Enlarge image

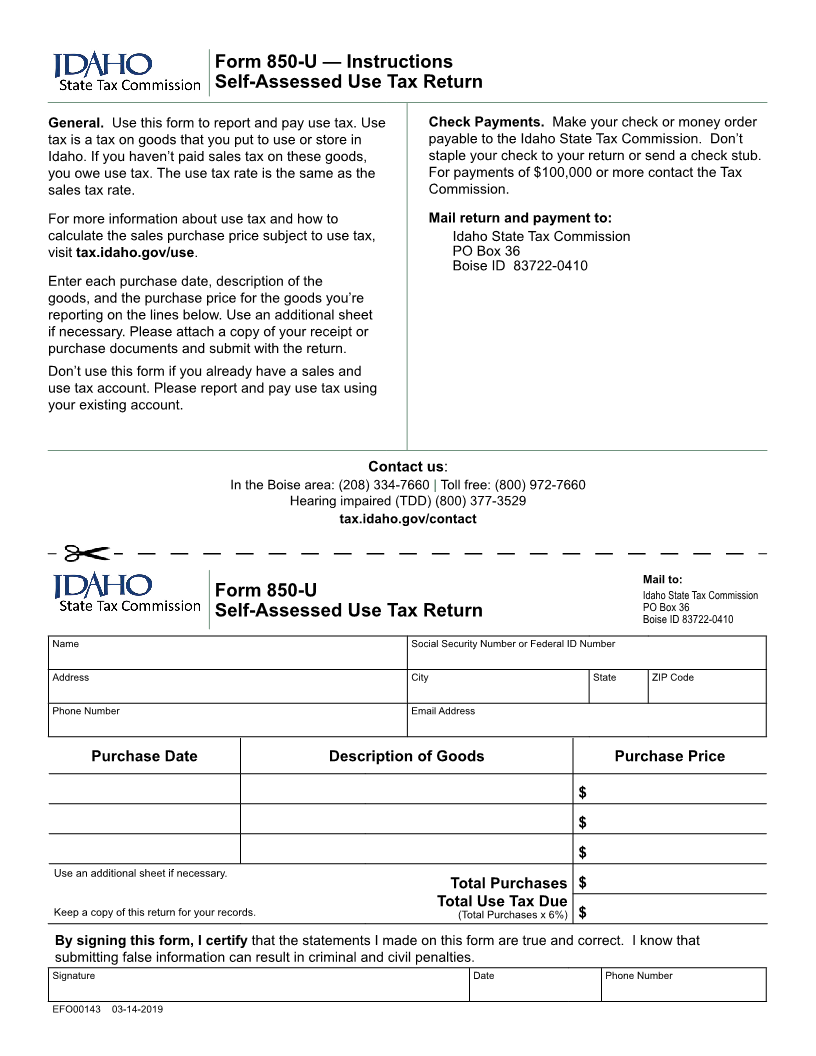

Form 850-U — Instructions

Self-Assessed Use Tax Return

General. Use this form to report and pay use tax. Use Check Payments. Make your check or money order

tax is a tax on goods that you put to use or store in payable to the Idaho State Tax Commission. Don’t

Idaho. If you haven’t paid sales tax on these goods, staple your check to your return or send a check stub.

you owe use tax. The use tax rate is the same as the For payments of $100,000 or more contact the Tax

sales tax rate. Commission.

For more information about use tax and how to Mail return and payment to:

calculate the sales purchase price subject to use tax, Idaho State Tax Commission

visit tax.idaho.gov/use. PO Box 36

Boise ID 83722-0410

Enter each purchase date, description of the

goods, and the purchase price for the goods you’re

reporting on the lines below. Use an additional sheet

if necessary. Please attach a copy of your receipt or

purchase documents and submit with the return.

Don’t use this form if you already have a sales and

use tax account. Please report and pay use tax using

your existing account.

Contact us:

In the Boise area: (208) 334-7660 |Toll free: (800) 972-7660

Hearing impaired (TDD) (800) 377-3529

tax.idaho.gov/contact

Mail to:

Form 850-U Idaho State Tax Commission

PO Box 36

Self-Assessed Use Tax Return Boise ID 83722-0410

Name Social Security Number or Federal ID Number

Address City State ZIP Code

Phone Number Email Address

Purchase Date Description of Goods Purchase Price

$

$

$

Use an additional sheet if necessary.

Total Purchases $

Total Use Tax Due

Keep a copy of this return for your records. (Total Purchases x 6%) $

By signing this form, I certify that the statements I made on this form are true and correct. I know that

submitting false information can result in criminal and civil penalties.

Signature Date Phone Number

EFO00143 03-14-2019