Enlarge image

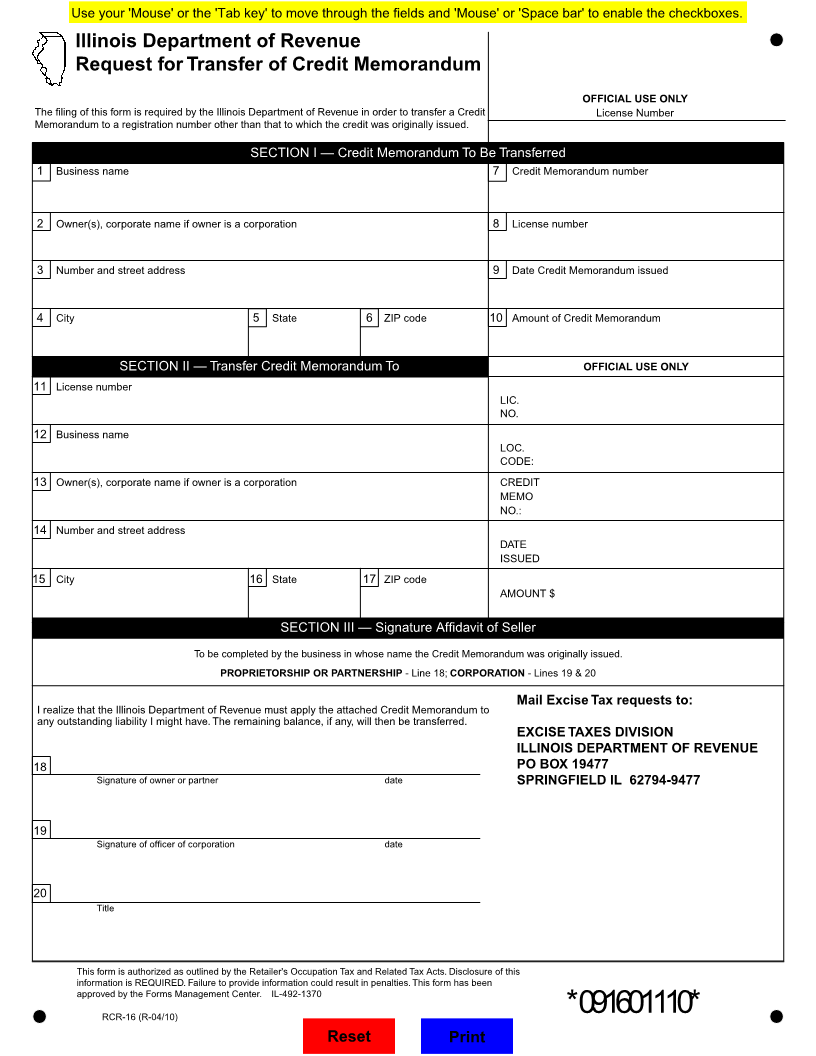

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

Request for Transfer of Credit Memorandum

OFFICIAL USE ONLY

The fi ling of this form is required by the Illinois Department of Revenue in order to transfer a Credit License Number

Memorandum to a registration number other than that to which the credit was originally issued.

SECTION I — Credit Memorandum To Be Transferred

1 Business name 7 Credit Memorandum number

2 Owner(s), corporate name if owner is a corporation 8 License number

3 Number and street address 9 Date Credit Memorandum issued

4 City 5 State 6 ZIP code 10 Amount of Credit Memorandum

SECTION II — Transfer Credit Memorandum To OFFICIAL USE ONLY

11 License number

LIC.

NO.

12 Business name

LOC.

CODE:

13 Owner(s), corporate name if owner is a corporation CREDIT

MEMO

NO.:

14 Number and street address

DATE

ISSUED

15 City 16 State 17 ZIP code

AMOUNT $

SECTION III — Signature Affi davit of Seller

To be completed by the business in whose name the Credit Memorandum was originally issued.

PROPRIETORSHIP OR PARTNERSHIP - Line 18; CORPORATION - Lines 19 & 20

Mail Excise Tax requests to:

I realize that the Illinois Department of Revenue must apply the attached Credit Memorandum to

any outstanding liability I might have. The remaining balance, if any, will then be transferred.

EXCISE TAXES DIVISION

ILLINOIS DEPARTMENT OF REVENUE

18 PO BOX 19477

Signature of owner or partner date SPRINGFIELD IL 62794-9477

19

Signature of officer of corporation date

20

Title

This form is authorized as outlined by the Retailer's Occupation Tax and Related Tax Acts. Disclosure of this

information is REQUIRED. Failure to provide information could result in penalties. This form has been

approved by the Forms Management Center. IL-492-1370

*091601110*

RCR-16 (R-04/10)

Reset Print