Enlarge image

Use your 'Mouse' or 'Tab key' to move through the fields.

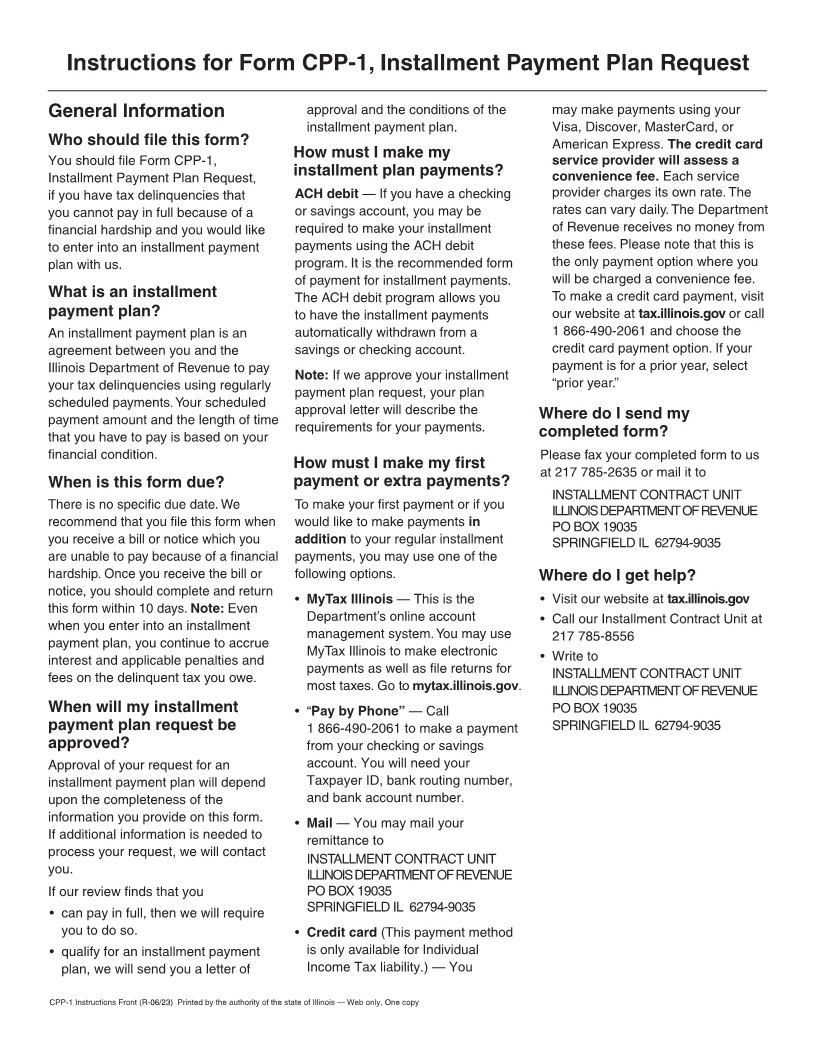

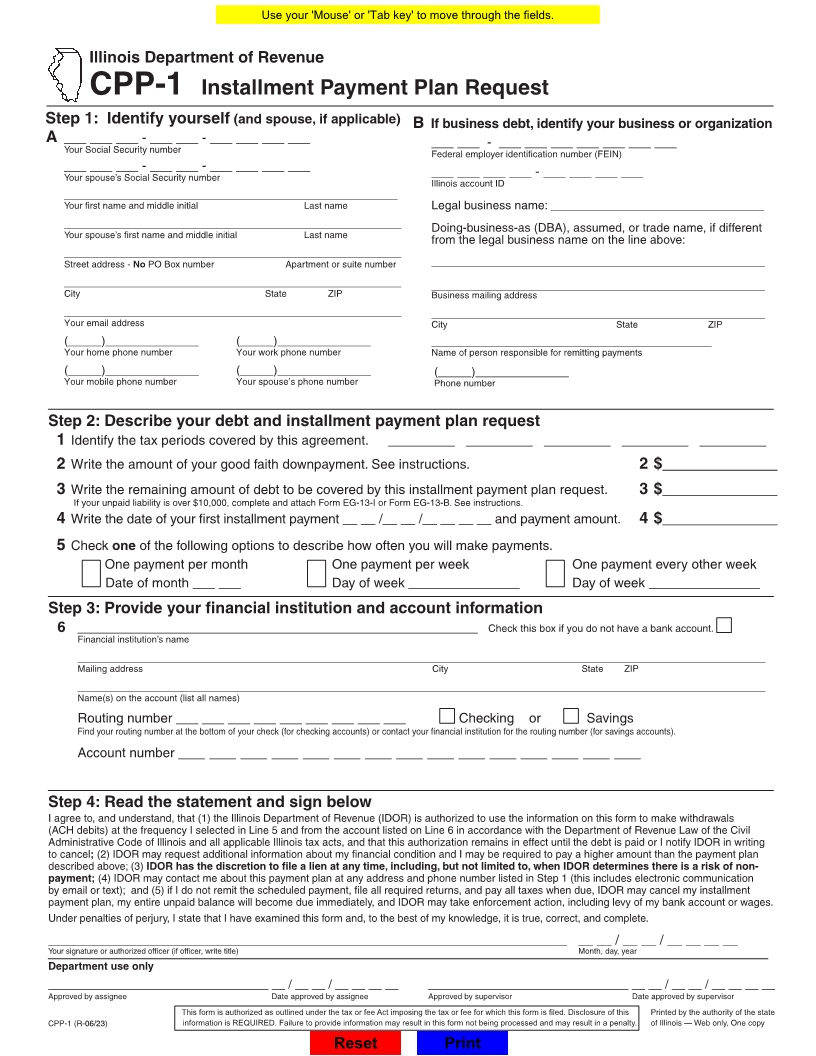

Illinois Department of Revenue

CPP-1 Installment Payment Plan Request

Step 1: Identify yourself (and spouse, if applicable) B If business debt, identify your business or organization

A ___ ___ ___ - ___ ___ - ___ ___ ___ ___ ___ ___ - ___ ___ ___ ___ ___ ___ ___

Your Social Security number Federal employer identifcation number (FEIN)

___ ___ ___ - ___ ___ - ___ ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___ ___

Your spouse’s Social Security number Illinois account ID

__________________________________________________

Your frst name and middle initial Last name Legal business name: ________________________________

_________________________________________________________________ Doing-business-as (DBA), assumed, or trade name, if different

Your spouse’s frst name and middle initial Last name from the legal business name on the line above:

_________________________________________________________________

Street address - No PO Box number Apartment or suite number __________________________________________________

_________________________________________________________________ __________________________________________________

City State ZIP Business mailing address

_________________________________________________________________ __________________________________________________

Your email address City State ZIP

(_____)______________ (_____)______________ __________________________________________

Your home phone number Your work phone number Name of person responsible for remitting payments

(_____)______________ (_____)______________ (_____)______________

Your mobile phone number Your spouse’s phone number Phone number

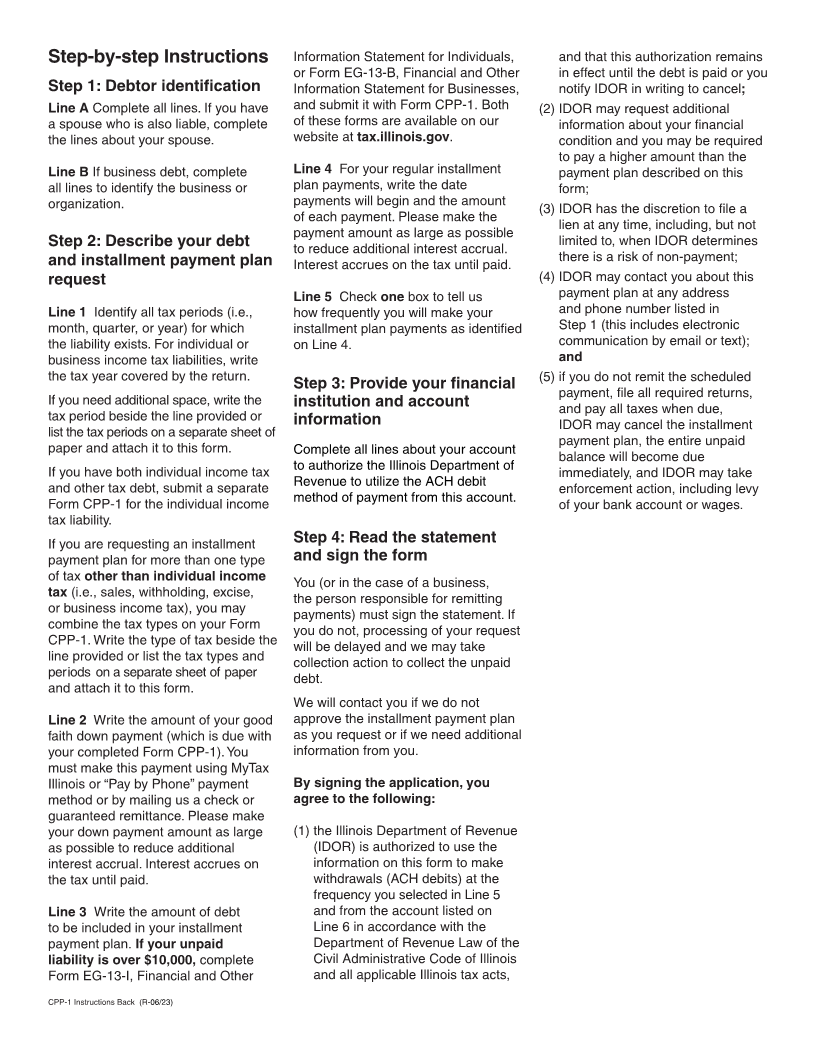

Step 2: Describe your debt and installment payment plan request

1 Identify the tax periods covered by this agreement. _________ _________ _________ _________ _________

2 Write the amount of your good faith downpayment. See instructions. 2 $_____________

3 Write the remaining amount of debt to be covered by this installment payment plan request. 3 $_____________

If your unpaid liability is over $10,000, complete and attach Form EG-13-I or Form EG-13-B. See instructions.

4 Write the date of your frst installment payment __ __ /__ __ /__ __ __ __ and payment amount. 4 $_____________

5 Check one of the following options to describe how often you will make payments.

One payment per month One payment per week One payment every other week

Date of month ___ ___ Day of week _______________ Day of week _______________

Step 3: Provide your fnancial institution and account information

6 ______________________________________________________ Check this box if you do not have a bank account.

Financial institution’s name

____________________________________________________________________________________________________________________

Mailing address City State ZIP

____________________________________________________________________________________________________________________

Name(s) on the account (list all names)

Routing number ___ ___ ___ ___ ___ ___ ___ ___ ___ Checking or Savings

Find your routing number at the bottom of your check (for checking accounts) or contact your fnancial institution for the routing number (for savings accounts).

Account number ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Step 4: Read the statement and sign below

I agree to, and understand, that (1) the Illinois Department of Revenue (IDOR) is authorized to use the information on this form to make withdrawals

(ACH debits) at the frequency I selected in Line 5 and from the account listed on Line 6 in accordance with the Department of Revenue Law of the Civil

Administrative Code of Illinois and all applicable Illinois tax acts, and that this authorization remains in effect until the debt is paid or I notify IDOR in writing

to cancel ;(2) IDOR may request additional information about my fnancial condition and I may be required to pay a higher amount than the payment plan

described above; (3) IDOR has the discretion to fle a lien at any time, including, but not limited to, when IDOR determines there is a risk of non-

payment; (4) IDOR may contact me about this payment plan at any address and phone number listed in Step 1 (this includes electronic communication

by email or text); and (5) if I do not remit the scheduled payment, fle all required returns, and pay all taxes when due, IDOR may cancel my installment

payment plan, my entire unpaid balance will become due immediately, and IDOR may take enforcement action, including levy of my bank account or wages.

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

______________________________________________________________________ __ __ / __ __ / __ __ __ __

Your signature or authorized offcer (if offcer, write title) Month, day, year

Department use only

_________________________________ __ / __ __ / __ __ __ __ ______________________________ __ __ / __ __ / __ __ __ __

Approved by assignee Date approved by assignee Approved by supervisor Date approved by supervisor

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this Printed by the authority of the state

CPP-1 (R-06/23) information is REQUIRED. Failure to provide information may result in this form not being processed and may result in a penalty. of Illinois — Web only, One copy

Reset Print