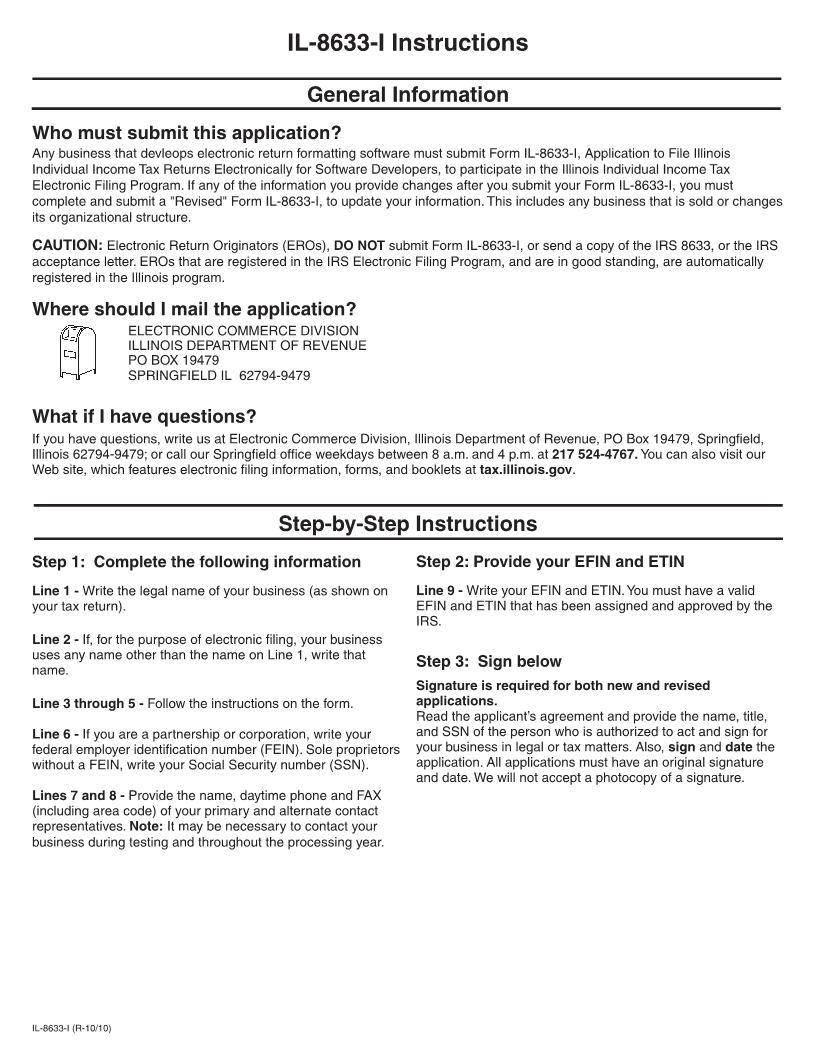

Enlarge image

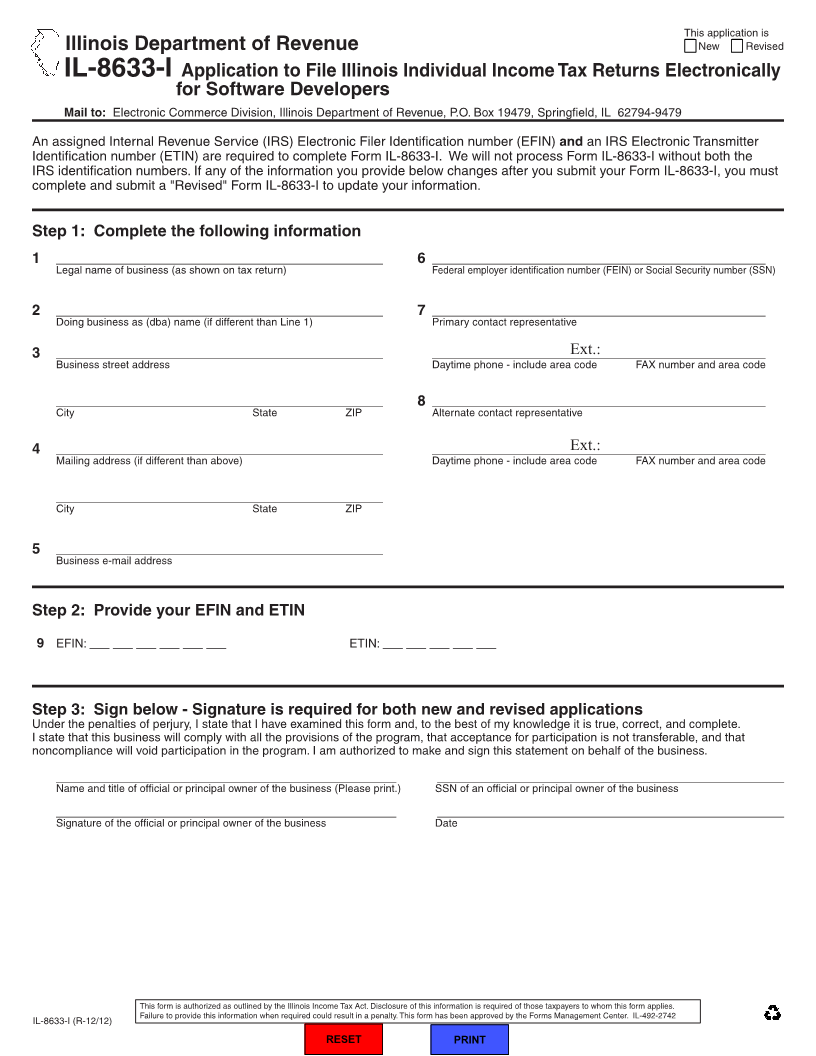

This application is

Illinois Department of Revenue New Revised

IL-8633-I Application to File Illinois Individual Income Tax Returns Electronically

for Software Developers

Mail to: Electronic Commerce Division, Illinois Department of Revenue, P.O. Box 19479, Springfield, IL 62794-9479

An assigned Internal Revenue Service (IRS) Electronic Filer Identification number (EFIN) and an IRS Electronic Transmitter

Identification number (ETIN) are required to complete Form IL-8633-I. We will not process Form IL-8633-I without both the

IRS identification numbers. If any of the information you provide below changes after you submit your Form IL-8633-I, you must

complete and submit a "Revised" Form IL-8633-I to update your information.

Step 1: Complete the following information

1 _________________________________________________ 6 __________________________________________________

Legal name of business (as shown on tax return) Federal employer identification number (FEIN) or Social Security number (SSN)

2 _________________________________________________ 7 __________________________________________________

Doing business as (dba) name (if different than Line 1) Primary contact representative

3 _________________________________________________ __________________________________________________Ext.:

Business street address Daytime phone - include area code FAX number and area code

_________________________________________________ 8 __________________________________________________

City State ZIP Alternate contact representative

4 _________________________________________________ __________________________________________________Ext.:

Mailing address (if different than above) Daytime phone - include area code FAX number and area code

_________________________________________________

City State ZIP

5 _________________________________________________

Business e-mail address

Step 2: Provide your EFIN and ETIN

9 EFIN: ___ ___ ___ ___ ___ ___ ETIN: ___ ___ ___ ___ ___

Step 3: Sign below - Signature is required for both new and revised applications

Under the penalties of perjury, I state that I have examined this form and, to the best of my knowledge it is true, correct, and complete.

I state that this business will comply with all the provisions of the program, that acceptance for participation is not transferable, and that

noncompliance will void participation in the program. I am authorized to make and sign this statement on behalf of the business.

___________________________________________________ ____________________________________________________

Name and title of official or principal owner of the business (Please print.) SSN of an official or principal owner of the business

___________________________________________________ ____________________________________________________

Signature of the official or principal owner of the business Date

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is required of those taxpayers to whom this form applies.

IL-8633-I (R-12/12) Failure to provide this information when required could result in a penalty. This form has been approved by the Forms Management Center. IL-492-2742

RESET PRINT