Enlarge image

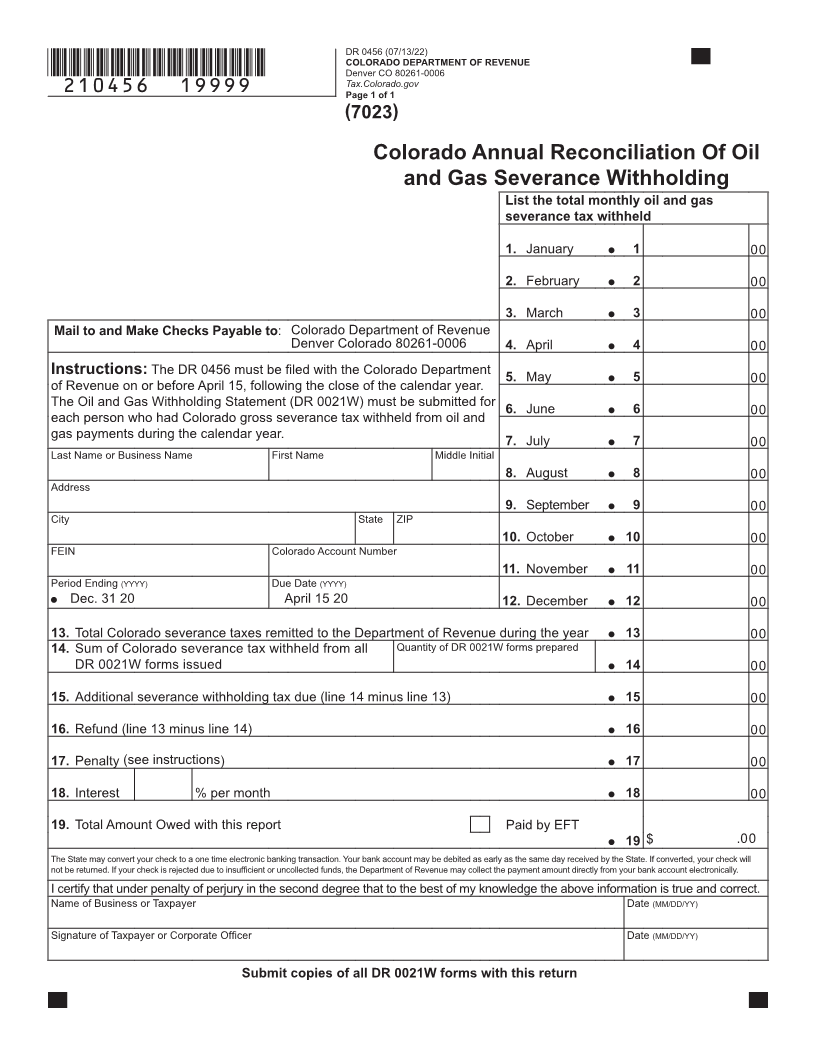

DR 0456 (07/13/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

Tax.Colorado.gov

Colorado Annual Reconciliation Of Oil and Gas Severance Withholding

Instructions and Information

(See form on page 2)

This reconciliation must be filed with the Colorado The DR 0021W forms can be submitted electronically via

Department of Revenue on or before April 15, following Revenue Online at www.Colorado.gov/RevenueOnline

the close of the calendar year. Copies of each DR 0021W, Please review FYI publication - Withholding 9 for filing

Oil and Gas Withholding Statement, that was issued by specifications. This form DR 0456 should be submitted to

this entity must also accompany this form. Unless the the address shown below.

production is exempt from tax, a DR 0021W must be COLORADO DEPARTMENT OF REVENUE

issued to any person or entity with a working interest, Denver, CO 80261-0006

royalty interest, production payment, or any other interest

in the oil or gas that was produced in Colorado. This address and ZIP code is exclusive to the Colorado

Department of Revenue, so a street address is not

Failure to file this Annual Reconciliation and/or the required.

accompanying DR 0021W forms can result in a penalty of

15% or $1,500, whichever is less.

Reminders Line 16

Please be sure to submit copies of all DR 0021W forms Line 13 minus line 14; this will be any refund due.

with the DR 0456 return.

Line 17

If you filed 12 consecutive months of zero returns, you Failure to file a return and pay the tax on or before the

should close your account. due date will result in a penalty at the rate of 30% or $30,

Be sure to round all amounts to the nearest dollar. Make whichever is greater, per §39-29-115(1), C.R.S.

sure the amount of your payment matches the amount Line 18

listed on line 19 on the form. Failure to file a return and pay the tax on or before the due

date will result in interest at the current statutory rate from

Lines 1–12

The total oil and gas severance taxes withheld per the the due date of payment. See FYI publication - General 11

DR 0021W(s). for more information.

Line 13 Line 19

Total severance taxes withheld and remitted to the Total amount owed with this report. You must round to the

Colorado Department of Revenue during the calendar year. nearest dollar.

Please see FYI publication - Withholding 4, Colorado Oil

Line 14

The total on line 14 should match the amount of Colorado and Gas Severance Withholding Requirements. For further

severance tax withheld from all DR 0021W forms issued. information call (303) 238-SERV (7378) or visit the Official

Taxation Web site, Tax.Colorado.gov

Line 15

Line 14 minus line 13; this will be the additional severance

withholding tax due.