Enlarge image

DR 1330 (10/19/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*221330==19999* Page 1 of 1

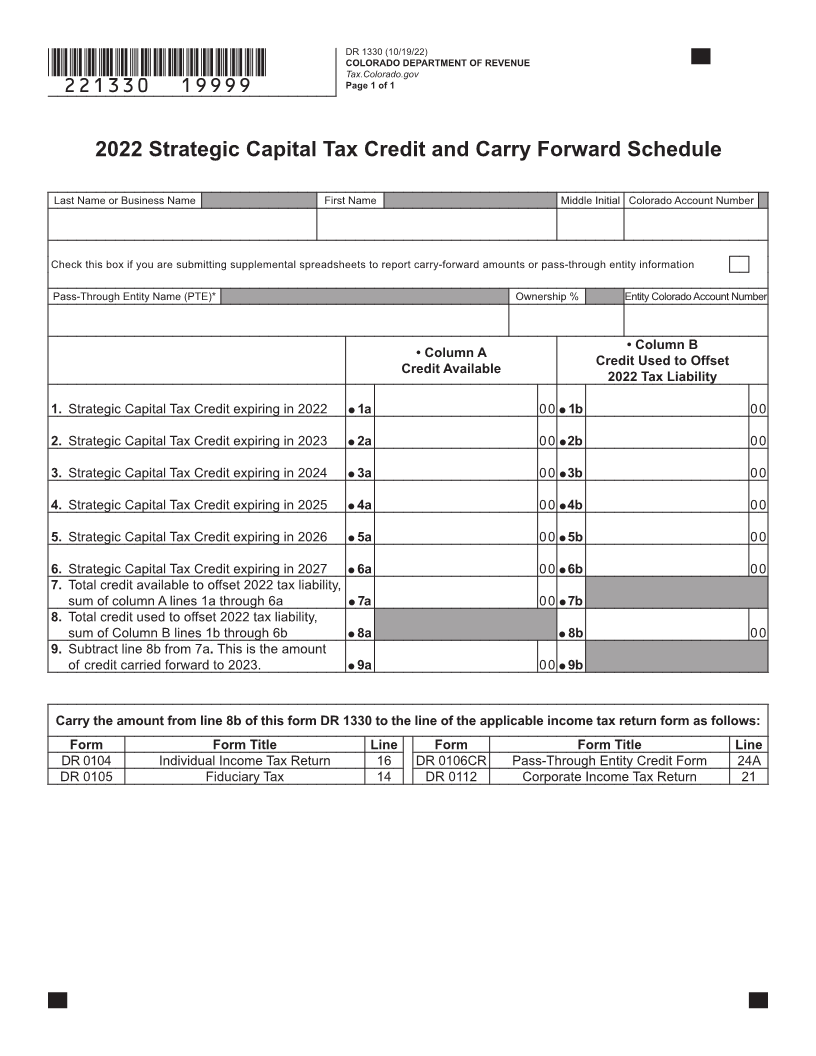

2022 Strategic Capital Tax Credit and Carry Forward Schedule

Last Name or Business Name First Name Middle Initial Colorado Account Number

Check this box if you are submitting supplemental spreadsheets to report carry-forward amounts or pass-through entity information

Pass-Through Entity Name (PTE)* Ownership % Entity Colorado Account Number

• Column B

• Column A

Credit Used to Offset

Credit Available

2022 Tax Liability

1. Strategic Capital Tax Credit expiring in 2022 1a 00 1b 00

2. Strategic Capital Tax Credit expiring in 2023 2a 00 2b 00

3. Strategic Capital Tax Credit expiring in 2024 3a 00 3b 00

4. Strategic Capital Tax Credit expiring in 2025 4a 00 4b 00

5. Strategic Capital Tax Credit expiring in 2026 5a 00 5b 00

6. Strategic Capital Tax Credit expiring in 2027 6a 00 6b 00

7. Total credit available to offset 2022 tax liability,

sum of column A lines 1a through 6a 7a 00 7b

8. Total credit used to offset 2022 tax liability,

sum of Column B lines 1b through 6b 8a 8b 00

9. Subtract line 8b from 7a.This is the amount

of credit carried forward to 2023. 9a 00 9b

Carry the amount from line 8b of this form DR 1330 to the line of the applicable income tax return form as follows:

Form Form Title Line Form Form Title Line

DR 0104 Individual Income Tax Return 16 DR 0106CR Pass-Through Entity Credit Form 24A

DR 0105 Fiduciary Tax 14 DR 0112 Corporate Income Tax Return 21