Enlarge image

PRINT FORM CLEAR FIELDS

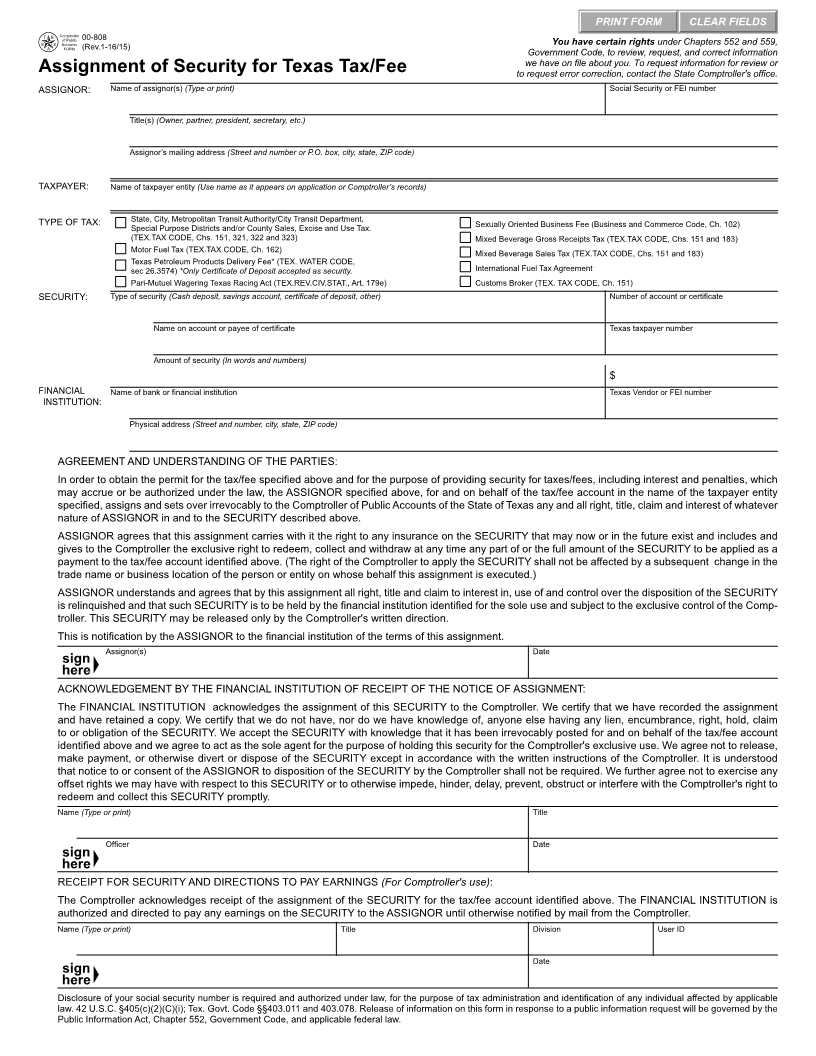

00-808 You have certain rights under Chapters 552 and 559,

(Rev.1-16/15) Government Code, to review, request, and correct information

we have on file about you. To request information for review or

Assignment of Security for Texas Tax/Fee to request error correction, contact the State Comptroller's office.

ASSIGNOR: Name of assignor(s) (Type or print) Social Security or FEI number

Title(s) (Owner, partner, president, secretary, etc.)

Assignor’s mailing address (Street and number or P.O. box, city, state, ZIP code)

TAXPAYER: Name of taxpayer entity (Use name as it appears on application or Comptroller’s records)

TYPE OF TAX: State, City, Metropolitan Transit Authority/City Transit Department, Sexually Oriented Business Fee (Business and Commerce Code, Ch. 102)

Special Purpose Districts and/or County Sales, Excise and Use Tax.

(TEX.TAX CODE, Chs. 151, 321, 322 and 323) Mixed Beverage Gross Receipts Tax (TEX.TAX CODE, Chs. 151 and 183)

Motor Fuel Tax (TEX.TAX CODE, Ch. 162) Mixed Beverage Sales Tax (TEX.TAX CODE, Chs. 151 and 183)

Texas Petroleum Products Delivery Fee* (TEX. WATER CODE,

sec 26.3574) *Only Certificate of Deposit accepted as security. International Fuel Tax Agreement

Pari-Mutuel Wagering Texas Racing Act (TEX.REV.CIV.STAT., Art. 179e) Customs Broker (TEX. TAX CODE, Ch. 151)

SECURITY: Type of security (Cash deposit, savings account, certificate of deposit, other) Number of account or certificate

Name on account or payee of certificate Texas taxpayer number

Amount of security (In words and numbers)

$

FINANCIAL Name of bank or financial institution Texas Vendor or FEI number

INSTITUTION:

Physical address (Street and number, city, state, ZIP code)

AGREEMENT AND UNDERSTANDING OF THE PARTIES:

In order to obtain the permit for the tax/fee specified above and for the purpose of providing security for taxes/fees, including interest and penalties, which

may accrue or be authorized under the law, the ASSIGNOR specified above, for and on behalf of the tax/fee account in the name of the taxpayer entity

specified, assigns and sets over irrevocably to the Comptroller of Public Accounts of the State of Texas any and all right, title, claim and interest of whatever

nature of ASSIGNOR in and to the SECURITY described above.

ASSIGNOR agrees that this assignment carries with it the right to any insurance on the SECURITY that may now or in the future exist and includes and

gives to the Comptroller the exclusive right to redeem, collect and withdraw at any time any part of or the full amount of the SECURITY to be applied as a

payment to the tax/fee account identified above. (The right of the Comptroller to apply the SECURITY shall not be affected by a subsequent change in the

trade name or business location of the person or entity on whose behalf this assignment is executed.)

ASSIGNOR understands and agrees that by this assignment all right, title and claim to interest in, use of and control over the disposition of the SECURITY

is relinquished and that such SECURITY is to be held by the financial institution identified for the sole use and subject to the exclusive control of the Comp-

troller. This SECURITY may be released only by the Comptroller's written direction.

This is notification by the ASSIGNOR to the financial institution of the terms of this assignment.

Assignor(s) Date

ACKNOWLEDGEMENT BY THE FINANCIAL INSTITUTION OF RECEIPT OF THE NOTICE OF ASSIGNMENT:

The FINANCIAL INSTITUTION acknowledges the assignment of this SECURITY to the Comptroller. We certify that we have recorded the assignment

and have retained a copy. We certify that we do not have, nor do we have knowledge of, anyone else having any lien, encumbrance, right, hold, claim

to or obligation of the SECURITY. We accept the SECURITY with knowledge that it has been irrevocably posted for and on behalf of the tax/fee account

identified above and we agree to act as the sole agent for the purpose of holding this security for the Comptroller's exclusive use. We agree not to release,

make payment, or otherwise divert or dispose of the SECURITY except in accordance with the written instructions of the Comptroller. It is understood

that notice to or consent of the ASSIGNOR to disposition of the SECURITY by the Comptroller shall not be required. We further agree not to exercise any

offset rights we may have with respect to this SECURITY or to otherwise impede, hinder, delay, prevent, obstruct or interfere with the Comptroller's right to

redeem and collect this SECURITY promptly.

Name (Type or print) Title

Officer Date

RECEIPT FOR SECURITY AND DIRECTIONS TO PAY EARNINGS (For Comptroller's use):

The Comptroller acknowledges receipt of the assignment of the SECURITY for the tax/fee account identified above. The FINANCIAL INSTITUTION is

authorized and directed to pay any earnings on the SECURITY to the ASSIGNOR until otherwise notified by mail from the Comptroller.

Name (Type or print) Title Division User ID

Date

Disclosure of your social security number is required and authorized under law, for the purpose of tax administration and identification of any individual affected by applicable

law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on this form in response to a public information request will be governed by the

Public Information Act, Chapter 552, Government Code, and applicable federal law.