Enlarge image

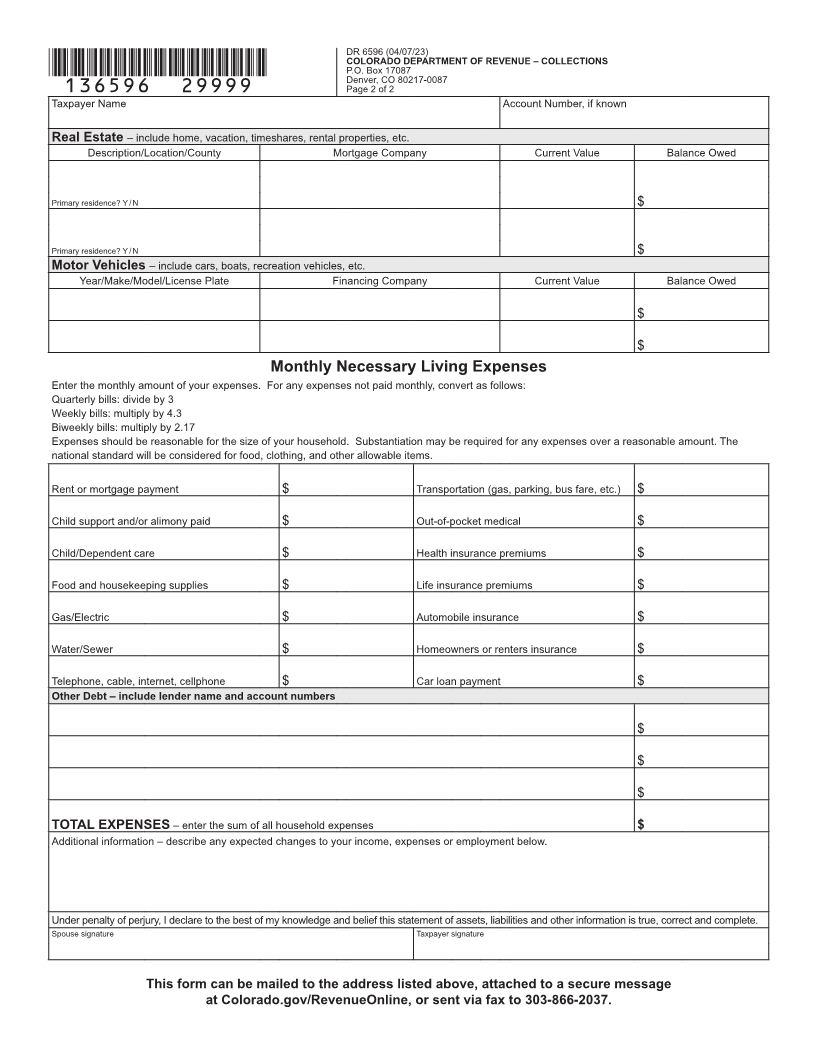

DR 6596 (04/07/23)

COLORADO DEPARTMENT OF REVENUE – COLLECTIONS

P.O. Box 17087

*136596==19999* Denver, CO 80217-0087

Page 1 of 2

Statement of Economic Hardship

The Department of Revenue uses this form to determine if the tax levy or standard installment agreement amount prevents

you from meeting basic, reasonable living expenses. Be sure to write clearly and do not leave any area blank.

If additional space is needed, please attach a separate sheet that includes your name, social security number and clearly

classify the additional information according to the areas below.

Account Number, if known Date (MM/DD/YY)

Taxpayer Information

Taxpayer Name SSN DOB

Spouse Name SSN DOB

Address City State ZIP

Daytime Phone Email

Age and relationship of people living with you (dependents only):

Employer Information

Current Employer - Taxpayer Phone

Employer Address City State ZIP

Length of Employment Pay Cycle (monthly, biweekly, weekly) Net Pay (after taxes)

Current Employer - Spouse Phone

Employer Address City State ZIP

Length of Employment Pay Cycle (monthly, biweekly, weekly) Net Pay (after taxes)

Non-Wage Household Income - list monthly amounts for the entire household

Profit from business $ Unemployment Income $

Commissions $ Interest/Dividends $

Pension/Social Security Income $ Net Rental Income $

Alimony/Child Support Income $ Other Income $

TOTAL INCOME - enter the sum of all household income $

Accounts - include checking, online/mobile (PayPal, etc.), savings, loans, CD, credit union, etc.

Name of Institution Address Account Number Current Balance

$

$

Securities - include stocks, bonds, annuities, mutual funds, IRA, money market funds, whole life insurance policies, etc.

Type Issuer Quantity/Denomination Current Value

$

$

Please complete reverse side of form