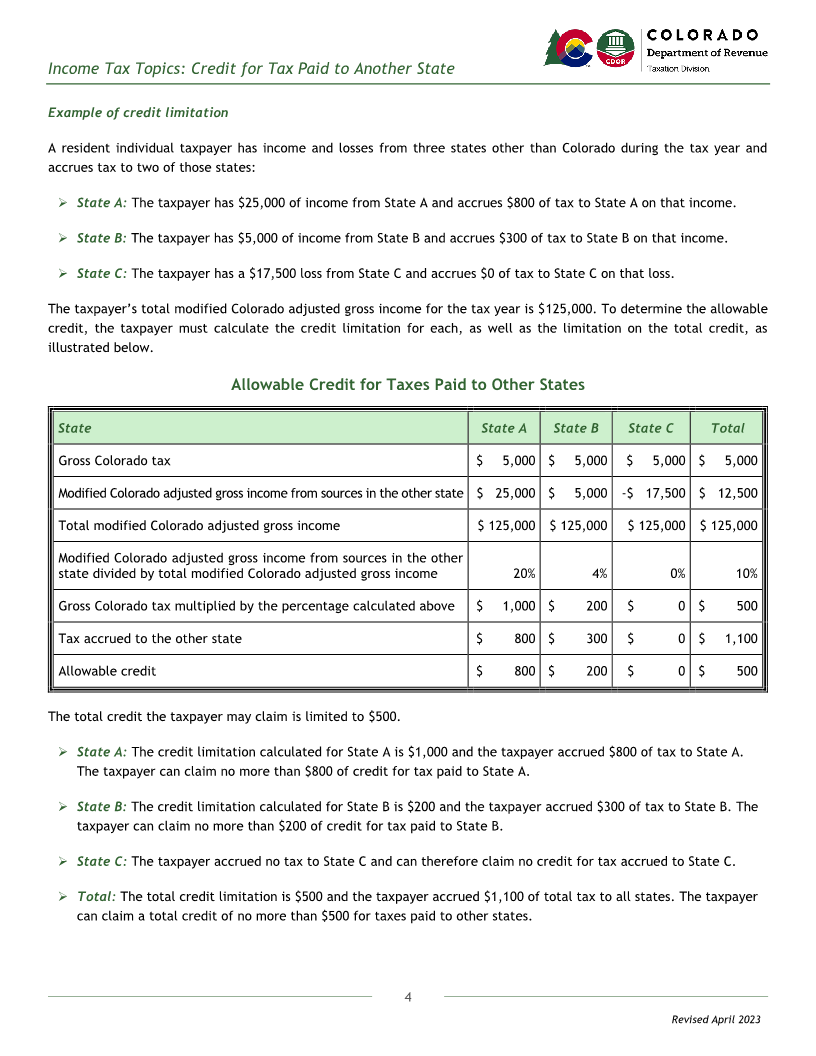

Enlarge image

Income Tax Topics: Credit for Tax Paid to Another State

Colorado resident individuals may claim a credit on their Eligible taxes

Colorado returns for income tax accrued to another state

for the same tax year. The credit is subject to several

The credit is allowed for net taxes accrued to another

requirements and limitations, discussed later in this

state on an individual’s federal taxable income derived

publication. Nonresidents may not claim the credit.

from sources in that state. The following sections discuss

qualifying conditions for the credit.

This publication is designed to provide general guidance

regarding the credit for taxes paid to other states and to

supplement the guidance provided in the Colorado State taxes

Individual Income Tax Guide. Nothing in this publication

modifies or is intended to modify Colorado’s statutes or The credit is allowed only for state taxes accrued for the

regulations. Taxpayers are encouraged to consult their tax year to one of the following:

tax advisors for guidance regarding specific situations.

➢ another state in the United States;

The guidance in this publication applies specifically to

➢

resident individuals, but generally applies to resident the District of Columbia; or

estates and trusts as well. ➢ a territory or possession of the United States.

Within this publication, the term “state” is used to

Colorado residency

include another state in the United States, the District

of Columbia, and any territory or possession of the

The credit for taxes paid to other states is allowed only

United States.

to Colorado residents. Please see Part 1 of the Colorado

Individual Income Tax Guide for information about how The credit is not allowed for taxes accrued to any city,

Colorado residency is determined. local jurisdiction, foreign country, or any subdivision

thereof.

The credit is allowed to both full-year residents and

part-year residents, although part-year residents may

claim the credit only for income earned or recognized Taxes on income from sources in another state

from sources in another state while they were a Colorado

resident. Part-year residents may not claim any credit The credit is allowed only for state taxes imposed on the

for taxes paid on income earned or recognized during taxpayer’s income. It is allowed regardless of whether the

the part of the year when they were not a Colorado state imposing the tax refers to it as an income tax, as a

resident. Please see the section on part-year residents, gross receipts tax, or by another name. The income must

later in this publication, for additional information. be included in the taxpayer’s modified adjusted gross

income for the tax year, discussed later in this publication.

Taxpayers who are not Colorado residents for any part

of the year may not claim any credit for taxes paid to The credit is not allowed for any franchise tax or any

other states. Instead, Colorado income tax for other tax accrued to another state that is not imposed

nonresidents is apportioned so that only their Colorado- on income.

source income is taxed. For additional information,

please see Department publication Income Tax Topics: Additionally, the credit is not allowed for any amount of

Part-Year Residents and Nonresidents, available online tax a state imposes based on the taxpayer’s residency in

at Tax.Colorado.gov/individual-income-tax-guidance- that state, rather than based upon the source from

publications. which the income is derived.

1

Revised April 2023