Enlarge image

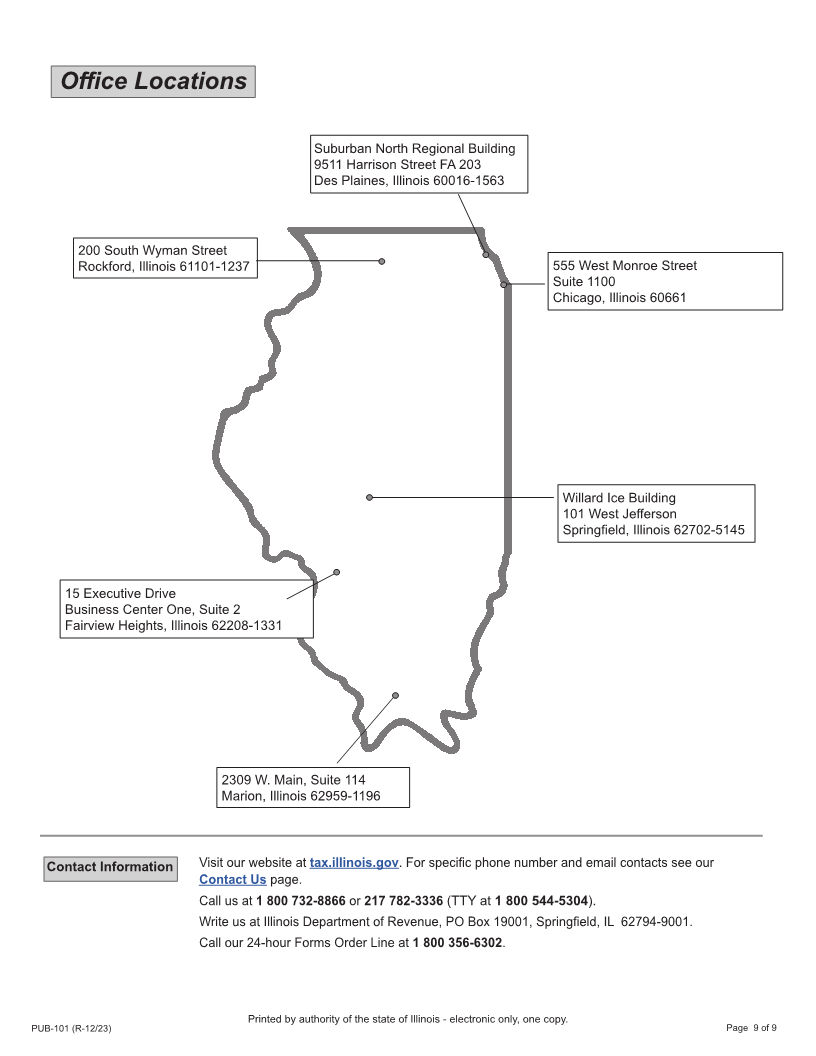

Illinois Department of Revenue

December 2023

Publication 101

Income Exempt from Tax

About this publication

The Constitution, treaties or statutes of the United States, and the Illinois Constitution exempt certain income from

Illinois Income Tax. Illinois law also exempts income of certain obligations of state and local governments from

Illinois Income Tax.

Publication 101, Income Exempt from Tax, provides a quick reference and a brief explanation of income that is

exempt from Illinois Income Tax. The objectives of Publication 101 are to

• identify who is entitled to a subtraction of income exempt from Illinois Income Tax.

• define income that is exempt from Illinois Income Tax as outlined in the Illinois Income Tax Rules.

• identify exceptions.

• explain how to claim a subtraction of exempt income on your Illinois Income Tax return.

This publication is reviewed on an annual basis and may not include the latest changes in the Illinois Income Tax

Rules. For more information regarding Illinois Income Tax exemptions, see the Illinois Income Tax Rules, 86 Illinois

Administrative Code 100.2470. To obtain a copy of these rules, call

• 1 800 356-6302 or

• our TTY at 1 800 544-5304.

The information in this publication is current as of the date of the publication. Please visit our website at

tax.illinois.gov to verify you have the most current revision.

This publication is written so the tax information is easier to understand. As a result, we do not directly quote

Illinois statutes and the Illinois Administrative Code. The contents of this publication are informational only and

do not take the place of statutes, rules, and court decisions. For many topics covered in this publication, we have

provided a reference to the applicable section or part of the Illinois Administrative Code for further clarification or

more detail. All of the sections and parts referenced can be found in Title 86 of the Code.

Taxpayer Bill of Rights

You have the right to call the Illinois Department of Revenue (IDOR) for help in resolving tax problems.

You have the right to privacy and confidentiality under most tax laws.

You have the right to respond, within specified time periods, to IDOR notices by asking questions, paying the

amount due, or providing proof to refute IDOR’s findings.

You have the right to appeal IDOR decisions, in many instances, within specified time periods, by asking for IDOR

review, by filing a petition with the Illinois Independent Tax Tribunal, or by filing a complaint in circuit court.

If you have overpaid your taxes, you have the right, within specified time periods, to a credit (or, in some cases, a

refund) of that overpayment.

For more information about these rights and other IDOR procedures, you may write us at the following address:

Problems Resolution Office

Illinois Department of Revenue

PO Box 19014

Springfield, IL 62794-9014

For information or forms, visit IDOR’s website at: tax.illinois.gov