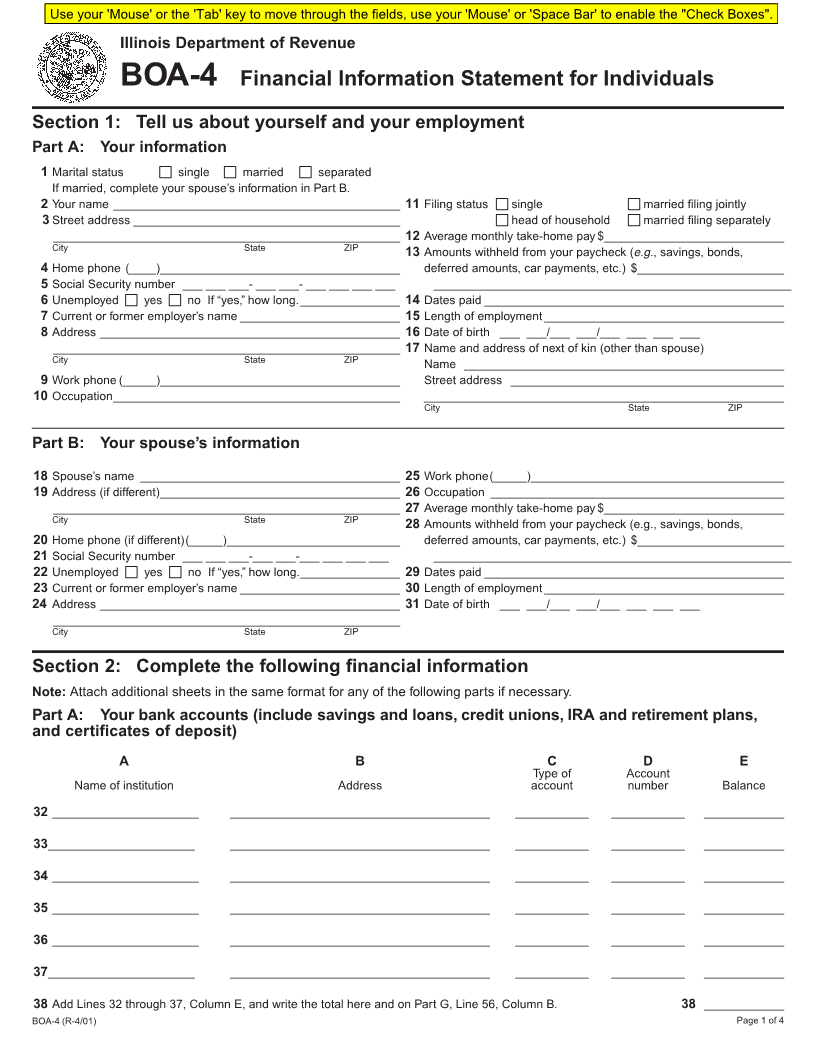

Enlarge image

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

BOA-4 Financial Information Statement for Individuals

Section 1: Tell us about yourself and your employment

Part A: Your information

1 Marital status single married separated

If married, complete your spouse’s information in Part B.

2 Your name ___________________________________________ 11 Filing status single married filing jointly

3Street address ________________________________________ head of household married filing separately

____________________________________________________ 12 Average monthly take-home pay $___________________________

City State ZIP 13 Amounts withheld from your paycheck (e.g., savings, bonds,

4 Home phone (____)____________________________________ deferred amounts, car payments, etc.) $______________________

5 Social Security number ___ ___ ___- ___ ___- ___ ___ ___ ___ ______________________________________________________

6 Unemployed yes no If “yes,” how long._______________ 14 Dates paid _____________________________________________

7 Current or former employer’s name ________________________ 15 Length of employment____________________________________

8 Address _____________________________________________ 16 Date of birth ___ ___/___ ___/___ ___ ___ ___

____________________________________________________ 17 Name and address of next of kin (other than spouse)

City State ZIP Name ________________________________________________

9 Work phone (_____)____________________________________ Street address _________________________________________

10 Occupation___________________________________________ ______________________________________________________

City State ZIP

Part B: Your spouse’s information

18 Spouse’s name _______________________________________ 25 Work phone(_____)______________________________________

19 Address (if different)____________________________________ 26 Occupation ____________________________________________

____________________________________________________ 27 Average monthly take-home pay $___________________________

City State ZIP 28 Amounts withheld from your paycheck (e.g., savings, bonds,

20 Home phone (if different)(_____)__________________________ deferred amounts, car payments, etc.) $______________________

21 Social Security number ___ ___ ___-___ ___-___ ___ ___ ___ ______________________________________________________

22 Unemployed yes no If “yes,” how long._______________ 29 Dates paid _____________________________________________

23 Current or former employer’s name ________________________ 30 Length of employment____________________________________

24 Address _____________________________________________ 31 Date of birth ___ ___/___ ___/___ ___ ___ ___

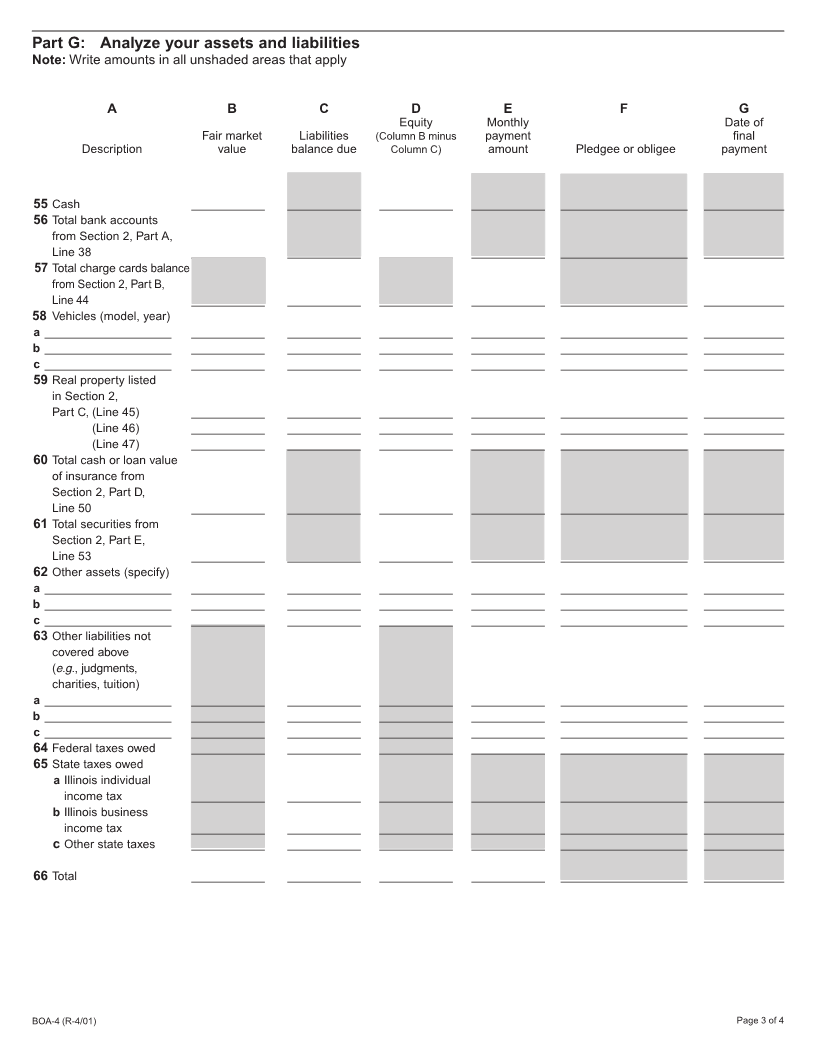

____________________________________________________

City State ZIP

Section 2: Complete the following financial information

Note: Attach additional sheets in the same format for any of the following parts if necessary.

Part A: Your bank accounts (include savings and loans, credit unions, IRA and retirement plans,

and certificates of deposit)

ABCDE

Type of Account

Name of institution Address account number Balance

32 ______________________ _______________________________________ ___________ ___________ ____________

33 ______________________ _______________________________________ ___________ ___________ ____________

34 ______________________ _______________________________________ ___________ ___________ ____________

35 ______________________ _______________________________________ ___________ ___________ ____________

36 ______________________ _______________________________________ ___________ ___________ ____________

37 ______________________ _______________________________________ ___________ ___________ ____________

38 Add Lines 32 through 37, Column E, and write the total here and on Part G, Line 56, Column B. 38 ____________

BOA-4 (R-4/01) Page 1 of 4