Enlarge image

General 11: Colorado Civil Tax Penalties and Interest

If a taxpayer does not pay their tax by the applicable due date, that taxpayer will owe penalty and interest. Interest rates

may vary from year to year and are listed below. Penalty calculations vary depending on the type of tax (income tax,

sales tax, severance tax, etc.). Taxpayers can calculate and pay the applicable penalty and interest on any late or

amended return. The Department will issue a notice of deficiency for any unpaid penalty and interest that is due. In

addition to interest and penalties for the late payment of tax, there are several other types of penalties that may be

imposed under certain circumstances.

INTEREST ON LATE PAYMENTS OF TAX

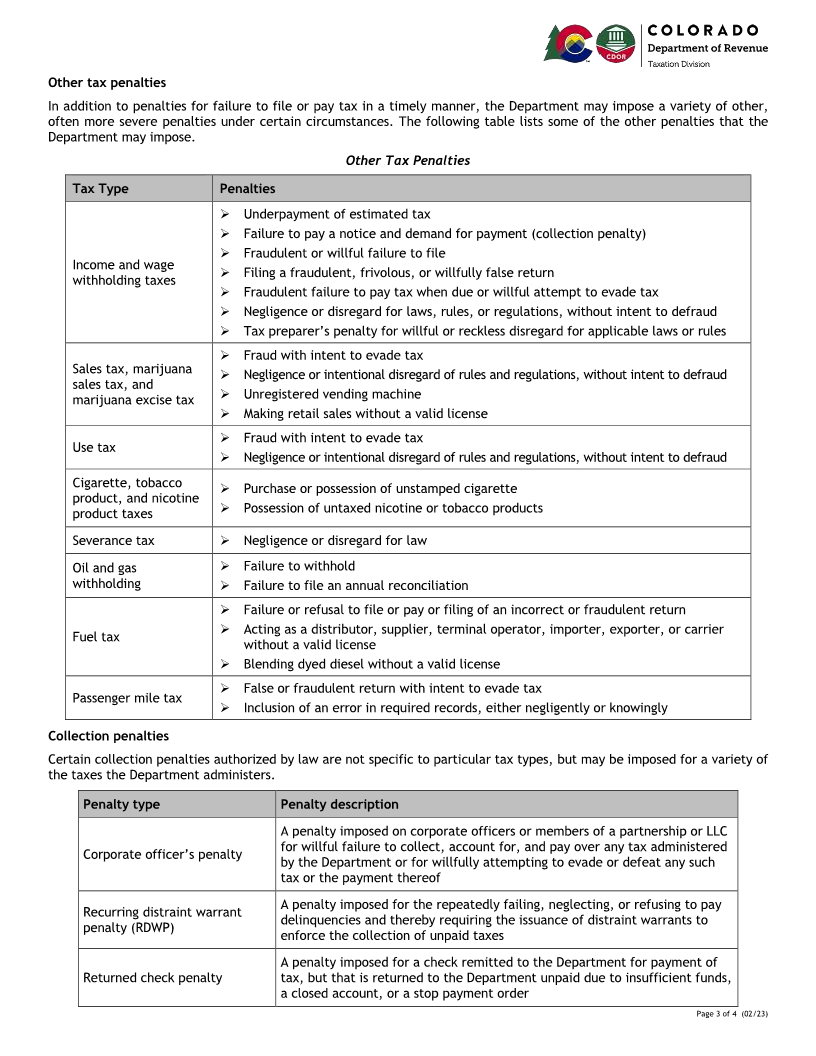

The interest due on the late payment of tax accrues from the original due date of Annual Interest Rates on Tax

the tax to the date the tax is paid. Since the interest rate may differ from year to Underpayments

year, it may be necessary to use multiple rates to calculate interest due. For

example, if the tax was due April 15, 2016, but was not paid until October 1, 2017, Calendar Discounted Regular

the interest rate for 2016 will be used to calculate the interest accrued from April Year Rate Rate

15, 2016 to December 31, 2016 and the interest rate for 2017 will be used to

calculate the interest accrued from January 1, 2017 to October 1, 2017. 2014 3% 6%

The interest rates for each calendar year are listed in the table to the right. The

first rate listed is the “discounted rate”, which applies if the taxpayer pays the tax 2015 3% 6%

prior to the issuance of a notice of deficiency or if the taxpayer pays or makes an

agreement to pay the tax within 30 days of the issuance of the notice of deficiency 2016 3% 6%

for the unpaid tax. Criteria for the discounted rate are prescribed by law. If the

taxpayer does not meet the criteria necessary to qualify for this discounted 2017 4% 7%

interest rate, the second rate listed in the table, the “regular rate” applies.

2018 4% 7%

Interest will accrue for only that part of the year in which the tax was due, but not

paid. For example, if tax due April 15, 2014 was paid on August 24, 2014, interest

2019 5% 8%

does not accrue over the entirety of 2014. Instead, interest accrues for only the

131 days between the due date and the date of payment. The daily interest rate

used to compute interest accrued over partial years can be calculated by dividing 2020 6% 9%

the annual rate by 365 (or 366 for leap years).

2021 3% 6%

Example

A taxpayer files a 2014 individual income tax return on February 22, 2017. The 2022 3% 6%

return reports a total of $1,000 in tax and $800 of wage withholding, resulting in a

$200 underpayment of tax, which the taxpayer pays with the return. The 2014 2023 5% 8%

income tax was originally due April 15, 2015, so interest accrues on the $200

underpayment from the April 15, 2015 due date to February 22, 2017. The * For calculation of interest over

taxpayer is eligible for the discounted interest rate because the tax is paid prior to only part of a year, daily interest

the issuance of any notice of deficiency. Interest must be calculated from April 15, rates can be calculated by dividing

2015 to December 31, 2015 at an annual rate of 3%, for all of 2016 at an annual the above rates by 365 (or 366 for

rate of 3%, and from January 1, 2017 to February 22, 2017 at an annual rate of 4%. leap years).

The interest calculation is illustrated below.

Accrual period Tax (times) Days (times) Daily rate (equals) Interest

4/15/15 –12/31/15 $200.00 X 260 X 0.00008219 = $4.27

1/1/16 –12/31/16 $200.00 X 366 X 0.00008197 = $6.00

1/1/17 –2/22/17 $200.00 X 53 X 0.00010959 = $1.16

Total accrued interest $11.43

International Fuel Tax Agreement (IFTA)

The above interest rates do not apply to IFTA. See iftach.org for IFTA interest rates.

Page 1 of 4 (02/23)