., Ford-150).

If yes, you must include a copy of the signed election

• Light Duty Electric Truck consists of an

statement (DR 0618) for each purchaser with your income

electric truck with a GVWR of less than or

tax return along with a DR 0617 for each credit/vehicle.

equal to 10,000 lbs but does not include a

If you are a transportation network company or are passenger motor vehicle.

claiming a credit that was assigned to you by a • Medium Duty Electric Truck consists of an electric

transportation network company, please check ‘Yes’ truck with a GVWR greater than 10,000 lbs. and up

checkbox. If claiming a credit assigned to you by a to 26,000 lbs.

transportation network company, you must include a

• Heavy Duty Electric Truck consists of an electric

copy of the signed election statement (DR 0618) for each

truck with a GVWR greater than 26,000 lbs.

credit/vehicle with your income tax return along with a DR

0617 for each credit/vehicle. Line 6. Enter the date the vehicle or truck was purchased or

leased. Enter mm/dd/yyyy.

If you checked yes, please provide the transportation

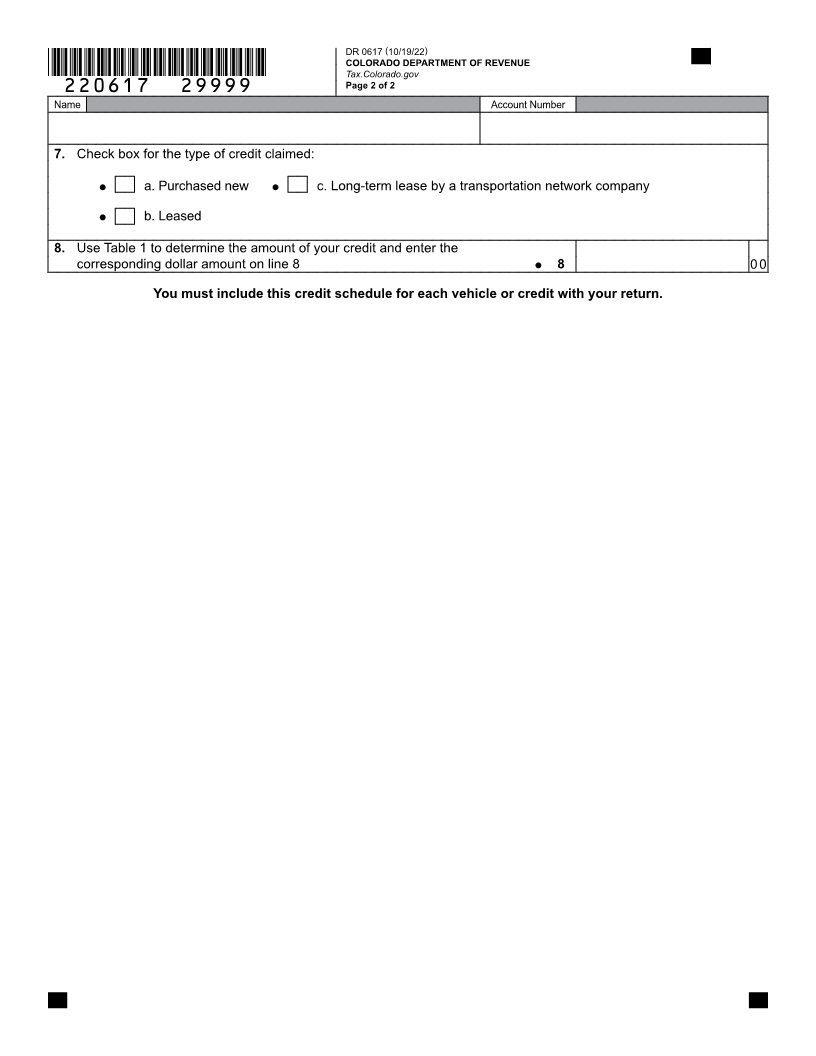

Line 7. Designate whether the vehicle was purchased

network company’s Public Utilities Commission (PUC)

new, leased, or long-term leased by a transportation

number. The PUC number is provided by the PUC for

network company by marking the appropriate check

commercial carriers of property, excluding household

box. You may only mark one check box on line 7.

goods, when providing transportation between points.

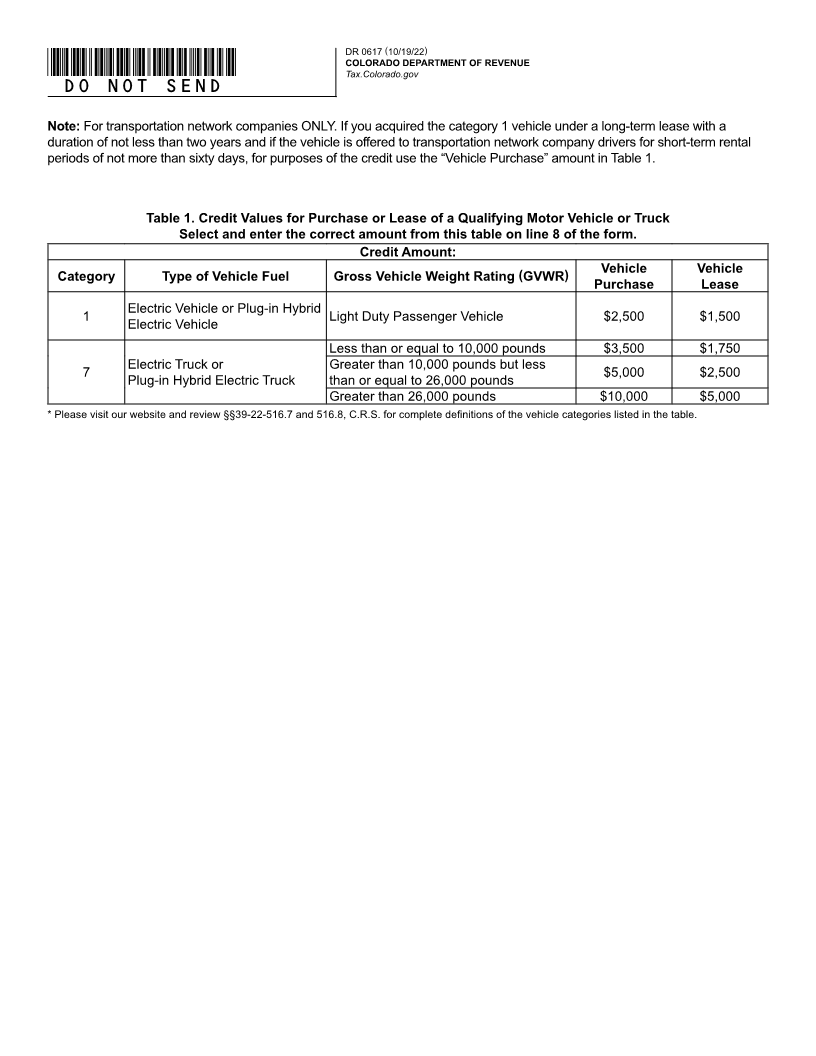

Line 8. Use Table 1 to determine the amount of your

Transportation network companies are companies involved credit and enter the corresponding dollar amount on line

in ride-sharing and other similar activities. Examples of these 8. Transfer this amount to the appropriate income tax

types of companies are Lyft, Uber, and other similar entities. form where requested.