Enlarge image

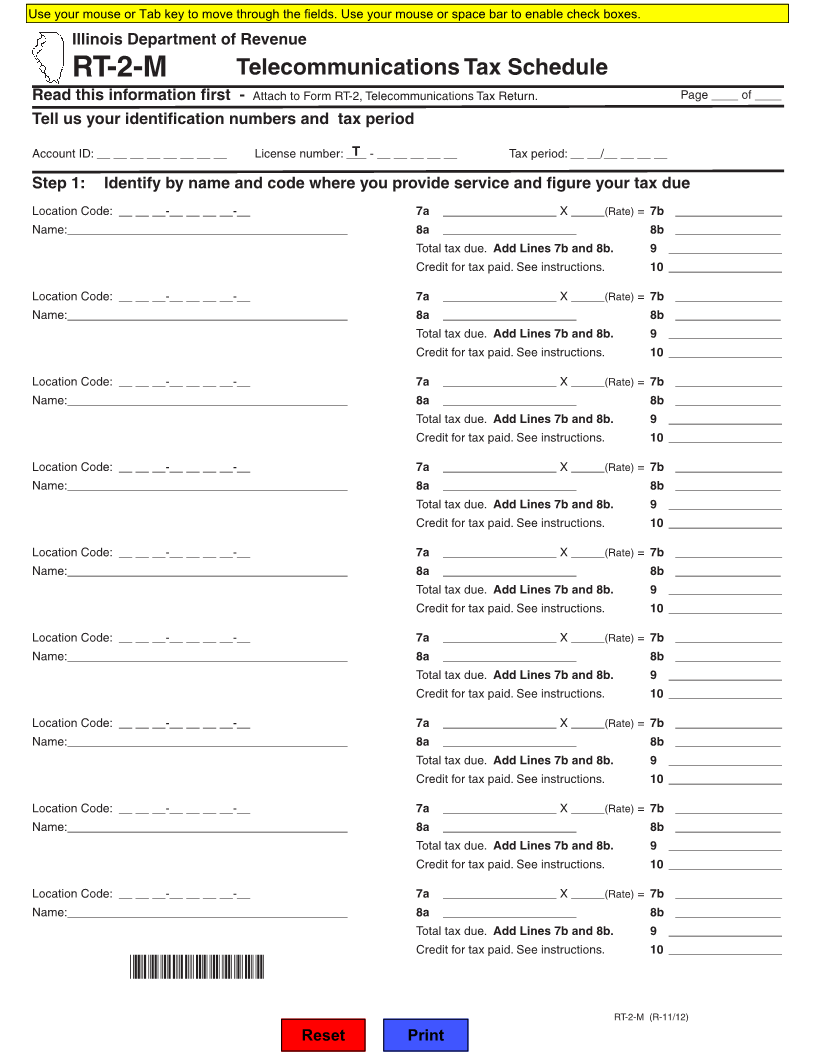

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RT-2-M Telecommunications Tax Schedule

Read this information first - Attach to Form RT-2, Telecommunications Tax Return. Page ____ of ____

Tell us your identification numbers and tax period

Account ID: __ __ __ __ __ __ __ __ License number: ___T - __ __ __ __ __ Tax period: __ __/__ __ __ __

Step 1: Identify by name and code where you provide service and figure your tax due

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

Location Code: __ __ __-__ __ __ __-__ 7a _________________ X _____(Rate) = 7b ________________

Name:__________________________________________ 8a ____________________ 8b ________________

Total tax due. Add Lines 7b and 8b. 9 _________________

Credit for tax paid. See instructions. 10 _________________

*216601110*

RT-2-M (R-11/12)

Reset Print