Enlarge image

Use your 'Mouse' or the 'Tab' key to move through the fields. Use your 'Mouse' or 'Space Bar' to activate Check Boxes.

*67212211W*

Illinois Department of Revenue

IL-8857 Request for Innocent Spouse Relief

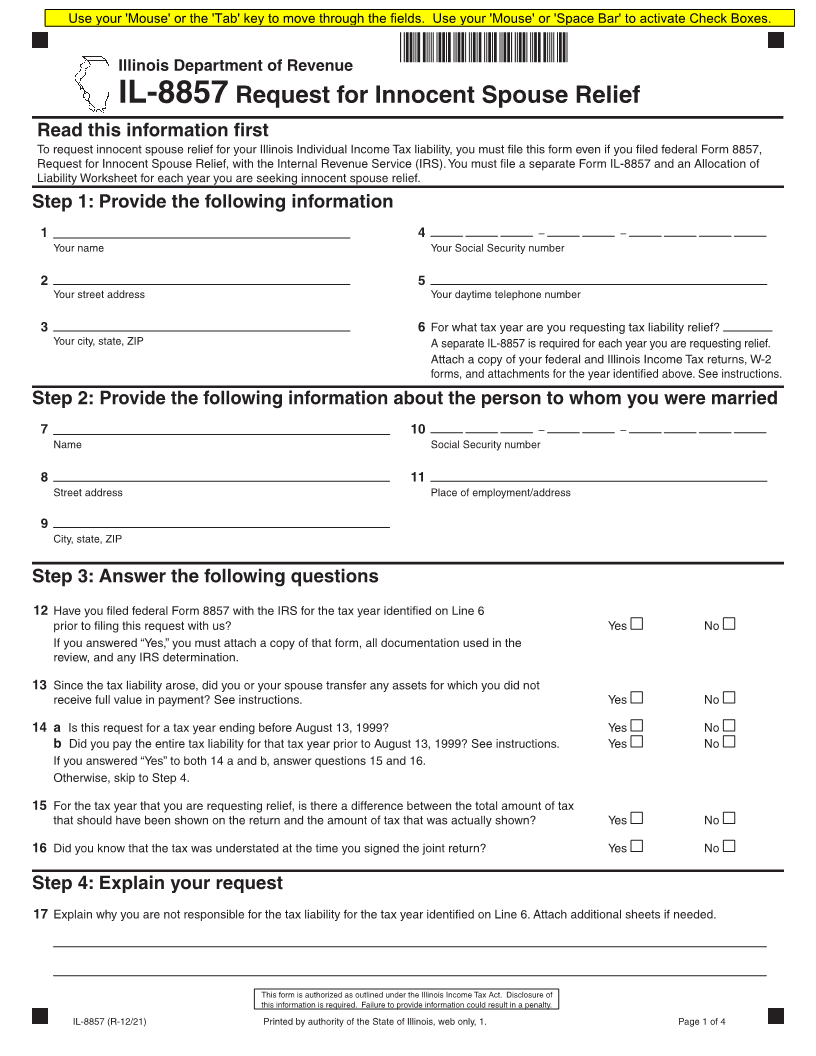

Read this information first

To request innocent spouse relief for your Illinois Individual Income Tax liability, you must file this form even if you filed federal Form 8857,

Request for Innocent Spouse Relief, with the Internal Revenue Service (IRS). You must file a separate Form IL-8857 and an Allocation of

Liability Worksheet for each year you are seeking innocent spouse relief.

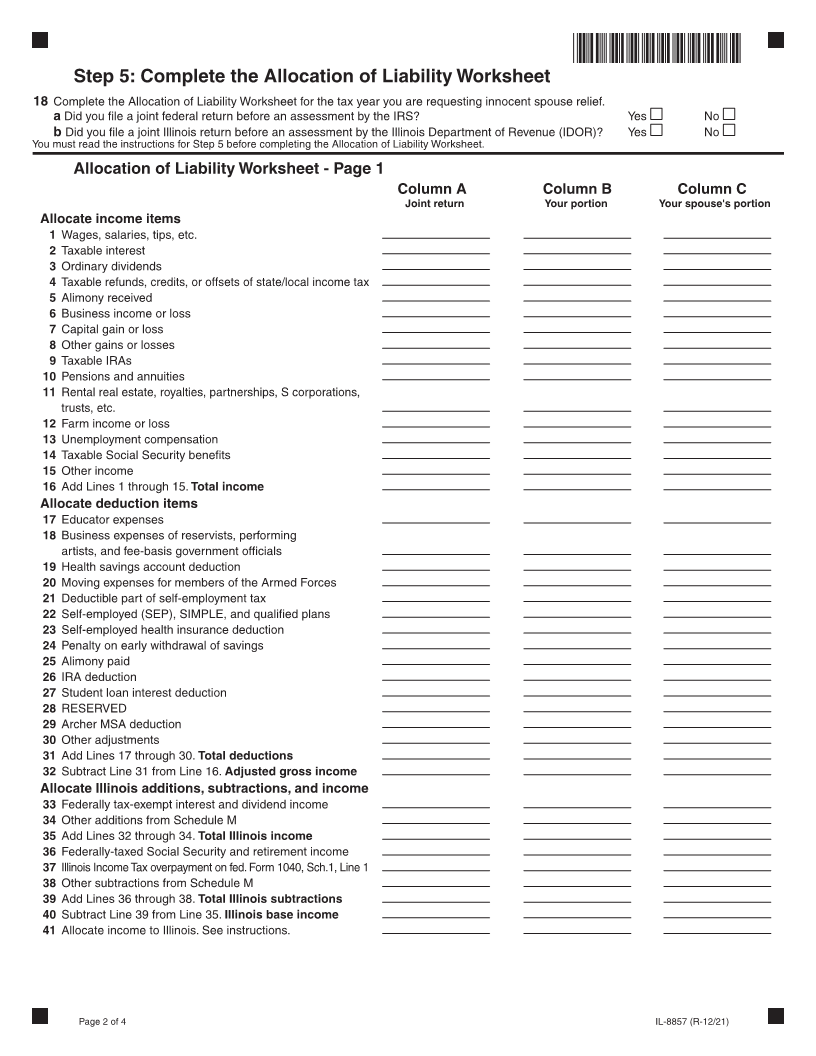

Step 1: Provide the following information

1 4 – –

Your name Your Social Security number

2 5

Your street address Your daytime telephone number

3 6 For what tax year are you requesting tax liability relief?

Your city, state, ZIP A separate IL-8857 is required for each year you are requesting relief.

Attach a copy of your federal and Illinois Income Tax returns, W-2

forms, and attachments for the year identified above. See instructions.

Step 2: Provide the following information about the person to whom you were married

7 10 – –

Name Social Security number

8 11

Street address Place of employment/address

9

City, state, ZIP

Step 3: Answer the following questions

12 Have you filed federal Form 8857 with the IRS for the tax year identified on Line 6

prior to filing this request with us? Yes No

If you answered “Yes,” you must attach a copy of that form, all documentation used in the

review, and any IRS determination.

13 Since the tax liability arose, did you or your spouse transfer any assets for which you did not

receive full value in payment? See instructions. Yes No

14 a Is this request for a tax year ending before August 13, 1999? Yes No

b Did you pay the entire tax liability for that tax year prior to August 13, 1999? See instructions. Yes No

If you answered “Yes” to both 14 a and b, answer questions 15 and 16.

Otherwise, skip to Step 4.

15 For the tax year that you are requesting relief, is there a difference between the total amount of tax

that should have been shown on the return and the amount of tax that was actually shown? Yes No

16 Did you know that the tax was understated at the time you signed the joint return? Yes No

Step 4: Explain your request

17 Explain why you are not responsible for the tax liability for the tax year identified on Line 6. Attach additional sheets if needed.

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

IL-8857 (R-12/21) Printed by authority of the State of Illinois, web only, 1. Page 1 of 4