Enlarge image

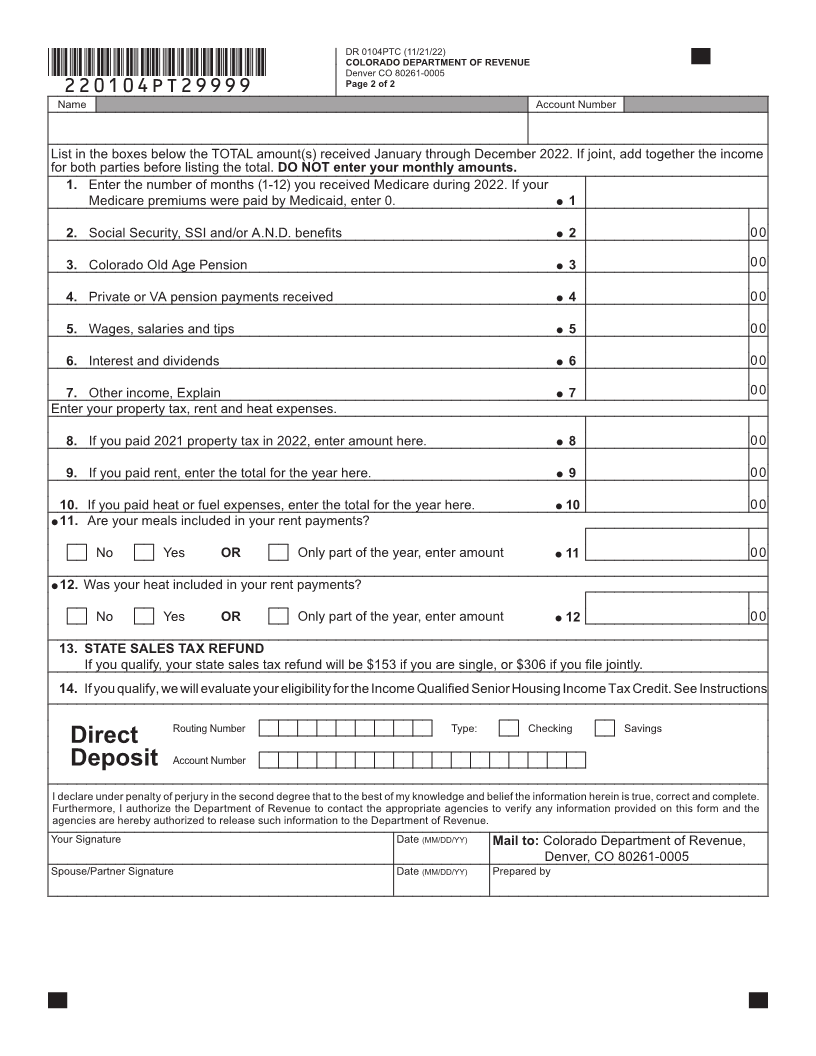

DR 0104PTC (11/21/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

*220104PT19999* Page 1 of 2

(1063)

2022 Colorado Property Tax/Rent/Heat Rebate Application

Mark here if this application is being filed to correct a previously filed 2022 PTC application.

Last Name (yourself) First Name Middle Initial

Deceased Date of Birth (MM/DD/YYYY) SSN or ITIN

Yes

Colorado Driver License/ID Number Expiration Date (MM/DD/YYYY) Alternate ID

Last Name (spouse, if married) First Name Middle Initial

Deceased Date of Birth (MM/DD/YYYY) SSN or ITIN

Yes

Spouse's Driver License/ID Number Expiration Date (MM/DD/YYYY) Alternate ID

Physical Address Phone Number

City State ZIP

Mailing Address (if different from physical address) Email Address

City State ZIP

If you did not live at the address listed above for all of 2022, you must include a list of addresses at which you lived

during 2022 and the dates you lived at each location.

Check the first box that applies to you or your spouse/partner. If none apply, do not fill out this form because you do not qualify for this rebate.

A Age 65 or older on December 31, 2022.

B A widow or widower at least 58 years of age on December 31, 2022.

C Totally disabled for all of 2022 and received payment of full benefits from Social Security, SSI or the

Department of Human Services based solely on such disability.

D Totally disabled for all of 2022 and received payment of full benefits from a bona fide public or private plan

or source based solely on such disability. You MUST include proof of disability (see page 4 of the instruction

book for examples of proof).