Enlarge image

DR 1210 (10/03)

COLORADO DEPARTMENT OF REVENUE COLORADO ESTATE TAX RETURN

1375 SHERMAN STREET DUE DATE: ON OR BEFORE THE DATE THE

DENVER CO 80261

www.taxcolorado.com FEDERAL RETURN IS REQUIRED TO BE FILED.

TO BE FILED ONLY IF DATE OF DEATH IS ON OR AFTER JANUARY 1, 1980. CHECK THE

APPLICABLE STATEMENT LISTED BELOW:

A Federal return is not required to be filed but a Certificate of Estate Tax Determination

is requested. Complete Sections I and II below.

A Federal return is attached but no Colorado estate tax is due. A Certificate of

Estate Tax Determination is requested. Complete Sections I and II below.

A Federal return is attached and a Colorado estate tax is due. A Certificate of Estate

Tax Determination is requested.

Department of Revenue Use Only

FOR DEPARTMENT USE ONLY

ACCOUNT NUMBER: L2126495 PERIOD _____________________ LIABILITY: 2800-800

Attached is a payment for Colorado tax in amount (999) $

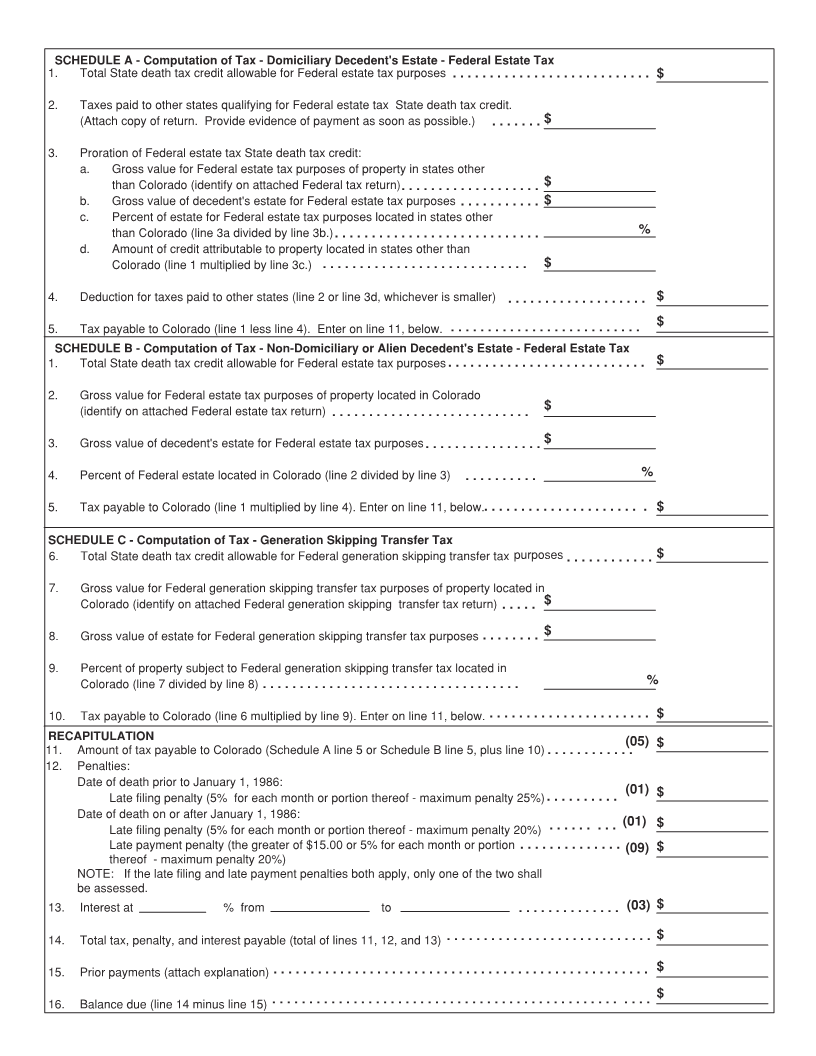

The amount of payment was computed in accordance with Schedule A, B, C and Decedent was:

Recapitulation page 2. Domiciliary

Non-Domiciliary

of Colorado.

Alien

An extension of time to file the Federal return has has not been approved.

The Estate has elected

A true copy of such approved extension is attached. Extension date: ________________________ 10 yr 15 yr

installment payments.

An extension of time to pay the Federal tax has has not been approved.

First payment due date:

A true copy of such approved extension is attached. Extension date: _______________________

____________________

SECTION I

Estate of Date of Death Decedent's Social Security Number

Domicile at Date of Death (Number and Street) City County State Zip

Name of Personal Representative or person filing return Address (Number and Street)

City State Zip Telephone

Name of Attorney Address (Number and Street)

City State Zip Telephone:

SECTION II

Enter the total gross value of the decedent's estate. Gross value means the total value of assets before any deductions.

Colorado Assets

Non-Colorado Assets

TOTAL

I declare, under penalties of perjury in the second degree, that I have examined this return including any and all accompanying

schedules or attachments and that I believe the same to be true and correct as to every material matter.

Signature of person filing return Title Date

Signature of person preparing return Title Date