Enlarge image

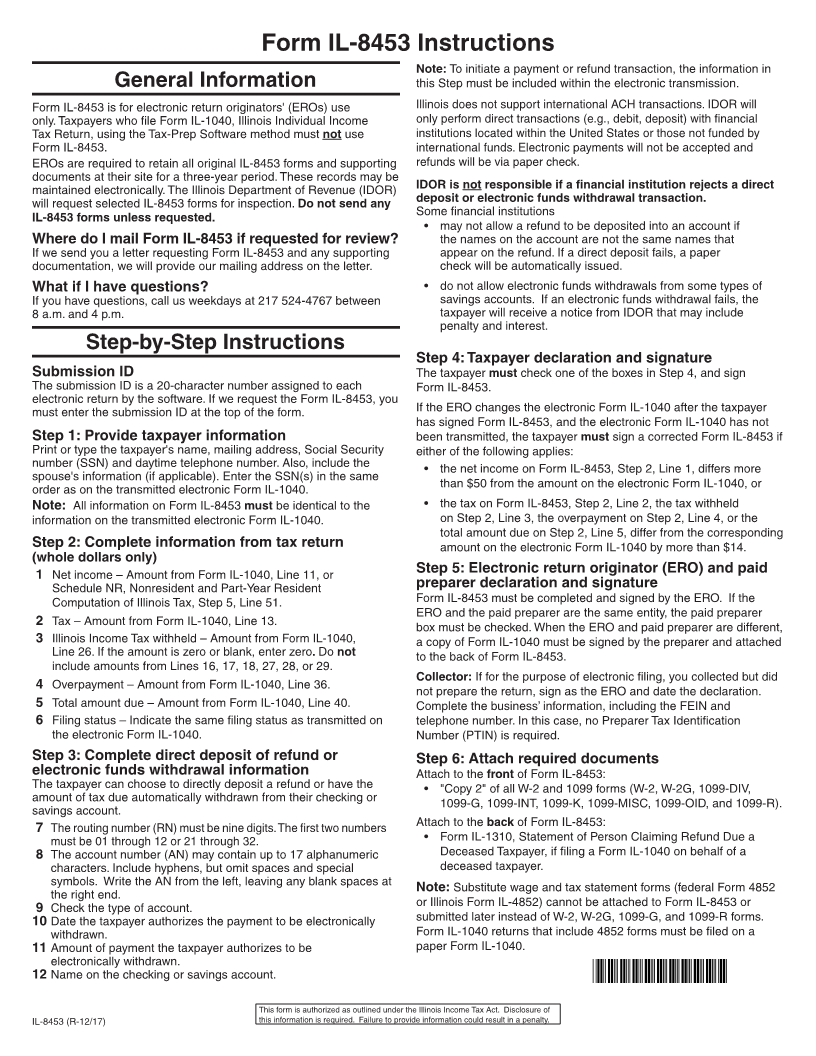

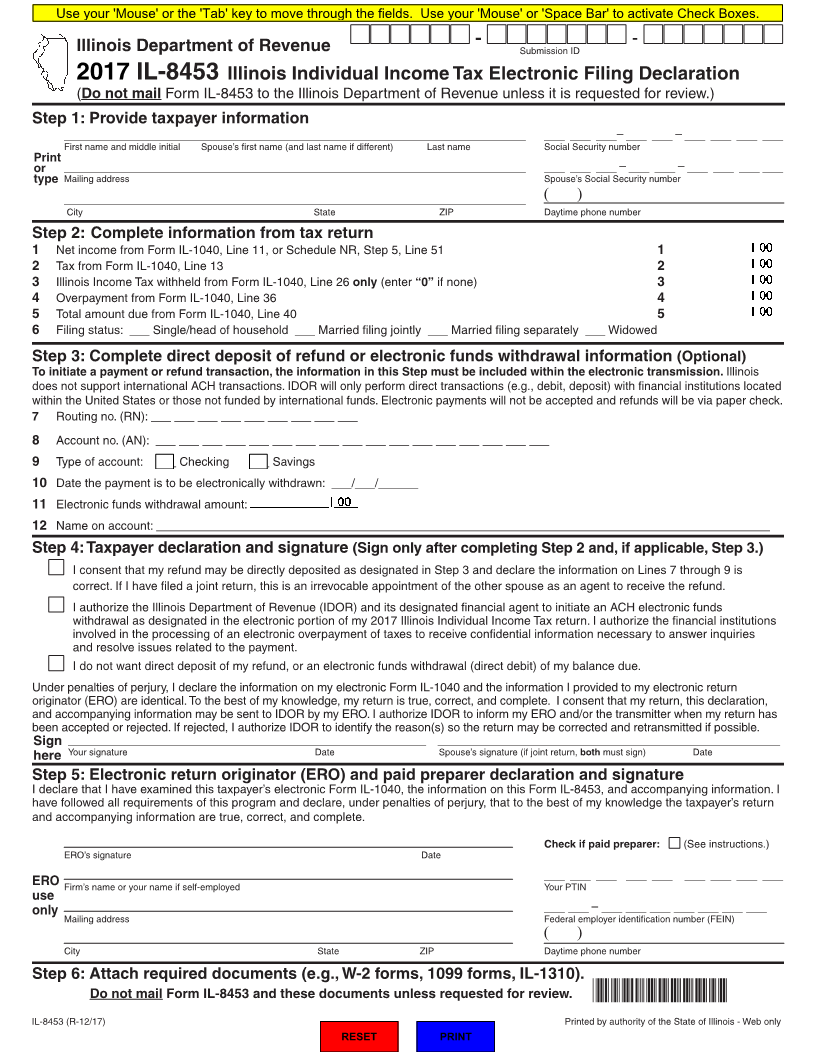

Use your 'Mouse' or the 'Tab' key to move through the fields. Use your 'Mouse' or 'Space Bar' to activate Check Boxes.

- -

Illinois Department of Revenue Submission ID

2017 IL-8453 Illinois Individual Income Tax Electronic Filing Declaration

(Do not mail Form IL-8453 to the Illinois Department of Revenue unless it is requested for review.)

Step 1: Provide taxpayer information

_________________________________________________________________________________________ ____ ____ ____ –____ ____ –____ ____ ____ ____

First name and middle initial Spouse’s first name (and last name if different) Last name Social Security number

Print _________________________________________________________________________________________ ____ ____ ____ –____ ____ –____ ____ ____ ____

or

type Mailing address Spouse’s Social Security number

_________________________________________________________________________________________ ( )

City State ZIP Daytime phone number

Step 2: Complete information from tax return

1 Net income from Form IL-1040, Line 11, or Schedule NR, Step 5, Line 51 1

2 Tax from Form IL-1040, Line 13 2

3 Illinois Income Tax withheld from Form IL-1040, Line 26 only (enter “0” if none) 3

4 Overpayment from Form IL-1040, Line 36 4

5 Total amount due from Form IL-1040, Line 40 5

6 Filing status: ___ Single/head of household ___ Married filing jointly ___ Married filing separately ___ Widowed

Step 3: Complete direct deposit of refund or electronic funds withdrawal information (Optional)

To initiate a payment or refund transaction, the information in this Step must be included within the electronic transmission. Illinois

does not support international ACH transactions. IDOR will only perform direct transactions (e.g., debit, deposit) with financial institutions located

within the United States or those not funded by international funds. Electronic payments will not be accepted and refunds will be via paper check.

7 Routing no. (RN): ___ ___ ___ ___ ___ ___ ___ ___ ___

8 Account no. (AN): ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

9 Type of account: ___ Checking ___ Savings

10 Date the payment is to be electronically withdrawn: ___/___/______

11 Electronic funds withdrawal amount:

12 Name on account: ____________________________________________________________________________________________

Step 4: Taxpayer declaration and signature(Sign only after completing Step 2 and, if applicable, Step 3.)

I consent that my refund may be directly deposited as designated in Step 3 and declare the information on Lines 7 through 9 is

correct. If I have filed a joint return, this is an irrevocable appointment of the other spouse as an agent to receive the refund.

I authorize the Illinois Department of Revenue (IDOR) and its designated financial agent to initiate an ACH electronic funds

withdrawal as designated in the electronic portion of my 2017 Illinois Individual Income Tax return. I authorize the financial institutions

involved in the processing of an electronic overpayment of taxes to receive confidential information necessary to answer inquiries

and resolve issues related to the payment.

I do not want direct deposit of my refund, or an electronic funds withdrawal (direct debit) of my balance due.

Under penalties of perjury, I declare the information on my electronic Form IL-1040 and the information I provided to my electronic return

originator (ERO) are identical. To the best of my knowledge, my return is true, correct, and complete. I consent that my return, this declaration,

and accompanying information may be sent to IDOR by my ERO. I authorize IDOR to inform my ERO and/or the transmitter when my return has

been accepted or rejected. If rejected, I authorize IDOR to identify the reason(s) so the return may be corrected and retransmitted if possible.

Sign _____________________________________________________________________ __________________________________________________________________

here Your signature Date Spouse’s signature (if joint return,both must sign) Date

Step 5: Electronic return originator (ERO) and paid preparer declaration and signature

I declare that I have examined this taxpayer’s electronic Form IL-1040, the information on this Form IL-8453, and accompanying information. I

have followed all requirements of this program and declare, under penalties of perjury, that to the best of my knowledge the taxpayer’s return

and accompanying information are true, correct, and complete.

Check if paid preparer: (See instructions.)

ERO’s signature Date

____ ____ ____ ____ ____ ____ ____ ____ ____

ERO Firm’s name or your name if self-employed Your PTIN

use

only ____ ____ – ____ ____ ____ ____ ____ ____ ____

Mailing address Federal employer identification number (FEIN)

( )

City State ZIP Daytime phone number

Step 6: Attach required documents (e.g., W-2 forms, 1099 forms, IL-1310).

Do not mail Form IL-8453 and these documents unless requested for review. *176740001*

IL‑8453 (R‑12/17) Printed by authority of the State of Illinois ‑ Web only

RESET PRINT