- 2 -

Enlarge image

|

Page 2

against severance tax of 87.5% of your share of ad valorem

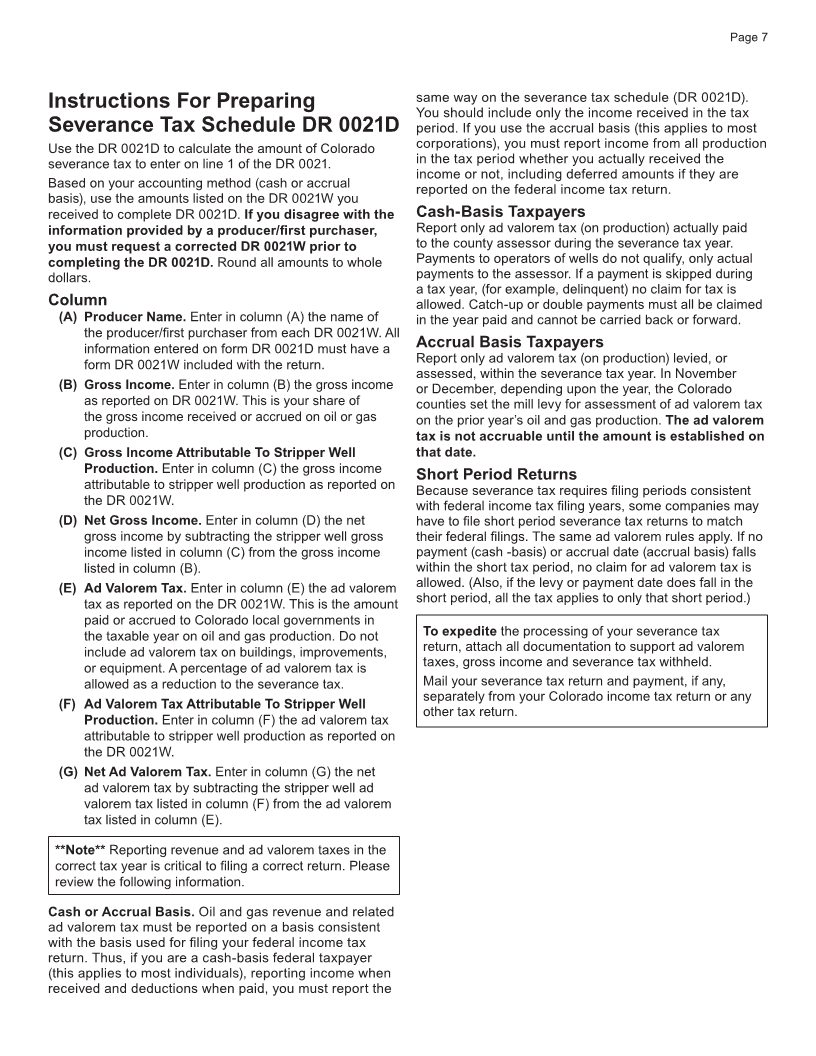

General Information taxes paid or assessed on actual oil or gas production (not

Colorado severance tax is imposed upon nonrenewable the tax on facilities or equipment). However, ad valorem

natural resources that are removed from the earth in taxes on production from “stripper wells” should not

Colorado. The tax is calculated on the gross income from be included in the credit. Specific instructions for this

oil and gas and carbon dioxide production. deduction are on the DR 0021D, Colorado Oil and Gas

Who Must File Return DR 0021 and Carbon Dioxide Severance Tax Schedule. You should

Anyone who receives taxable income from oil or gas verify that the withholding statements accurately report

produced in Colorado. If you are a producer or own a the same information as shown on your division of interest

working interest, or a royalty interest in any oil or gas statements and revenue checks.

(including carbon dioxide) produced in Colorado, or if

Important - Partners of a General Partnership

you receive royalties on Colorado oil shale, you must pay Partners of a General Partnership should attach a copy

severance tax to the State of Colorado. Severance tax of the partnership’s DR 0021W and a schedule detailing

might be due even though you do not realize a net profit on their individual portion of gross income and taxes paid or

your investment. withheld as reported on their individual returns.

A limited partnership, LLC or S Corporation must file at

the entity level. Partners, members, or shareholders do not file Filing Period

a severance tax return to report oil and gas income received by The Colorado severance tax filing period should match the

the pass-through entity. A General Partnership will not file at tax year/filing period used for federal income tax purposes.

the entity level. Each partner, and not the general partnership, Filing Status

is required to file a return. The Colorado filing status will generally match the filing

Oil and gas production from “stripper wells” is exempt status from your federal income tax return. However, the

from severance tax. This includes oil from a well that Colorado severance tax filing status will always be joint

produces 15 barrels or less of crude oil per day or gas if you are married - regardless of whether you file jointly

from a well that produces 90,000 cubic feet or less of gas or separately. Single or head of household filing statuses

per day, for the average of all producing days during the should file a single status Colorado severance tax return.

taxable year.

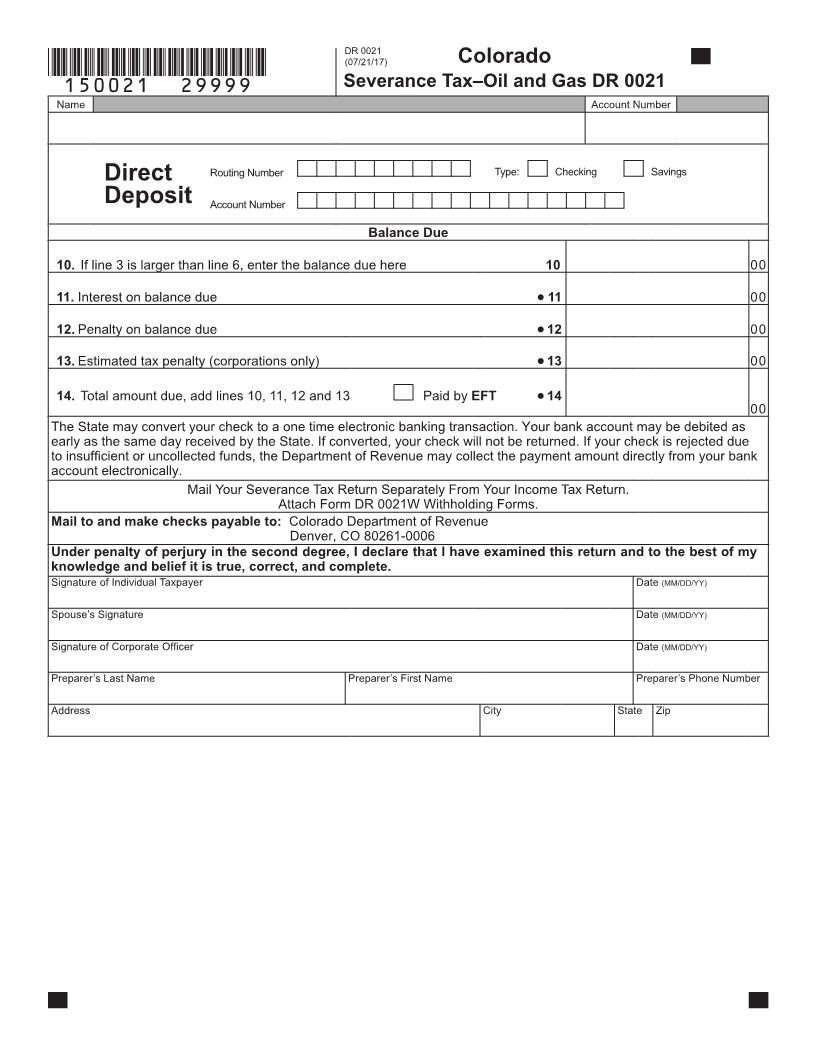

Due Date

You must complete and file the DR 0021, Colorado Oil

Exception and Gas Severance Tax Return annually. The return (and

It is not necessary to file a severance tax return if payment, if any) are due by the 15th day of the fourth

you meet both of the following conditions: month after the close of your taxable year. Therefore, if

1. the total gross oil and gas withholding on form(s) your taxable year ends on December 31, your severance

DR 0021W for the calendar year is less than $250; tax return is due April 15 of the following year. The

and envelope must be postmarked by the due date, or the next

business day if the deadline falls on a Saturday, Sunday or

2. the producer has withheld sufficiently from

holiday.

royalty or production payments to cover the

severance tax liability. Mail Colorado severance tax returns and tax payments to:

Colorado Department of Revenue

Severance Withholding Denver, CO 80261-0006

Producers or first purchasers who disburse funds must

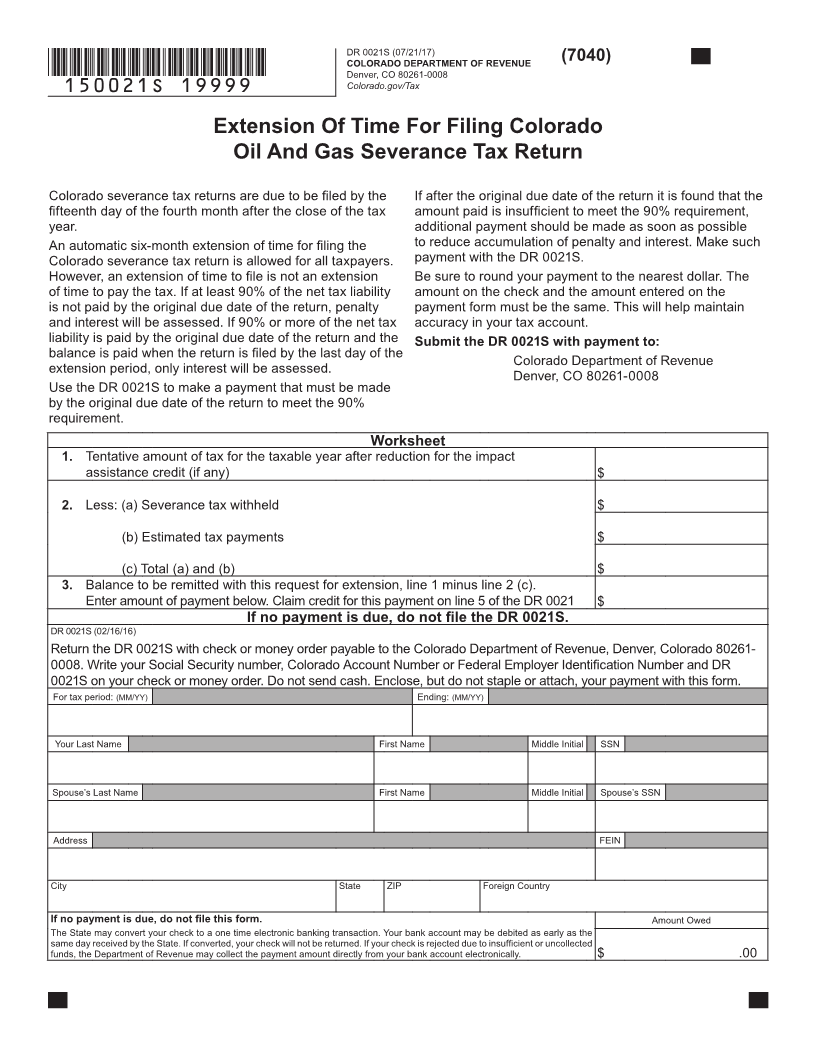

Filing Extension

withhold 1% of the gross income for each interest owner.

If you are unable to complete your severance tax return by

This can include royalty, working interest or any other

the due date and you estimate that you will owe severance

interest owner.

tax, you can request a six-month extension by filing the

The producer or first purchaser is required to send the DR 0021S on page 11. If no balance of severance tax is

DR 0021W, Oil and Gas Withholding Statement to interest due, an extension for filing is not required.

owners by March 1 of each year. This form lists the gross

The DR 0021S is an extension of time to file your return. It

income and the amount of severance tax the producer

is not an extension of time to pay severance tax.

has withheld and paid to the state from your royalty or

production payments. If you own an interest in more than A filing extension granted by the federal government will

one well or field, you should receive a separate withholding not be honored for the Colorado severance tax return.

statement from each producer or first purchaser. A copy Also, any extension to file Colorado income tax returns

of each withholding statement must be attached to your does not apply to the Colorado severance tax return.

severance tax return (DR 0021). Amended Returns

The producer or first purchaser will also list your share of To change or correct a Colorado severance tax return, you

“ad valorem” taxes, if any, on the withholding statement. must file a DR 0021X. This form is available for download

Ad valorem taxes are paid by the producer to local from Colorado.gov/Tax – the official Taxation web site.

governments (cities and counties). You are allowed a credit

|