Enlarge image

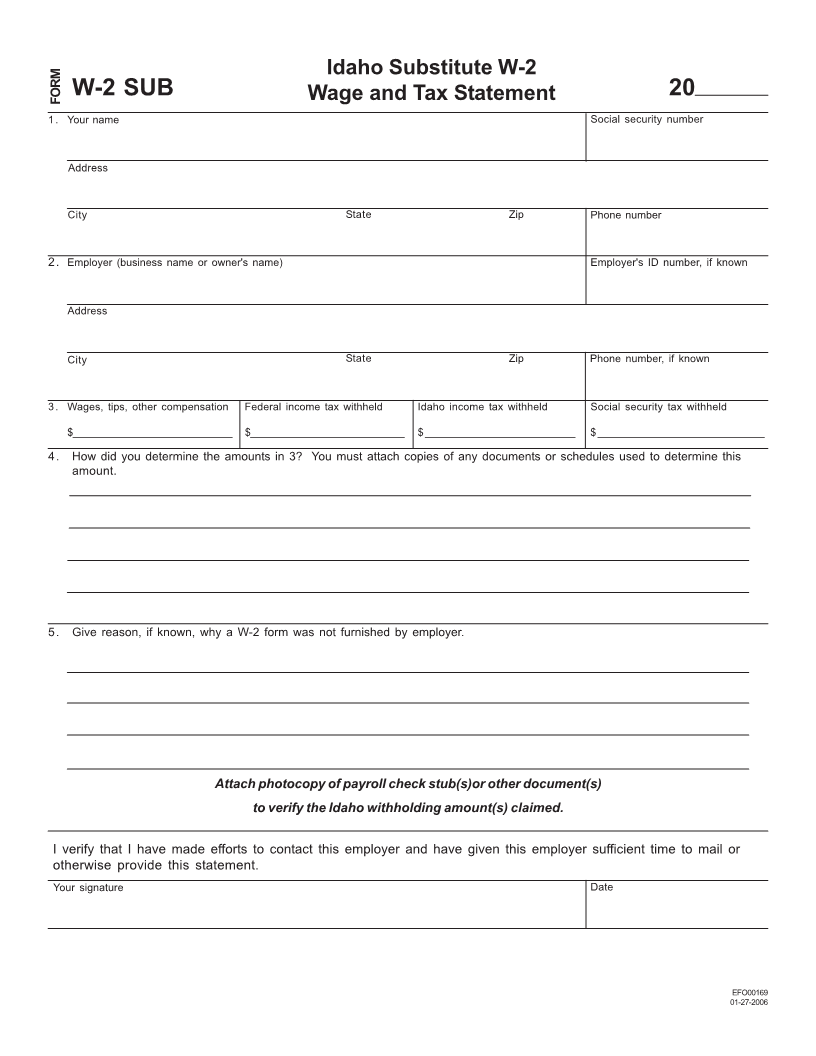

Idaho Substitute W-2

FORM W-2 SUB Wage and Tax Statement 20

1. Your name Social security number

Address

City State Zip Phone number

2. Employer (business name or owner's name) Employer's ID number, if known

Address

City State Zip Phone number, if known

3. Wages, tips, other compensation Federal income tax withheld Idaho income tax withheld Social security tax withheld

$_____________________________ $____________________________ $ ___________________________ $ ______________________________

4. How did you determine the amounts in 3? You must attach copies of any documents or schedules used to determine this

amount.

5. Give reason, if known, why a W-2 form was not furnished by employer.

Attach photocopy of payroll check stub(s)or other document(s)

to verify the Idaho withholding amount(s) claimed.

I verify that I have made efforts to contact this employer and have given this employer sufficient time to mail or

otherwise provide this statement.

Your signature Date

EFO00169

01-27-2006