Enlarge image

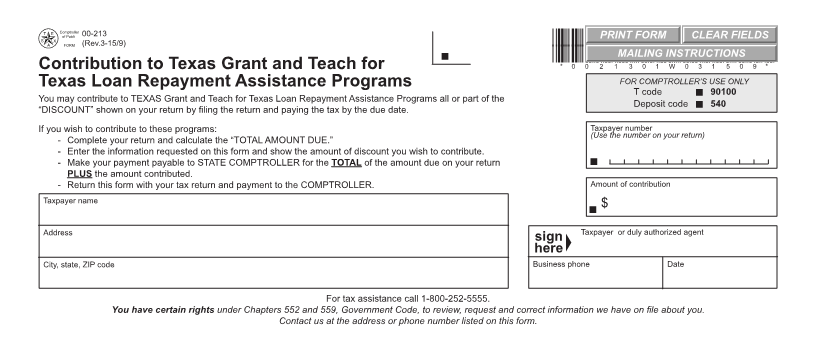

00-213 PRINT FORM CLEAR FIELDS

(Rev.3-15/9) *0021301W031509*

*0021301W031509*MAILING INSTRUCTIONS

Contribution to Texas Grant and Teach for * 0 0 2 1 3 0 1 W 0 3 1 5 0 9 *

Texas Loan Repayment Assistance Programs FOR COMPTROLLER’S USE ONLY

T code

You may contribute to TEXAS Grant and Teach for Texas Loan Repayment Assistance Programs all or part of the 90100

“DISCOUNT” shown on your return by filing the return and paying the tax by the due date. Deposit code 540

If you wish to contribute to these programs: Taxpayer number

- Complete your return and calculate the “TOTAL AMOUNT DUE.” (Use the number on your return)

- Enter the information requested on this form and show the amount of discount you wish to contribute.

- Make your payment payable to STATE COMPTROLLER for the TOTAL of the amount due on your return

PLUS the amount contributed.

- Return this form with your tax return and payment to the COMPTROLLER. Amount of contribution

Taxpayer name $

Address Taxpayer or duly authorized agent

City, state, ZIP code Business phone Date

For tax assistance call 1-800-252-5555.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you.

Contact us at the address or phone number listed on this form.