Enlarge image

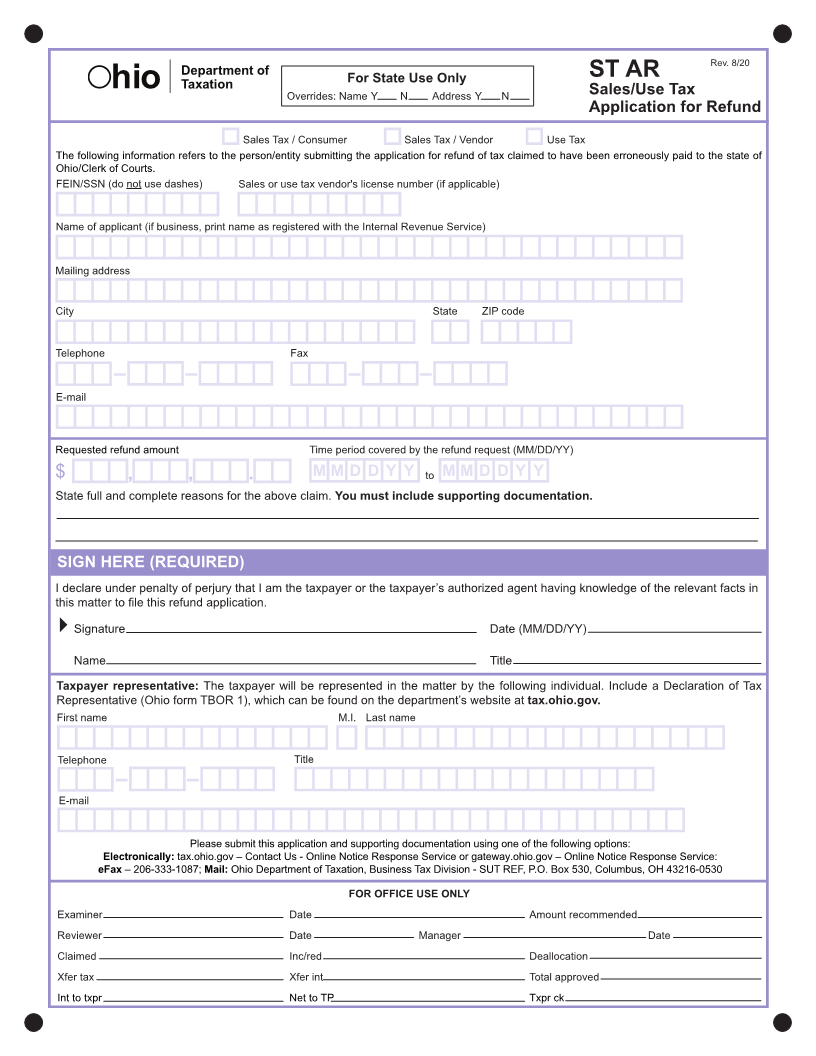

Rev. 8/20

Department of ST AR

Taxation For State Use Only

hio Overrides: Name Y N Address Y N Sales/Use Tax

Application for Refund

Sales Tax / Consumer Sales Tax / Vendor Use Tax

The following information refers to the person/entity submitting the application for refund of tax claimed to have been erroneously paid to the state of

Ohio/Clerk of Courts.

FEIN/SSN (do not use dashes) Sales or use tax vendor's license number (if applicable)

Name of applicant (if business, print name as registered with the Internal Revenue Service)

Mailing address

City State ZIP code

Telephone Fax

E-mail

Requested refund amount Time period covered by the refund request (MM/DD/YY)

$ , , . M M D D Y Y to M M D D Y Y

State full and complete reasons for the above claim. You must include supporting documentation.

SIGN HERE (REQUIRED)

I declare under penalty of perjury that I am the taxpayer or the taxpayer’s authorized agent having knowledge of the relevant facts in

this matter to file this refund application.

Signature Date (MM/DD/YY)

Name Title

Taxpayer representative: The taxpayer will be represented in the matter by the following individual. Include a Declaration of Tax

Representative (Ohio form TBOR 1), which can be found on the department’s website at tax.ohio.gov.

First name M.I. Last name

Telephone Title

E-mail

Please submit this application and supporting documentation using one of the following options:

Electronically: tax.ohio.gov – Contact Us - Online Notice Response Service or gateway.ohio.gov – Online Notice Response Service:

eFax – 206-333-1087;Mail: Ohio Department of Taxation, Business Tax Division - SUT REF, P.O. Box 530, Columbus , OH 43216-0530

FOR OFFICE USE ONLY

Examiner Date Amount recommended

Reviewer Date Manager Date

Claimed Inc/red Deallocation

Xfer tax Xfer int Total approved

Int to txpr Net to TP Txpr ck