Enlarge image

Departmental Use Only

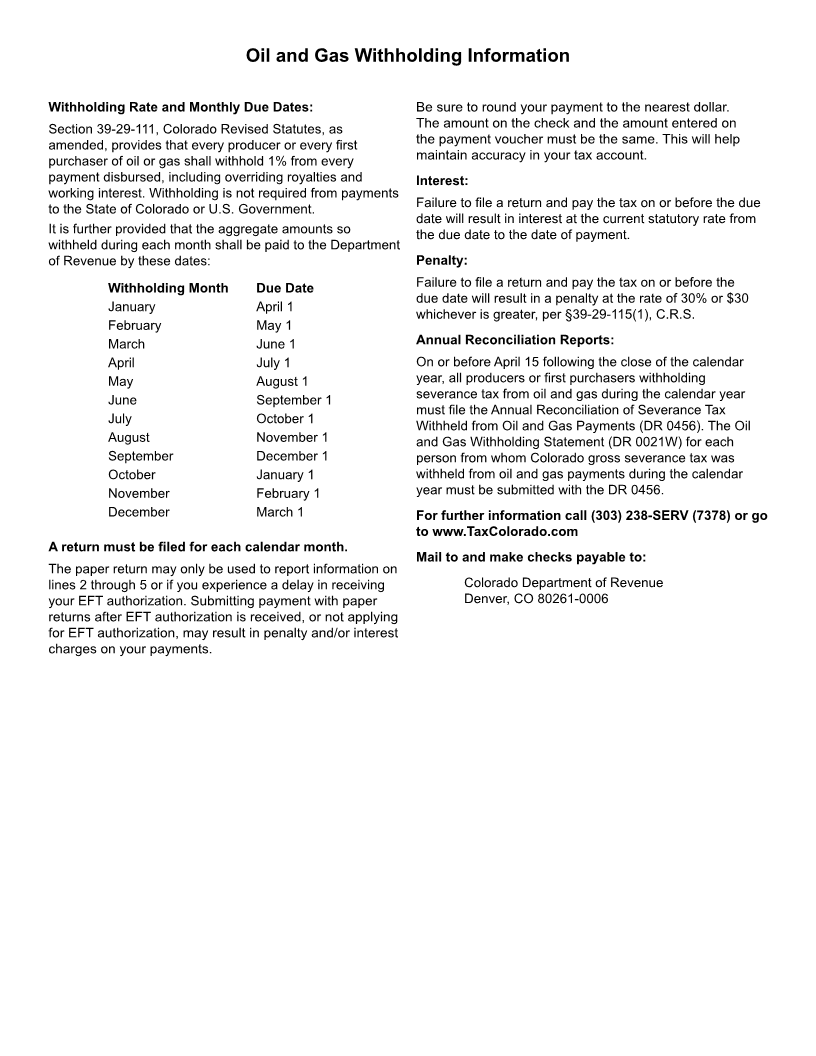

DR 0461 (08/30/13)

Colorado department of revenue

Denver CO 80261-0006

www.TaxColorado.com

7022

monthly return of oil

*130461==19999*

and Gas tax Withheld

Colorado Account Number FEIN

Name

Address City State Zip

Period (MM/YY-MM/YY) Due Date (MM/DD/YY)

-

mail to and make checks payable to: Colorado Department of Revenue

Denver, CO 80261-0006

Instructions

Oil and gas withholding must be remitted electronically. (Submit this paper return only if you are reporting an amount

on line 2, 3, 4 or 5, or until your eft account is established.) Penalty and interest will apply to payments submitted

with this form if you are not actively pursuing an EFT account.

line 1: Enter the total of all Colorado oil and gas severance taxes withheld from disbursements made during the

month.

line 2: Enter the total of any underpayment adjustments for prior periods. (Attach explanation.)

line 3: Enter the total of any overpayment (not to exceed the sum of lines 1 and 2) adjustments for prior tax periods.

(Attach explanation.)

line 4: Penalty: 30% of tax or $30, whichever is greater if payment is delinquent.

line 5: Interest applies at the current rate on the total tax due from the date due until paid if the payment is

delinquent.

line 6: Enter the total. (Add lines 1, 2, 4 and 5 minus line 3.)

You must round to the nearest dollar oil and Gas

1. Total Colorado severance tax withheld 1 $ 00

Month

2. Additional tax due for prior period within calendar year 2 $ 00

3. Overpayment of tax for prior period within calendar year to be applied to current tax 3 $ 00

4. Penalty 4 $ 00

5. Interest 5 $ 00

Paid by eft

6. Total Amount Due and Payable 6 $ .00

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your

check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account

electronically.

please include the account number on your check to ensure proper credit.

I hereby certify under penalty of perjury in the second degree that this return, including any accompanying schedules

and statements, is a true, correct and complete return to the best of my knowledge.

Trade Name Title Phone Number

( )

Signature of Officer or Agent Date (MM/DD/YY)