Enlarge image

Income Tax Topics: Child Care Credits

Colorado resident individuals may be allowed one of two Income limitations

credits on their Colorado income tax return for child

care expenses they pay during the tax year: the child

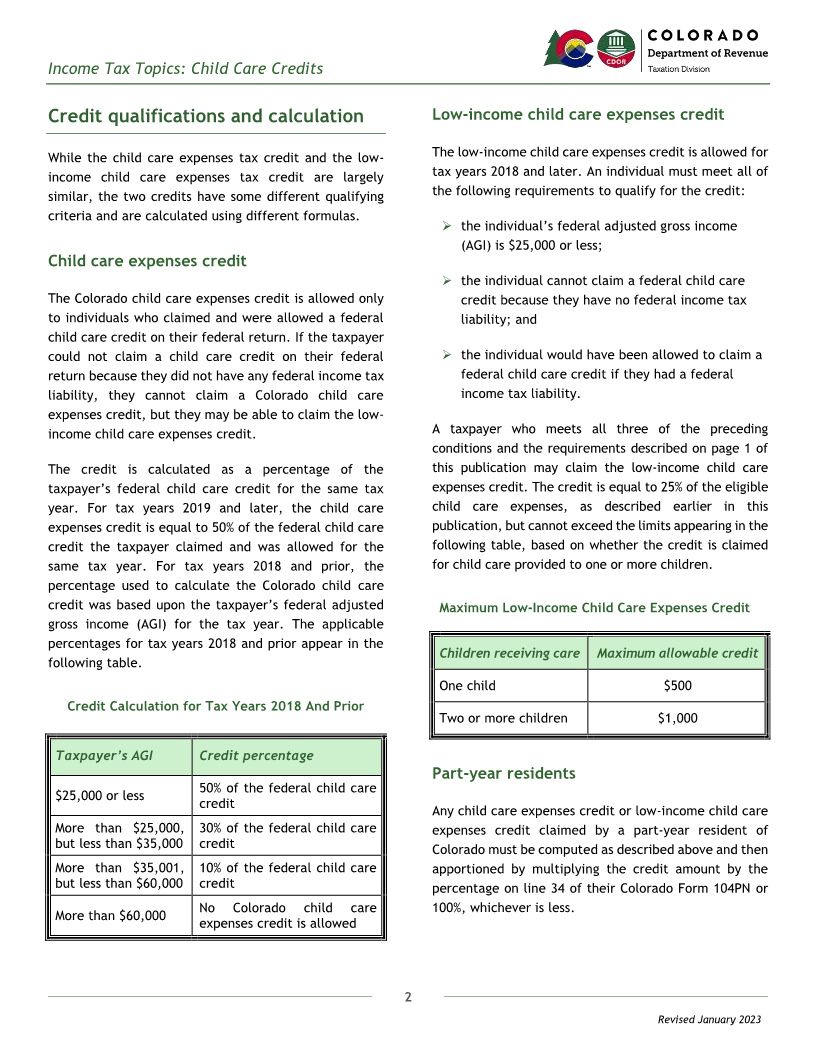

An individual may claim either a child care expenses credit

care expenses credit and the low-income child care

or a low-income child care expenses credit only if their

expenses credit. Among other requirements and

federal adjusted gross income (AGI) does not exceed the

restrictions, the credits are allowed only to taxpayers

application limitation, reflected in the following table:

whose federal adjusted gross incomes do not exceed

certain limitations. Additionally, the credits are allowed

Maximum allowable AGI for each credit

only for expenses paid for children under the age of 13.

Both Colorado credits are refundable. If the credit

allowed exceeds the taxpayer’s Colorado tax liability, Credit AGI Limitation

the excess credit is refunded to the taxpayer.

Child care expenses credit $60,000

This publication is designed to provide general guidance

Low-income child care

regarding child care credits and to supplement guidance $25,000

expenses credit

provided in the Colorado Individual Income Tax Guide.

Nothing in this publication modifies or is intended to

modify the requirements of Colorado’s statutes and If a taxpayer’s AGI exceeds the limitations shown in the

regulations. Taxpayers are encouraged to consult their preceding table, they may not claim a Colorado credit

tax advisors for guidance regarding specific situations. for their child care expenses.

This publication provides information about child care

credits, but not about child tax credits. Please see Eligible child care expenses

Department form DR 0104CN and the associated

instructions for information about child tax credits. The child care expenses credit and the low-income child

care expenses credit are allowed only for qualified

expenses incurred for the care of children under the age

Residency requirements of 13. Neither credit is allowed for expenses incurred for

the care of a taxpayer’s disabled spouse or disabled

Both the child care expenses credit and the low-income dependent over the age of 12 or for any expenses for

child care expenses credit are allowed only to Colorado

which the taxpayer receives reimbursement from the

residents. An individual may qualify for a credit if they

Department of Early Childhood or from any other source.

are either a full-year resident or part-year resident of

Additionally, the amount of child care expenses that can

Colorado for the tax year. Individuals who are not

be considered in calculating the credit are limited to:

Colorado residents are not eligible for either tax credit.

See Part 1 of the Colorado Individual Income Tax Guide ➢ In the case of an individual who files a single return,

for additional information about Colorado residency.

the individual's earned income for the year; or

➢ In the case of two individuals who file a joint

Joint filing requirement return, the lesser of either individual's earned

income for the year.

Generally, married couples must file a joint return to claim

either the child care expenses credit or the low-income child Please see the instructions for IRS Form 2441 and IRS

expenses credit. Please see the instructions for IRS Form Publication 503 for additional information regarding

2441 and IRS Publication 503 for additional information eligible child care expenses.

regarding joint and separate filing for married couples.

1

Revised January 2023