Enlarge image

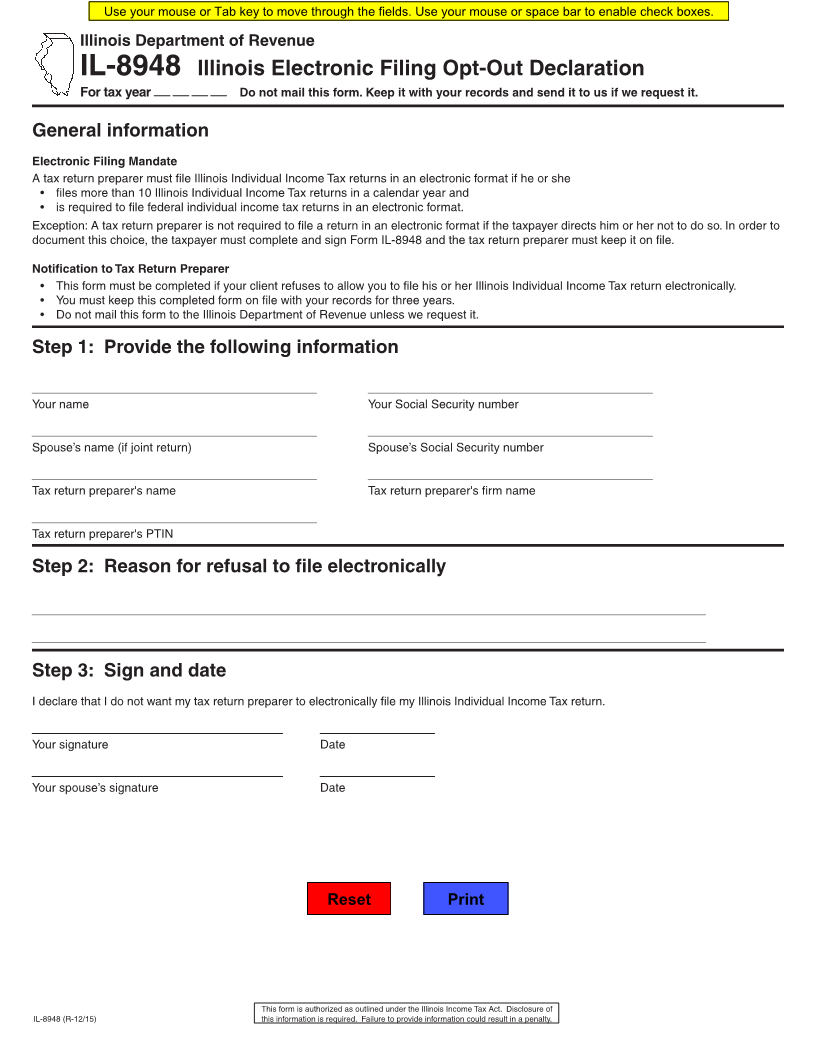

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-8948 Illinois Electronic Filing Opt-Out Declaration

For tax year Do not mail this form. Keep it with your records and send it to us if we request it.

General information

Electronic Filing Mandate

A tax return preparer must file Illinois Individual Income Tax returns in an electronic format if he or she

• files more than 10 Illinois Individual Income Tax returns in a calendar year and

• is required to file federal individual income tax returns in an electronic format.

Exception: A tax return preparer is not required to file a return in an electronic format if the taxpayer directs him or her not to do so. In order to

document this choice, the taxpayer must complete and sign Form IL-8948 and the tax return preparer must keep it on file.

Notification to Tax Return Preparer

• This form must be completed if your client refuses to allow you to file his or her Illinois Individual Income Tax return electronically.

• You must keep this completed form on file with your records for three years.

• Do not mail this form to the Illinois Department of Revenue unless we request it.

Step 1: Provide the following information

Your name Your Social Security number

Spouse’s name (if joint return) Spouse’s Social Security number

Tax return preparer's name Tax return preparer's firm name

Tax return preparer's PTIN

Step 2: Reason for refusal to file electronically

Step 3: Sign and date

I declare that I do not want my tax return preparer to electronically file my Illinois Individual Income Tax return.

Your signature Date

Your spouse’s signature Date

Reset Print

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

IL-8948 (R-12/15) this information is required. Failure to provide information could result in a penalty.