Enlarge image

DR 0900F (06/24/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0008

*220900F=19999* Tax.Colorado.gov

Page 1 of 1

(0031)

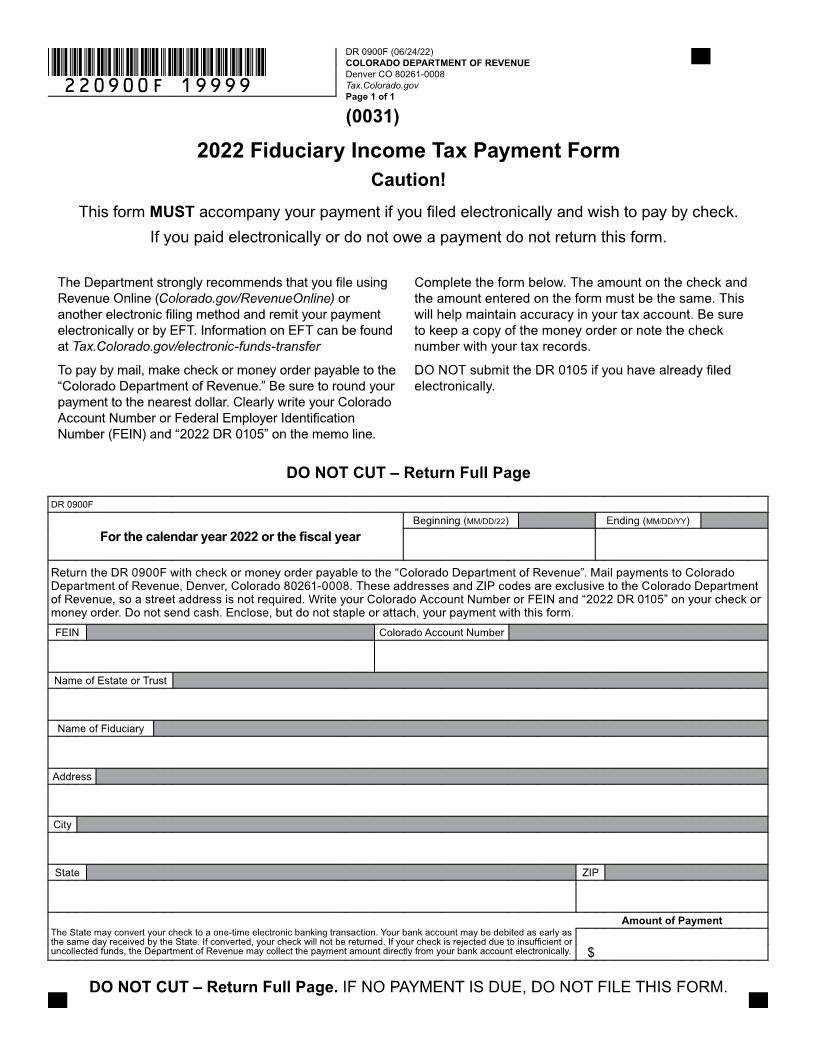

2022 Fiduciary Income Tax Payment Form

Caution!

This form MUST accompany your payment if you filed electronically and wish to pay by check.

If you paid electronically or do not owe a payment do not return this form.

The Department strongly recommends that you file using Complete the form below. The amount on the check and

Revenue Online (Colorado.gov/RevenueOnline) or the amount entered on the form must be the same. This

another electronic filing method and remit your payment will help maintain accuracy in your tax account. Be sure

electronically or by EFT. Information on EFT can be found to keep a copy of the money order or note the check

at Tax.Colorado.gov/electronic-funds-transfer number with your tax records.

To pay by mail, make check or money order payable to the DO NOT submit the DR 0105 if you have already filed

“Colorado Department of Revenue.” Be sure to round your electronically.

payment to the nearest dollar. Clearly write your Colorado

Account Number or Federal Employer Identification

Number (FEIN) and “2022 DR 0105” on the memo line.

DO NOT CUT – Return Full Page

DR 0900F

Beginning (MM/DD/22) Ending (MM/DD/YY)

For the calendar year 2022 or the fiscal year

Return the DR 0900F with check or money order payable to the “Colorado Department of Revenue”. Mail payments to Colorado

Department of Revenue, Denver, Colorado 80261‑0008. These addresses and ZIP codes are exclusive to the Colorado Department

of Revenue, so a street address is not required. Write your Colorado Account Number or FEIN and “2022 DR 0105” on your check or

money order. Do not send cash. Enclose, but do not staple or attach, your payment with this form.

FEIN Colorado Account Number

Name of Estate or Trust

Name of Fiduciary

Address

City

State ZIP

Amount of Payment

The State may convert your check to a one‑time electronic banking transaction. Your bank account may be debited as early as

the same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or

uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically. $

DO NOT CUT – Return Full Page. IF NO PAYMENT IS DUE, DO NOT FILE THIS FORM.