Enlarge image

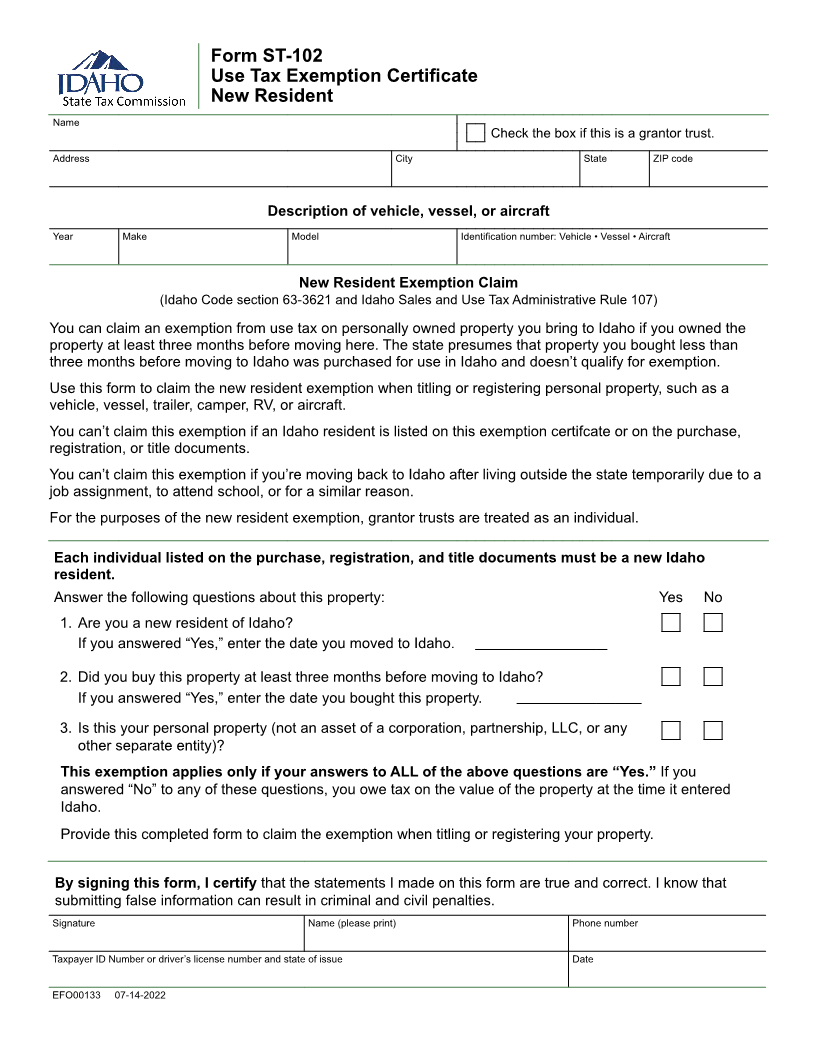

Form ST-102

Use Tax Exemption Certificate

New Resident

Name

Check the box if this is a grantor trust.

Address City State ZIP code

Description of vehicle, vessel, or aircraft

Year Make Model Identification number: Vehicle • Vessel • Aircraft

New Resident Exemption Claim

(Idaho Code section 63-3621 and Idaho Sales and Use Tax Administrative Rule 107)

You can claim an exemption from use tax on personally owned property you bring to Idaho if you owned the

property at least three months before moving here. The state presumes that property you bought less than

three months before moving to Idaho was purchased for use in Idaho and doesn’t qualify for exemption.

Use this form to claim the new resident exemption when titling or registering personal property, such as a

vehicle, vessel, trailer, camper, RV, or aircraft.

You can’t claim this exemption if an Idaho resident is listed on this exemption certifcate or on the purchase,

registration, or title documents.

You can’t claim this exemption if you’re moving back to Idaho after living outside the state temporarily due to a

job assignment, to attend school, or for a similar reason.

For the purposes of the new resident exemption, grantor trusts are treated as an individual.

Each individual listed on the purchase, registration, and title documents must be a new Idaho

resident.

Answer the following questions about this property: Yes No

1. Are you a new resident of Idaho?

If you answered “Yes,” enter the date you moved to Idaho.

2. Did you buy this property at least three months before moving to Idaho?

If you answered “Yes,” enter the date you bought this property.

3. Is this your personal property (not an asset of a corporation, partnership, LLC, or any

other separate entity)?

This exemption applies only if your answers to ALL of the above questions are “Yes.” If you

answered “No” to any of these questions, you owe tax on the value of the property at the time it entered

Idaho.

Provide this completed form to claim the exemption when titling or registering your property.

By signing this form, I certify that the statements I made on this form are true and correct. I know that

submitting false information can result in criminal and civil penalties.

Signature Name (please print) Phone number

Taxpayer ID Number or driver’s license number and state of issue Date

EFO00133 07-14-2022