Enlarge image

New Hampshire

Department of ED-02

Revenue Administration 00ED022011862

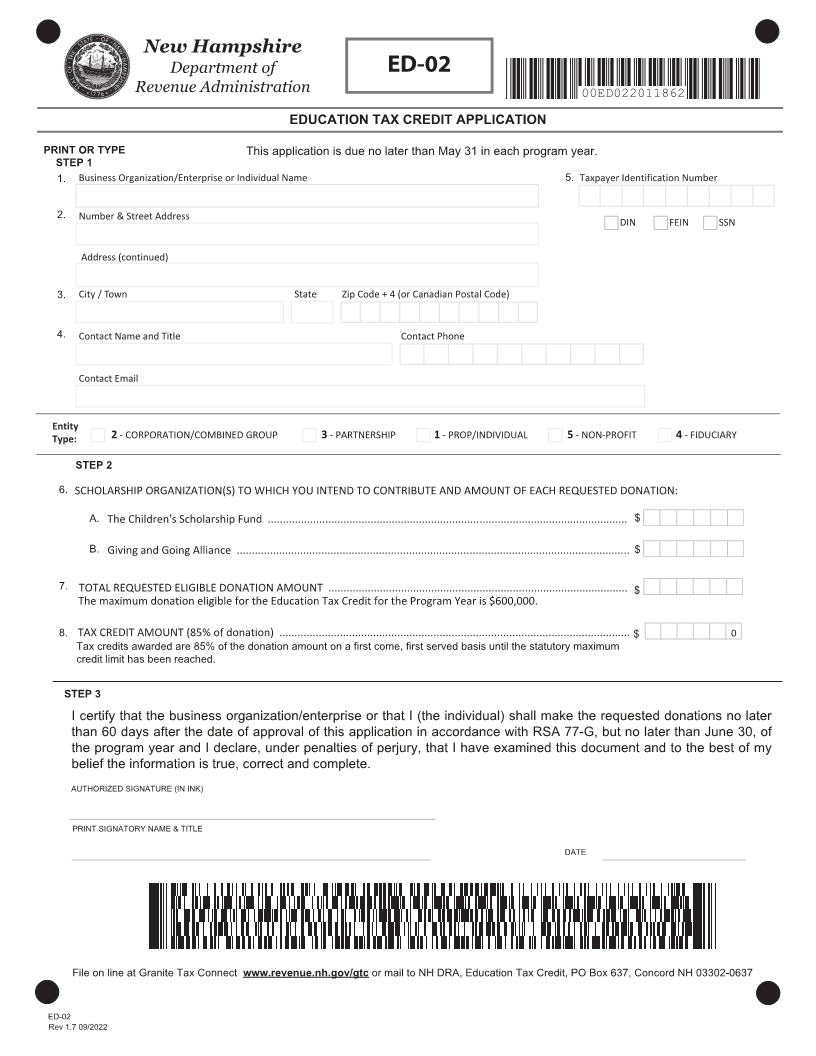

EDUCATION TAX CREDIT APPLICATION

PRINT OR TYPE This application is due no later than May 31 in each program year.

STEP 1

1. Business Organization/Enterprise or Individual Name 5. Taxpayer Identification Number

2. Number & Street Address DIN FEIN SSN

Address (continued)

3. City / Town State Zip Code + 4 (or Canadian Postal Code)

4. Contact Name and Title Contact Phone

Contact Email

Entity

Type: 2 - CORPORATION/COMBINED GROUP 3 - PARTNERSHIP 1 - PROP/INDIVIDUAL 5 - NON-PROFIT 4 - FIDUCIARY

STEP 2

6. SCHOLARSHIP ORGANIZATION(S) TO WHICH YOU INTEND TO CONTRIBUTE AND AMOUNT OF EACH REQUESTED DONATION:

A. The Children's Scholarship Fund ....................................................................................................................... $

B. Giving and Going Alliance .................................................................................................................................. $

7. TOTAL REQUESTED ELIGIBLE DONATION AMOUNT ................................................................................................... $

The maximum donation eligible for the Education Tax Credit for the Program Year is $600,000.

8. TAX CREDIT AMOUNT (85% of donation) .................................................................................................................... $ 0

Tax credits awarded are 85% of the donation amount on a first come, first served basis until the statutory maximum

credit limit has been reached.

STEP 3

I certify that the business organization/enterprise or that I (the individual) shall make the requested donations no later

than 60 days after the date of approval of this application in accordance with RSA 77-G, but no later than June 30, of

the program year and I declare, under penalties of perjury, that I have examined this document and to the best of my

belief the information is true, correct and complete.

AUTHORIZED SIGNATURE (IN INK)

PRINT SIGNATORY NAME & TITLE

DATE

File on line at Granite Tax Connect www.revenue.nh.gov/gtc or mail to NH DRA, Education Tax Credit, PO Box 637, Concord NH 03302-0637

ED-02

Rev 1.7 09/2022