- 2 -

Enlarge image

|

Page 2

severance tax of 87.5% of your share of ad valorem taxes

General Information paid or assessed on actual oil or gas production (not the

Colorado severance tax is imposed upon nonrenewable tax on facilities or equipment). However, ad valorem

natural resources that are removed from the earth in taxes on production from “stripper wells” should not

Colorado. The tax is calculated on the gross income from oil be included in the credit. Specific instructions for this

and gas and carbon dioxide production. deduction are on the DR 0021D, Colorado Oil and Gas and

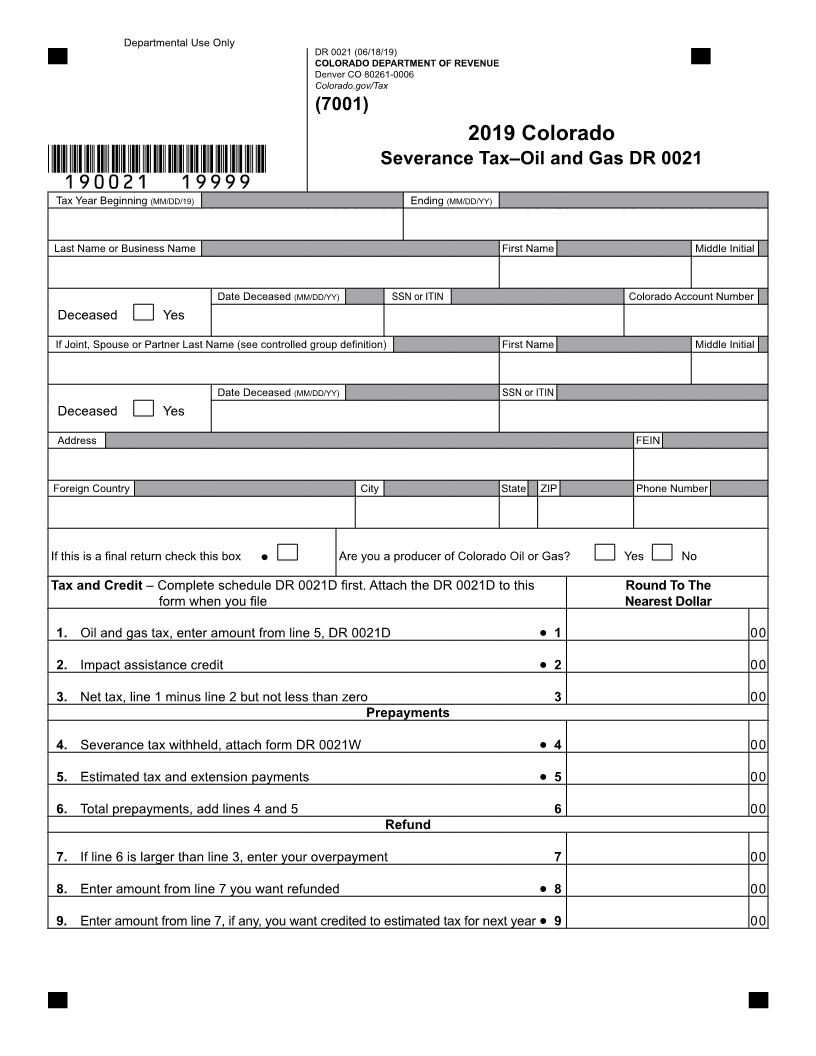

Who Must File Return DR 0021 Carbon Dioxide Severance Tax Schedule. You should verify

Anyone who receives taxable income from oil or gas that the withholding statements accurately report the same

produced in Colorado. If you are a producer or own a working information as shown on your division of interest statements

interest, or a royalty interest in any oil or gas (including carbon and revenue checks.

dioxide) produced in Colorado, or if you receive royalties on

Important - Partners of a General Partnership

Colorado oil shale, you must pay severance tax to the State Partners of a General Partnership should attach a copy

of Colorado. Severance tax might be due even though you of the partnership’s DR 0021W and a schedule detailing

do not realize a net profit on your investment. their individual portion of gross income and taxes paid or

A limited partnership, LLC or S Corporation must file at the withheld as reported on their individual returns.

entity level. Partners, members, or shareholders do not file

a severance tax return to report oil and gas income received Filing Period

by the pass-through entity. A General Partnership will not The Colorado severance tax filing period should match the

file at the entity level. Each partner, and not the general tax year/filing period used for federal income tax purposes.

partnership, is required to file a return. Filing Status

Oil and gas production from “stripper wells” is exempt from The Colorado filing status will generally match the filing status

severance tax. This includes oil from a well that produces from your federal income tax return. However, the Colorado

15 barrels or less of crude oil per day or gas from a well severance tax filing status will always be joint if you are

that produces 90,000 cubic feet or less of gas per day, for married - regardless of whether you file jointly or separately.

the average of all producing days during the taxable year. Single or head of household filing statuses should file a single

Each commodity must be tested for each well to determine status Colorado severance tax return.

that commodity’s stripper well status. More information about

Due Date

stripper well withholding and filing requirements can be found You must complete and file the DR 0021, Colorado Oil

at Colorado.gov/Tax by reading FYI Withholding 4 and FYI and Gas Severance Tax Return annually. The return (and

General 4. payment, if any) are due by the 15th day of the fourth month

after the close of your taxable year. Therefore, if your taxable

Exception year ends on December 31, your severance tax return is

It is not necessary to file a severance tax return if you due April 15 of the following year. The envelope must be

meet both of the following conditions: postmarked by the due date, or the next business day if the

1. the total gross oil and gas withholding on form(s) deadline falls on a Saturday, Sunday or holiday.

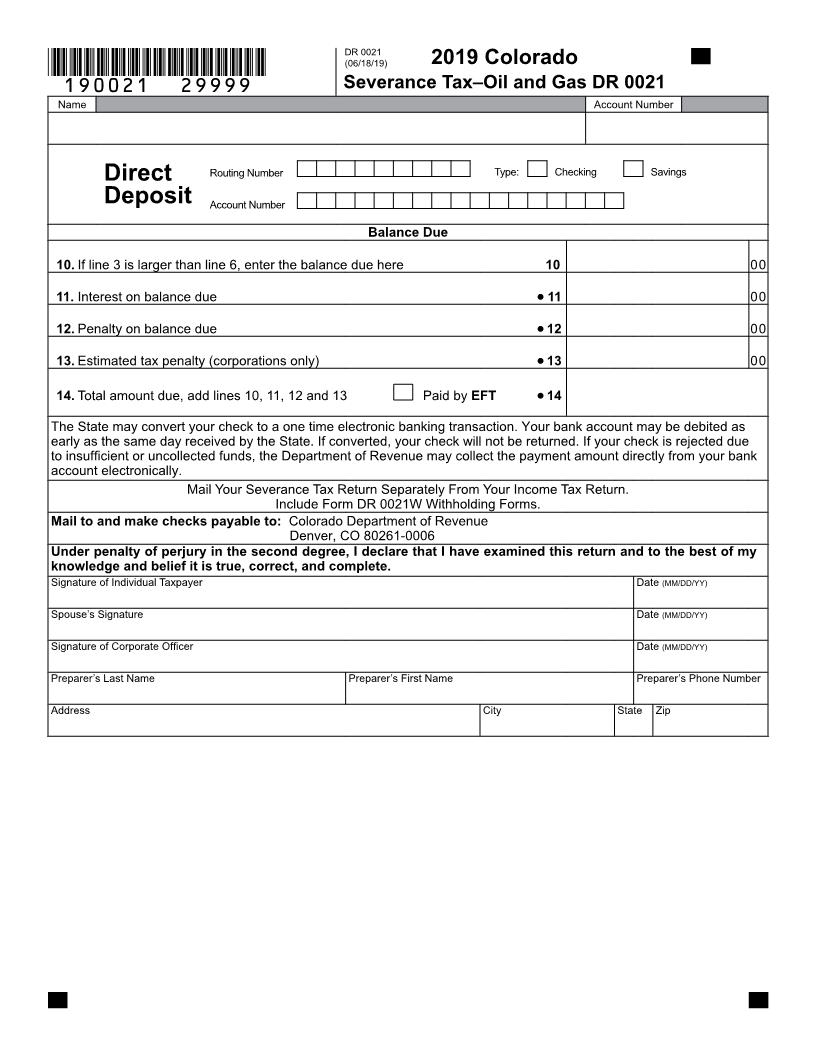

DR 0021W for the calendar year is less than $250; Mail Colorado severance tax returns and tax payments to:

and Colorado Department of Revenue

2. the producer has withheld sufficiently from Denver, CO 80261-0006

royalty or production payments to cover the

Filing Extension

severance tax liability.

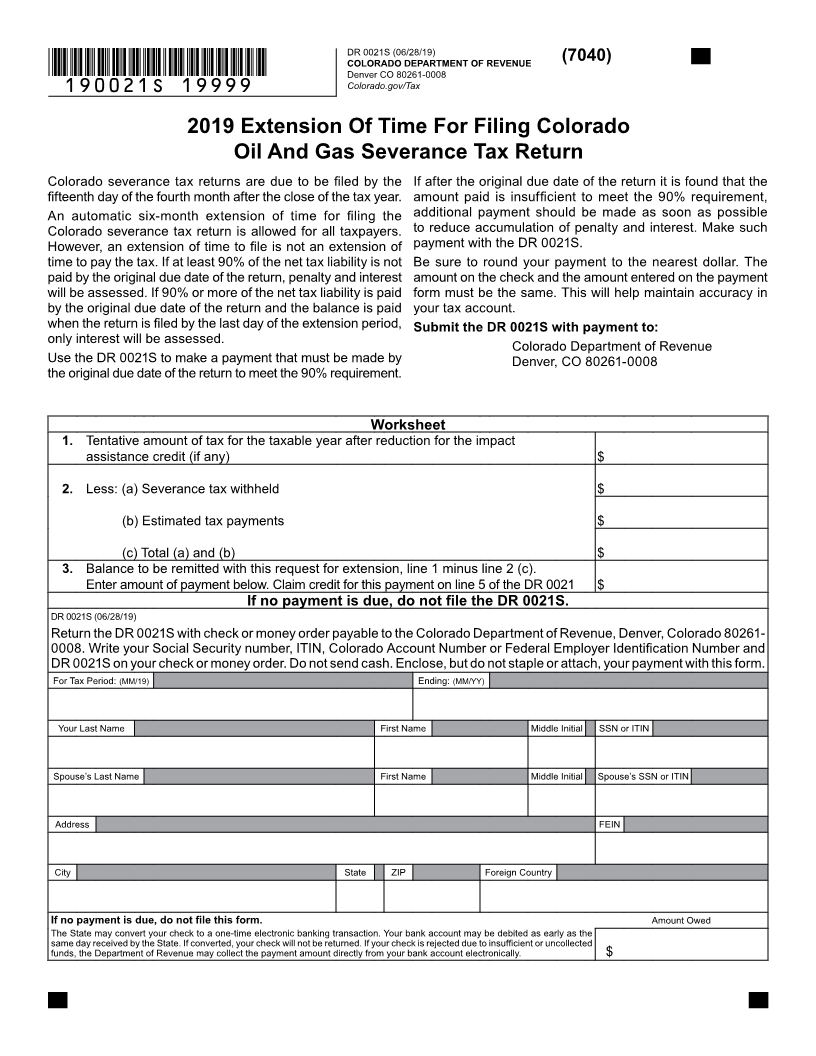

If you are unable to complete your severance tax return by

the due date and you estimate that you will owe severance

Severance Withholding tax, you can request a six-month extension by filing the

Producers or first purchasers who disburse funds must withhold

DR 0021S on page 7. If no balance of severance tax is due,

1% of the gross income for each interest owner. This can an extension for filing is not required.

include royalty, working interest or any other interest owner.

The DR 0021S is an extension of time to file your return. It is

The producer or first purchaser is required to send the

not an extension of time to pay severance tax.

DR 0021W, Oil and Gas Withholding Statement to interest

owners by March 1 of each year. This form lists the gross A filing extension granted by the federal government will not

income and the amount of severance tax the producer has be honored for the Colorado severance tax return. Also, any

withheld and paid to the state from your royalty or production extension to file Colorado income tax returns does not apply

payments. If you own an interest in more than one well or to the Colorado severance tax return.

field, you should receive a separate withholding statement Amended Returns

from each producer or first purchaser. A copy of each To change or correct a Colorado severance tax return, you

withholding statement must be attached to your severance must file a DR 0021X. This form is available for download

tax return (DR 0021). from Colorado.gov/Tax – the official Taxation web site.

The producer or first purchaser will also list your share of

“ad valorem” taxes, if any, on the withholding statement. Ad Returns For Prior Years

valorem taxes are paid by the producer to local governments Colorado severance tax returns for prior years can be filed

(cities and counties). You are allowed a credit against at any time. However, the statute of limitations for claiming a

severance tax refund is three years from the due date.

|