Enlarge image

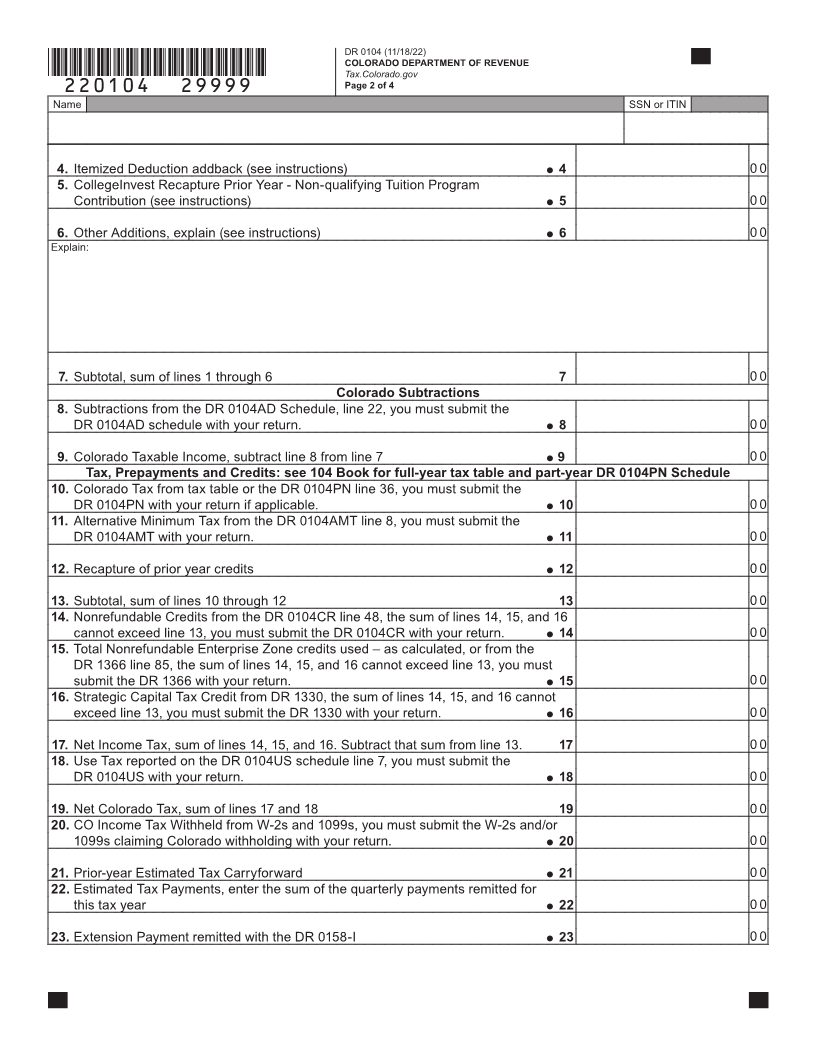

*220104==19999*

DR 0104 (11/18/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 1 of 4

(0013)

2022 Colorado Individual Income Tax Return

Full-Year Part-Year or Nonresident (or resident, part-year, Mark if Abroad on due date –

non-resident combination) *Must include DR 0104PN see instructions

Your Last Name Your First Name Middle Initial

Date of Birth (MM/DD/YYYY) SSN or ITIN Deceased

If checked and claiming a refund, you must include

the DR 0102 and death certificate with your return.

State of Issue Last 4 characters of ID number Date of Issuance

Enter the following information from your current

driver license or state identification card.

If Joint, Spouse’s Last Name Spouse’s First Name Middle Initial

Spouse’s Date of Birth (MM/DD/YYYY) Spouse’s SSN or ITIN Deceased

If checked and claiming a refund, you must include

the DR 0102 and death certificate with your return.

State of Issue Last 4 characters of ID number Date of Issuance

Enter the following information from your spouse’s

current driver license or state identification card.

Mailing Address Phone Number

City State ZIP Code Foreign Country (if applicable)

To see if you or members of your household qualify for free or reduced-cost health coverage, check this box if:

• You are a Colorado resident and at least one person in your household does not have health coverage

AND

• You give permission for the Colorado Department of Revenue to share the information on Form DR 0104EE with Connect

for Health Colorado (the Colorado Health Benefit Exchange) and the Department of Health Care Policy & Financing.

Round To The Nearest Dollar

1. Enter Federal Taxable Income from your federal income tax form:

1040, 1040 SR, or 1040 SP line 15. 1 0 0

Include W-2s and 1099s with CO withholding.

Additions to Federal Taxable Income

2. State Addback, enter the state income tax deduction from your federal form 1040,

1040 SR, or 1040 SP schedule A, line 5a (see instructions) 2 0 0

3. Qualified Business Income Deduction Addback (see instructions) 3 0 0