Enlarge image

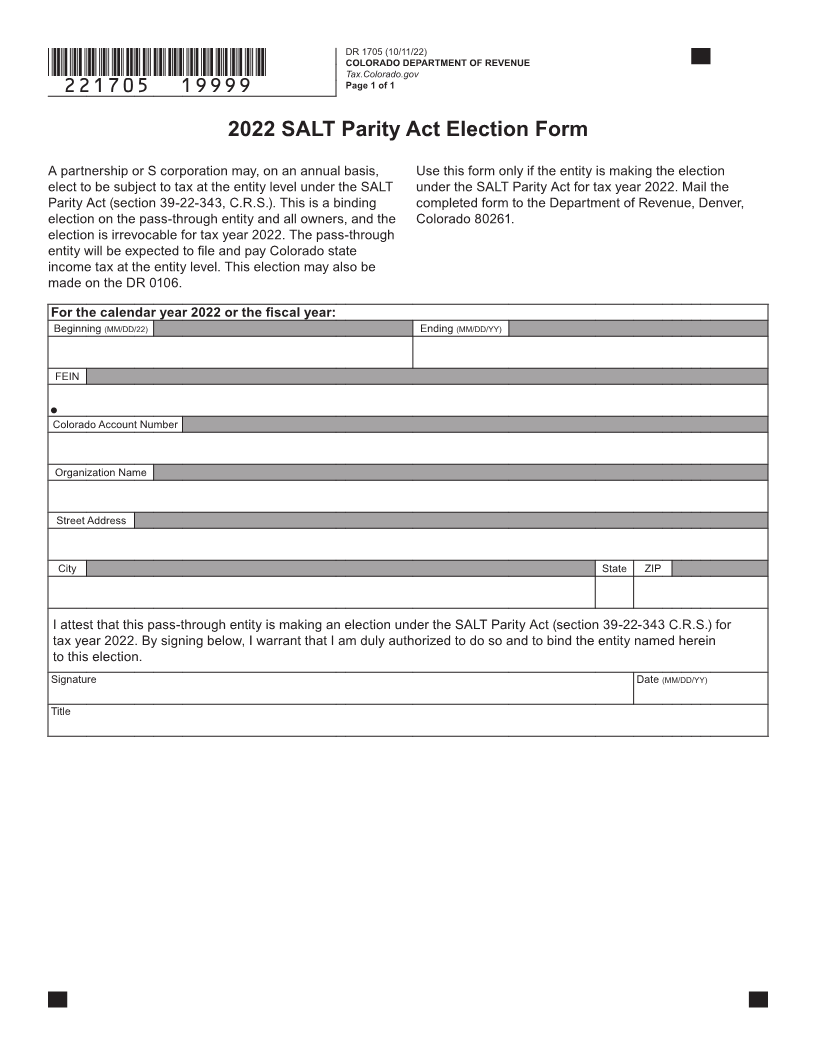

DR 1705 (10/11/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*221705==19999* Page 1 of 1

2022 SALT Parity Act Election Form

A partnership or S corporation may, on an annual basis, Use this form only if the entity is making the election

elect to be subject to tax at the entity level under the SALT under the SALT Parity Act for tax year 2022. Mail the

Parity Act (section 39-22-343, C.R.S.). This is a binding completed form to the Department of Revenue, Denver,

election on the pass-through entity and all owners, and the Colorado 80261.

election is irrevocable for tax year 2022. The pass-through

entity will be expected to file and pay Colorado state

income tax at the entity level. This election may also be

made on the DR 0106.

For the calendar year 2022 or the fiscal year:

Beginning (MM/DD/22) Ending (MM/DD/YY)

FEIN

Colorado Account Number

Organization Name

Street Address

City State ZIP

I attest that this pass-through entity is making an election under the SALT Parity Act (section 39-22-343 C.R.S.) for

tax year 2022. By signing below, I warrant that I am duly authorized to do so and to bind the entity named herein

to this election.

Signature Date (MM/DD/YY)

Title