Enlarge image

Illinois Department of Revenue

Substitute Forms Guidelines

2023

Note: Due to the reorganization of our website at tax.illinois.gov, an Illinois Public User Account is no longer required to access the

draft forms pages.

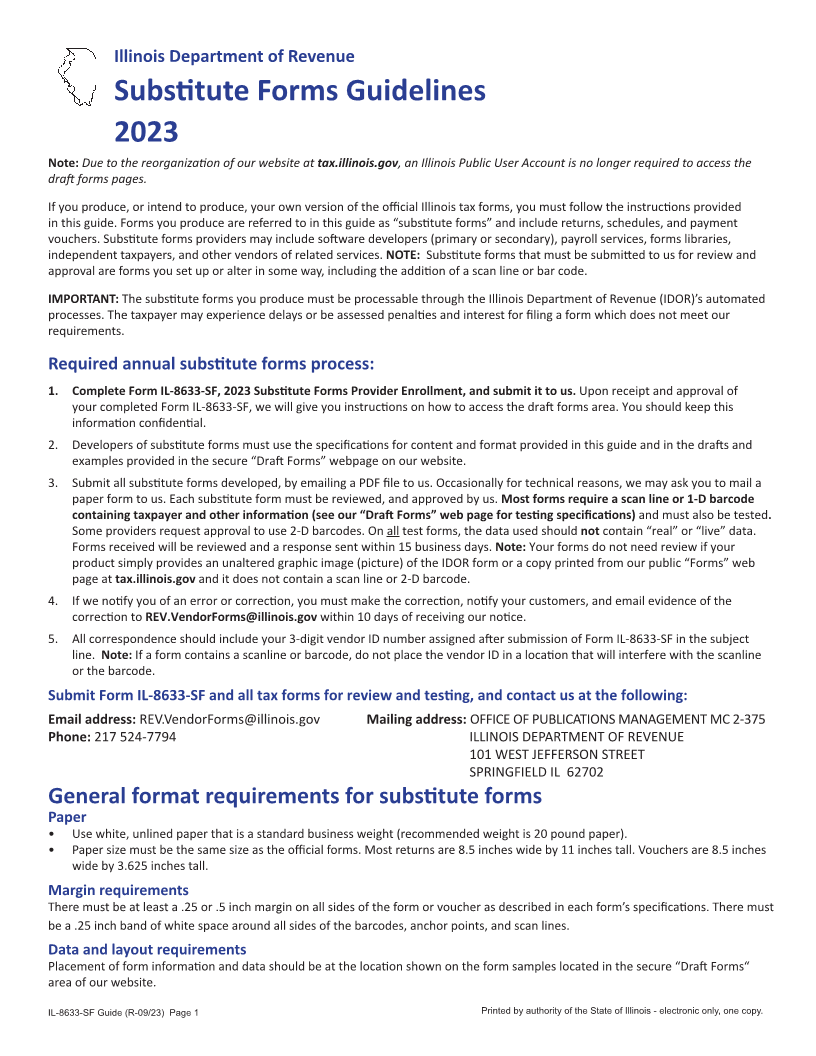

If you produce, or intend to produce, your own version of the official Illinois tax forms, you must follow the instructions provided

in this guide. Forms you produce are referred to in this guide as “substitute forms” and include returns, schedules, and payment

vouchers. Substitute forms providers may include software developers (primary or secondary), payroll services, forms libraries,

independent taxpayers, and other vendors of related services. NOTE: Substitute forms that must be submitted to us for review and

approval are forms you set up or alter in some way, including the addition of a scan line or bar code.

IMPORTANT: The substitute forms you produce must be processable through the Illinois Department of Revenue (IDOR)’s automated

processes. The taxpayer may experience delays or be assessed penalties and interest for filing a form which does not meet our

requirements.

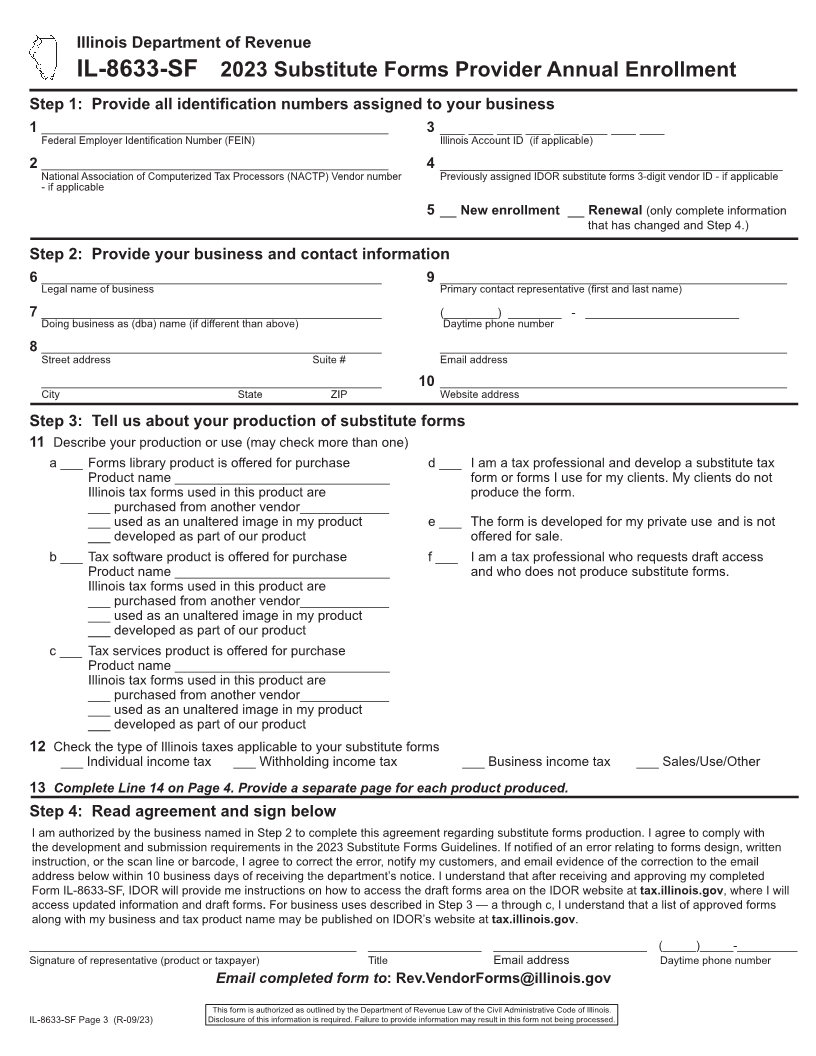

Required annual substitute forms process:

1. Complete Form IL-8633-SF, 2023 Substitute Forms Provider Enrollment, and submit it to us. Upon receipt and approval of

your completed Form IL-8633-SF, we will give you instructions on how to access the draft forms area. You should keep this

information confidential.

2. Developers of substitute forms must use the specifications for content and format provided in this guide and in the drafts and

examples provided in the secure “Draft Forms” webpage on our website.

3. Submit all substitute forms developed, by emailing a PDF file to us. Occasionally for technical reasons, we may ask you to mail a

paper form to us. Each substitute form must be reviewed, and approved by us. Most forms require a scan line or 1-D barcode

containing taxpayer and other information (see our “Draft Forms” web page for testing specifications) and must also be tested.

Some providers request approval to use 2-D barcodes. On all test forms, the data used should not contain “real” or “live” data.

Forms received will be reviewed and a response sent within 15 business days. Note: Your forms do not need review if your

product simply provides an unaltered graphic image (picture) of the IDOR form or a copy printed from our public “Forms” web

page at tax.illinois.gov and it does not contain a scan line or 2-D barcode.

4. If we notify you of an error or correction, you must make the correction, notify your customers, and email evidence of the

correction to REV.VendorForms@illinois.gov within 10 days of receiving our notice.

5. All correspondence should include your 3-digit vendor ID number assigned after submission of Form IL-8633-SF in the subject

line. Note: If a form contains a scanline or barcode, do not place the vendor ID in a location that will interfere with the scanline

or the barcode.

Submit Form IL-8633-SF and all tax forms for review and testing, and contact us at the following:

Email address: REV.VendorForms@illinois.gov Mailing address: OFFICE OF PUBLICATIONS MANAGEMENT MC 2-375

Phone: 217 524-7794 ILLINOIS DEPARTMENT OF REVENUE

101 WEST JEFFERSON STREET

SPRINGFIELD IL 62702

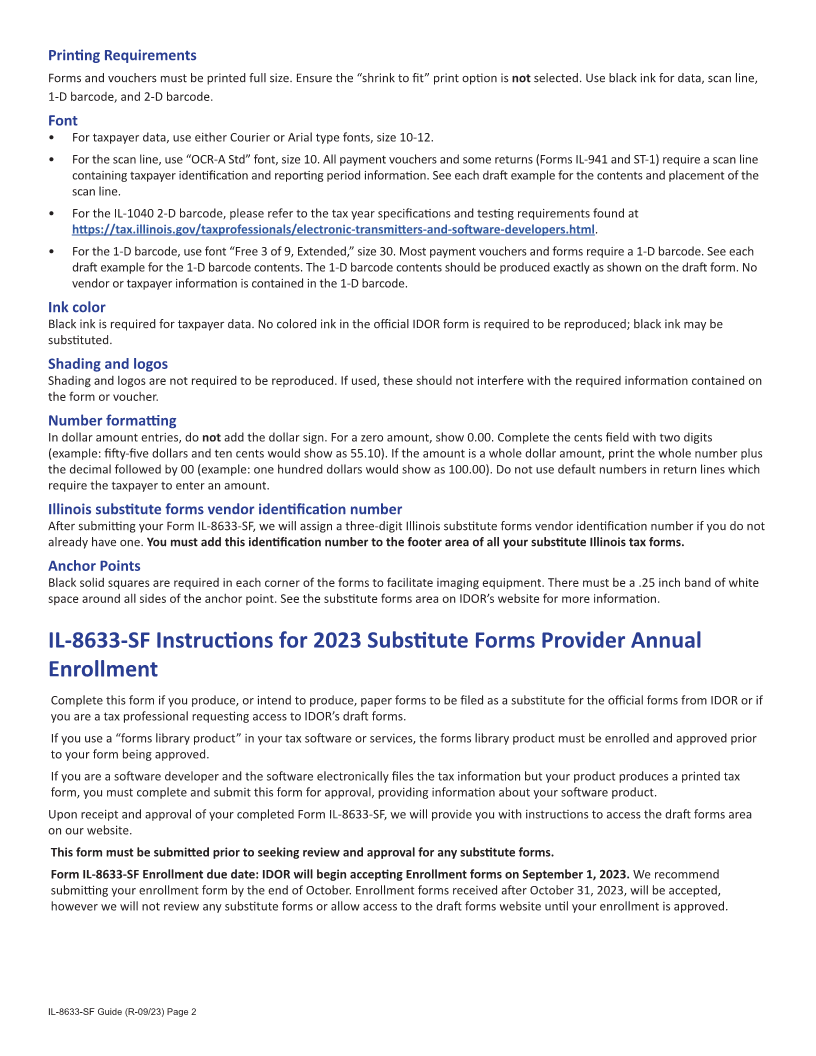

General format requirements for substitute forms

Paper

• Use white, unlined paper that is a standard business weight (recommended weight is 20 pound paper).

• Paper size must be the same size as the official forms. Most returns are 8.5 inches wide by 11 inches tall. Vouchers are 8.5 inches

wide by 3.625 inches tall.

Margin requirements

There must be at least a .25 or .5 inch margin on all sides of the form or voucher as described in each form’s specifications. There must

be a .25 inch band of white space around all sides of the barcodes, anchor points, and scan lines.

Data and layout requirements

Placement of form information and data should be at the location shown on the form samples located in the secure “Draft Forms“

area of our website.

IL-8633-SF Guide (R-09/23) Page 1 Printed by authority of the State of Illinois - electronic only, one copy.