Enlarge image

f Idaho state tax Commission

o

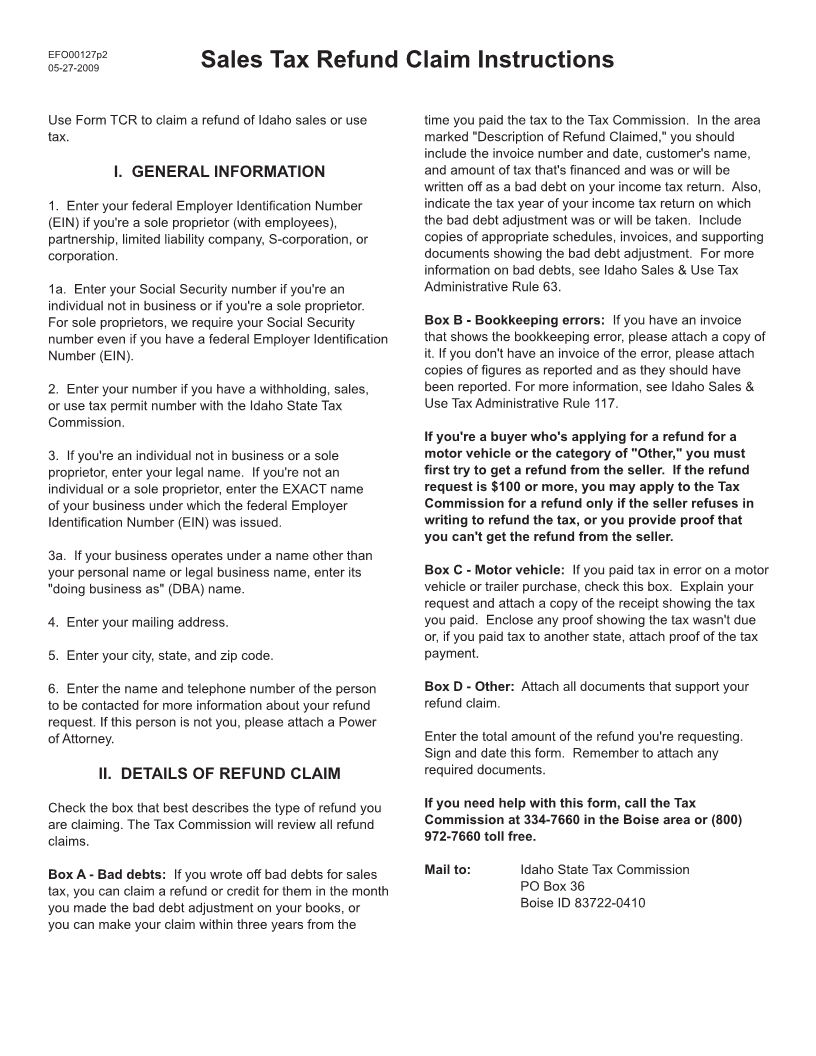

r EFO00127tCr sales tax refunD ClaIm

m

05-27-2009

Please read instructions on back

Please don't write in this space. EC RC

I. General InformatIon

1. Federal Employer Identification Number 1a. Social Security number 2. Permit number

3. Legal name 3a. Doing business as (DBA name)

4. Mailing address

5. City State ZIP

6. Name of person to contact Telephone number

( )

II. DetaIls of refunD ClaIm

Check the box that best describes the reason for your refund request. Attach copies of invoices or documents supporting this claim.

A. Bad debts B. Bookkeeping errors C. Motor vehicle D. Other

Description of refund Claimed tax Paid

Total Refund Requested:

III. refunD ClaIm

I request a sales tax refund for the reasons indicated above. If box C. or D. is checked, I have requested a refund of these taxes from

the seller and been denied. If the refund request is $100 or more, I have attached either a letter from the seller refusing to refund the

tax or other proof that shows I can't get a refund from the seller.

I certify that all statements I have made on this form are true and correct to the best of my knowledge. I understand that if I falsify this

form, I may be subject to criminal prosecution.

Authorized signature Title Date