Enlarge image

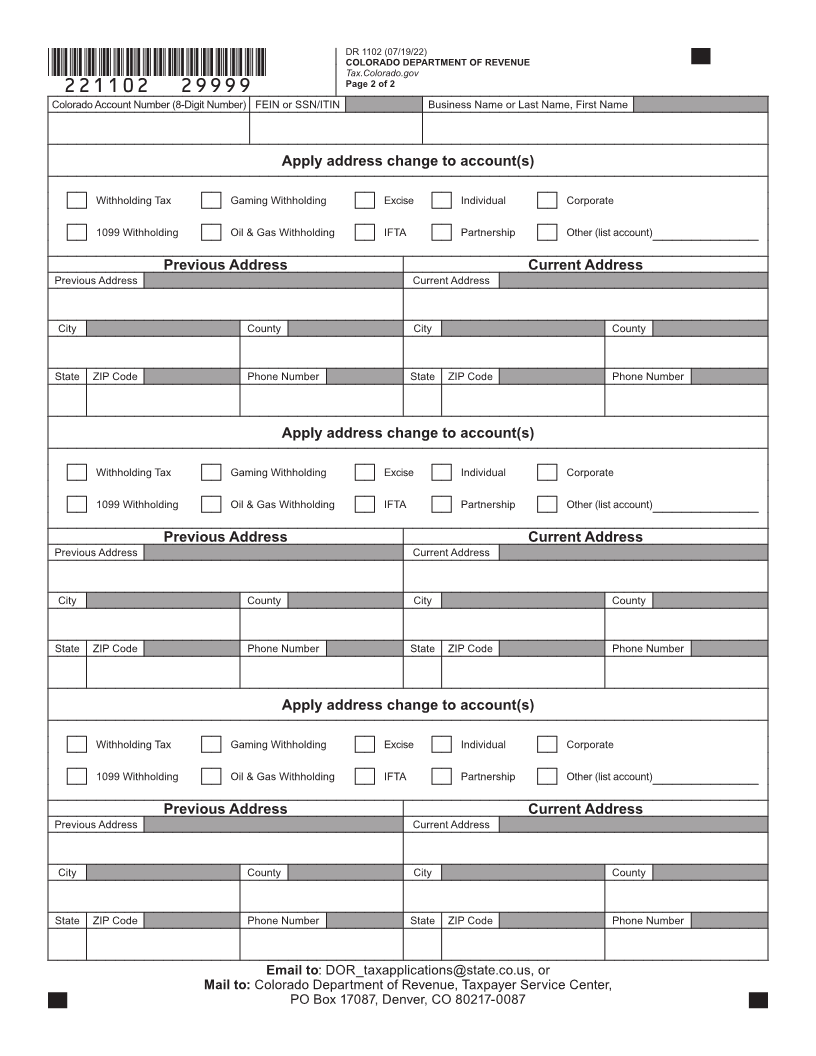

DR 1102 (07/19/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*221102==19999* Page 1 of 2

Address or Name Change Form

Use this form to notify the Department of Revenue by Note: A new Federal Employer Identification Number

selecting the appropriate accounts for the address change. (FEIN) assigned by the IRS or a change in ownership

(and you are the new owner) will require a new Colorado

To change the address for a specific physical location Account Number. Please fill out a Colorado Sales Tax and

you operate or sell into, refer to your sales tax license for Withholding Account Application (CR 0100) by visiting

the 8 digit Colorado Account number followed by a 4 digit Tax.Colorado.gov/forms-in-number-order.

location (site) number and indicate in the boxes below. Be

sure to include the effective date for the address change Revenue Online allows for convenient and secure access to

to avoid incorrect assessments of tax liability. If there conduct business with the Department of Revenue. If you

are multiple address changes for multiple account types, have a login, you can also change your mailing address for

please list the information on page 2. certain accounts online at Colorado.gov/RevenueOnline.

Colorado Account Number (8-Digit Number) FEIN or SSN/ITIN Business Name or Last Name, First Name

Apply address change to account(s)

Withholding Tax Gaming Withholding Excise Individual Corporate

1099 Withholding Oil & Gas Withholding IFTA Partnership Other (list account)

4 Digit Location (Site) Number to Change Effective Date of Change (MM/DD/YY)

Sales Tax Location (Site) Address Change Only

Note: If your retail business location changed Change Main Address

in the middle of a filing period, you must file a

separate sales tax return for the taxes collected Mailing Address Physical Address Both

at each location

Previous Address Current Address

Previous Address Current Address

City County City County

State ZIP Code Phone Number State ZIP Code Phone Number

For business name change, provide a copy of the IRS SS-4 and/or Amended Articles of Incorporation from the

Secretary of State.

For individual name change, provide either a copy of your state ID or driver’s license, social security card,

marriage certificate, divorce decree, or court document

Name Change Current or Previous Name New Name

Legal DBA

Authorized Signature Date

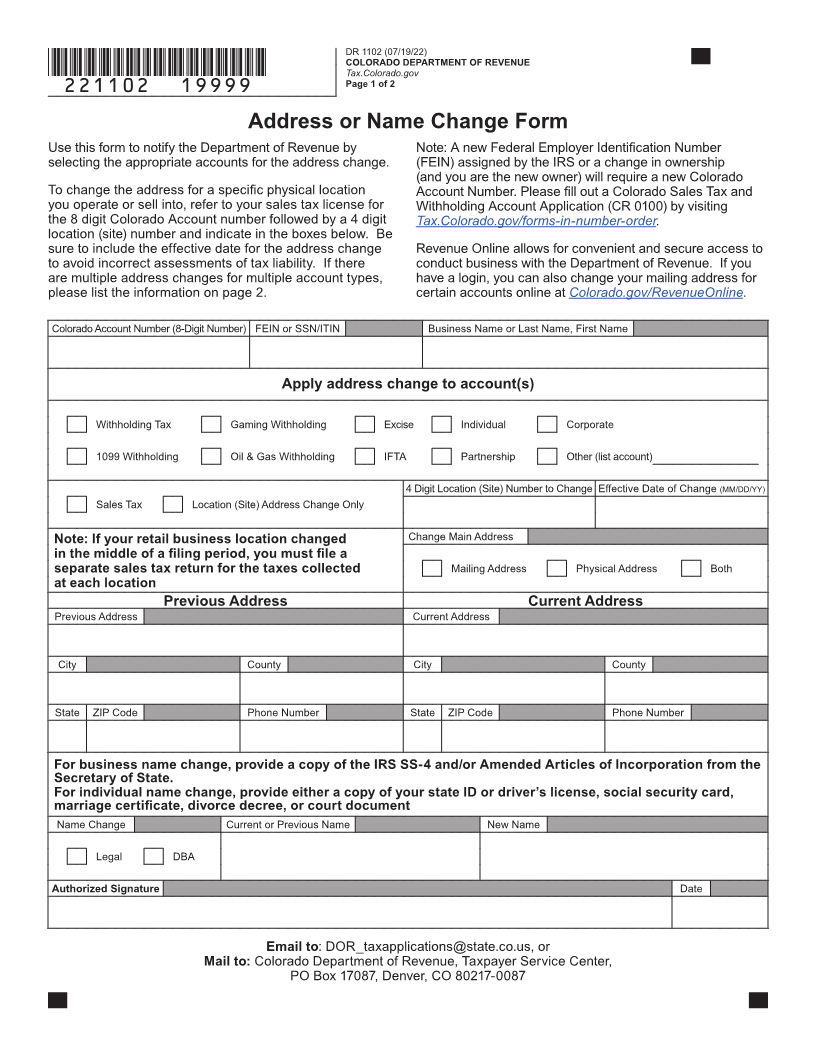

Email to: DOR_taxapplications@state.co.us, or

Mail to: Colorado Department of Revenue, Taxpayer Service Center,

PO Box 17087, Denver, CO 80217-0087