- 3 -

Enlarge image

|

Page 3

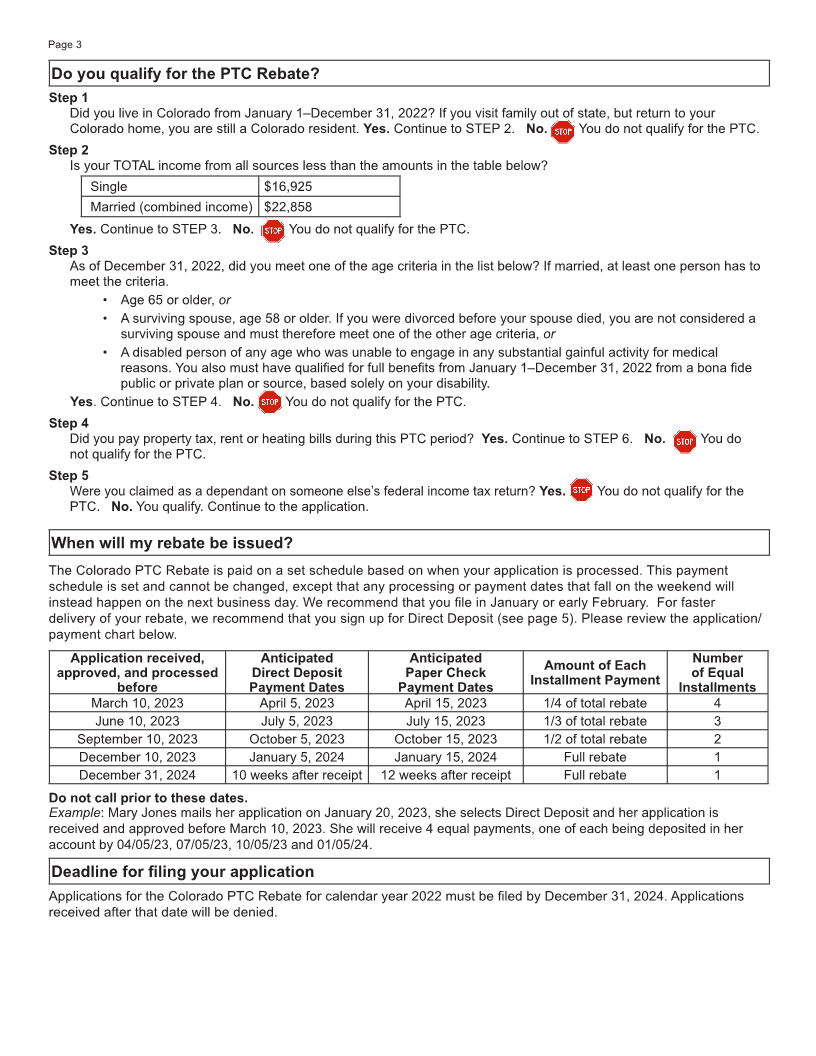

Do you qualify for the PTC Rebate?

Step 1

Did you live in Colorado from January 1–December 31, 2022? If you visit family out of state, but return to your

Colorado home, you are still a Colorado resident. Yes. Continue to STEP 2. No. You do not qualify for the PTC.

Step 2

Is your TOTAL income from all sources less than the amounts in the table below?

Single $16,925

Married (combined income) $22,858

Yes. Continue to STEP 3. No. You do not qualify for the PTC.

Step 3

As of December 31, 2022, did you meet one of the age criteria in the list below? If married, at least one person has to

meet the criteria.

• Age 65 or older, or

• A surviving spouse, age 58 or older. If you were divorced before your spouse died, you are not considered a

surviving spouse and must therefore meet one of the other age criteria, or

• A disabled person of any age who was unable to engage in any substantial gainful activity for medical

reasons. You also must have qualified for full benefits from January 1–December 31, 2022 from a bona fide

public or private plan or source, based solely on your disability.

Yes. Continue to STEP 4. No. You do not qualify for the PTC.

Step 4

Did you pay property tax, rent or heating bills during this PTC period? Yes. Continue to STEP 6. No. You do

not qualify for the PTC.

Step 5

Were you claimed as a dependant on someone else’s federal income tax return? Yes. You do not qualify for the

PTC. No. You qualify. Continue to the application.

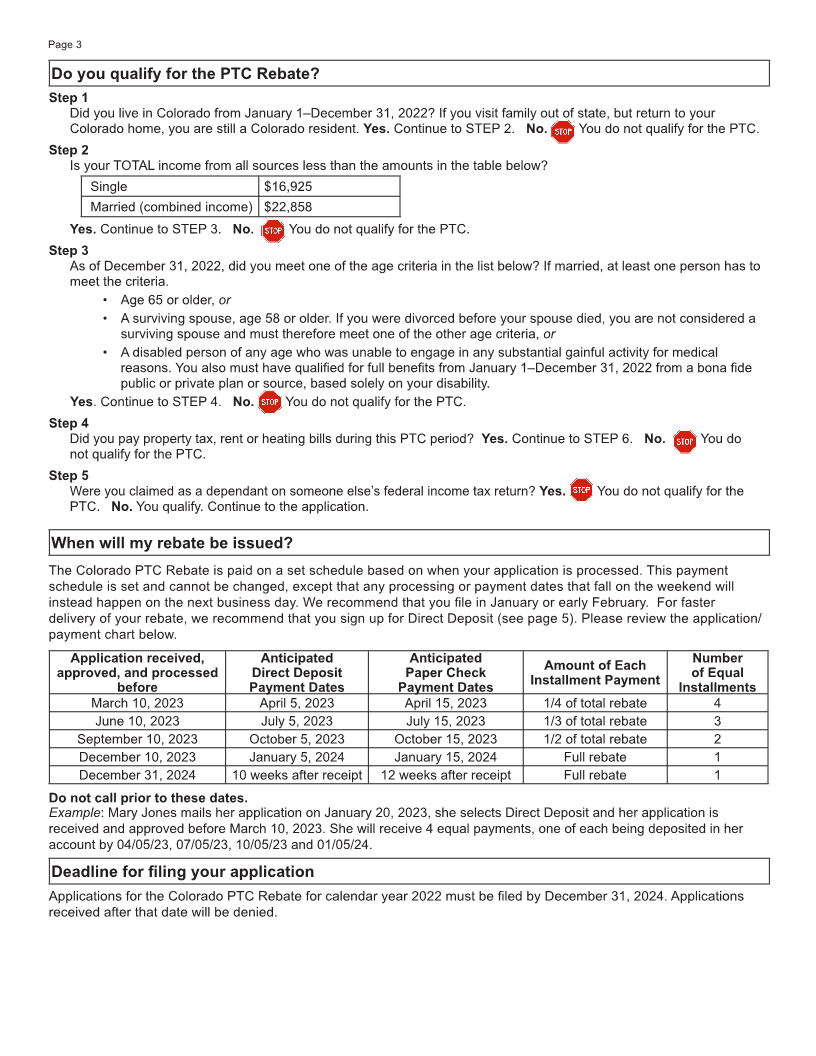

When will my rebate be issued?

The Colorado PTC Rebate is paid on a set schedule based on when your application is processed. This payment

schedule is set and cannot be changed, except that any processing or payment dates that fall on the weekend will

instead happen on the next business day. We recommend that you file in January or early February. For faster

delivery of your rebate, we recommend that you sign up for Direct Deposit (see page 5). Please review the application/

payment chart below.

Application received, Anticipated Anticipated Number

Amount of Each

approved, and processed Direct Deposit Paper Check of Equal

Installment Payment

before Payment Dates Payment Dates Installments

March 10, 2023 April 5, 2023 April 15, 2023 1/4 of total rebate 4

June 10, 2023 July 5, 2023 July 15, 2023 1/3 of total rebate 3

September 10, 2023 October 5, 2023 October 15, 2023 1/2 of total rebate 2

December 10, 2023 January 5, 2024 January 15, 2024 Full rebate 1

December 31, 2024 10 weeks after receipt 12 weeks after receipt Full rebate 1

Do not call prior to these dates.

Example: Mary Jones mails her application on January 20, 2023, she selects Direct Deposit and her application is

received and approved before March 10, 2023. She will receive 4 equal payments, one of each being deposited in her

account by 04/05/23, 07/05/23, 10/05/23 and 01/05/24.

Deadline for filing your application

Applications for the Colorado PTC Rebate for calendar year 2022 must be filed by December 31, 2024. Applications

received after that date will be denied.

|