Enlarge image

DR 0145 (05/26/21)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

Colorado Tax Information Authorization or Power of Attorney

Instructions for DR 0145 and Other Forms

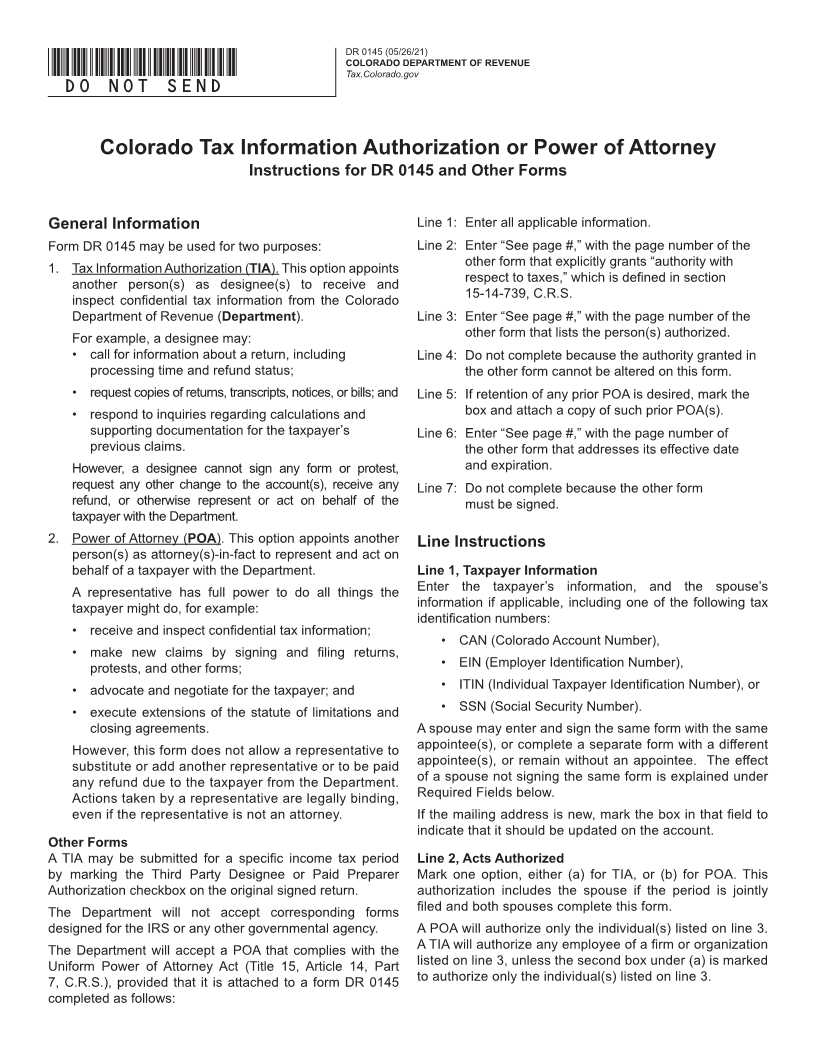

General Information Line 1: Enter all applicable information.

Form DR 0145 may be used for two purposes: Line 2: Enter “See page #,” with the page number of the

other form that explicitly grants “authority with

1. Tax Information Authorization (TIA). This option appoints

respect to taxes,” which is defined in section

another person(s) as designee(s) to receive and

15-14-739, C.R.S.

inspect confidential tax information from the Colorado

Department of Revenue (Department). Line 3: Enter “See page #,” with the page number of the

For example, a designee may: other form that lists the person(s) authorized.

• call for information about a return, including Line 4: Do not complete because the authority granted in

processing time and refund status; the other form cannot be altered on this form.

• request copies of returns, transcripts, notices, or bills; and Line 5: If retention of any prior POA is desired, mark the

• respond to inquiries regarding calculations and box and attach a copy of such prior POA(s).

supporting documentation for the taxpayer’s Line 6: Enter “See page #,” with the page number of

previous claims. the other form that addresses its effective date

However, a designee cannot sign any form or protest, and expiration.

request any other change to the account(s), receive any Line 7: Do not complete because the other form

refund, or otherwise represent or act on behalf of the must be signed.

taxpayer with the Department.

2. Power of Attorney (POA). This option appoints another Line Instructions

person(s) as attorney(s)-in-fact to represent and act on

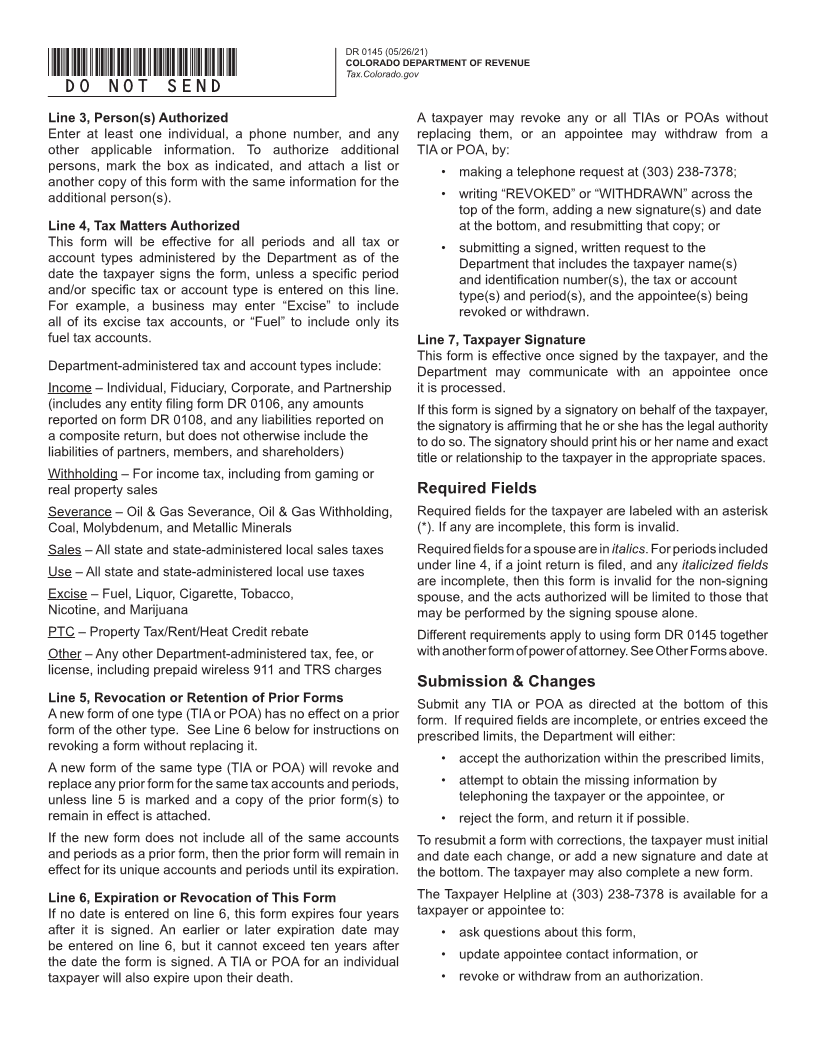

behalf of a taxpayer with the Department. Line 1, Taxpayer Information

A representative has full power to do all things the Enter the taxpayer’s information, and the spouse’s

taxpayer might do, for example: information if applicable, including one of the following tax

identification numbers:

• receive and inspect confidential tax information;

• CAN (Colorado Account Number),

• make new claims by signing and filing returns,

protests, and other forms; • EIN (Employer Identification Number),

• advocate and negotiate for the taxpayer; and • ITIN (Individual Taxpayer Identification Number), or

• execute extensions of the statute of limitations and • SSN (Social Security Number).

closing agreements. A spouse may enter and sign the same form with the same

However, this form does not allow a representative to appointee(s), or complete a separate form with a different

substitute or add another representative or to be paid appointee(s), or remain without an appointee. The effect

any refund due to the taxpayer from the Department. of a spouse not signing the same form is explained under

Actions taken by a representative are legally binding, Required Fields below.

even if the representative is not an attorney. If the mailing address is new, mark the box in that field to

indicate that it should be updated on the account.

Other Forms

A TIA may be submitted for a specific income tax period Line 2, Acts Authorized

by marking the Third Party Designee or Paid Preparer Mark one option, either (a) for TIA, or (b) for POA. This

Authorization checkbox on the original signed return. authorization includes the spouse if the period is jointly

The Department will not accept corresponding forms filed and both spouses complete this form.

designed for the IRS or any other governmental agency. A POA will authorize only the individual(s) listed on line 3.

The Department will accept a POA that complies with the A TIA will authorize any employee of a firm or organization

Uniform Power of Attorney Act (Title 15, Article 14, Part listed on line 3, unless the second box under (a) is marked

7, C.R.S.), provided that it is attached to a form DR 0145 to authorize only the individual(s) listed on line 3.

completed as follows: