- 4 -

Enlarge image

|

Colorado Severance Tax

Page 4

DR 0021 Instructions Line 4 Severance Tax Withheld

Enter the total amount shown on all of your oil and

Who Must File gas withholding statements (DR 0021W) as Colorado

Every individual, corporation, business trust, limited severance tax withheld. Add all amounts, then round to the

partnership, LLC, partner in a general partnership, nearest dollar. Be sure to attach your DR 0021W forms

association, estate, trust or any other legal entity that to your return; missing DR 0021Ws will delay your refund.

received income from oil and gas produced in Colorado Do not claim credit for conservation tax or ad valorem

must file a severance tax return. The return must be taxes on this line.

made for the same tax year used for federal income tax

Line 5 Estimated Tax and Extension Payments

purposes and is due on or before the 15th day of the fourth Enter on the total amount of your estimated tax and

month following the end of the taxable year. See General extension payments made for the taxable year.

Information section for exception.

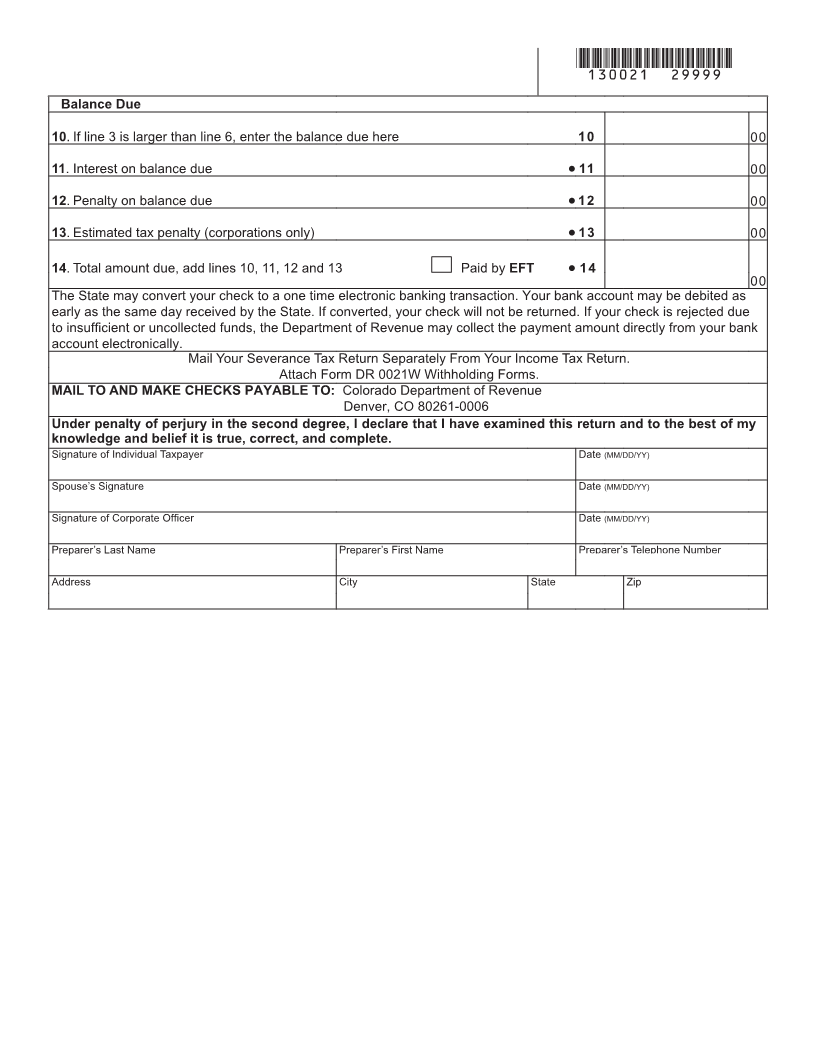

Refund or Balance Due

Controlled group: corporations, family group,

or other type of group Line 7 Overpayment

In the case of a controlled group of corporations as defined Subtract line 3 from line 6 and enter the difference on line

in section 613A of the Internal Revenue Code where more 7. The Department will send you a refund check for this

than one member of the group is subject to the severance amount if your form is properly completed.

tax, the tax must be jointly computed and the severance Line 8 Refund

tax return must be jointly filed under the name of the Enter the amount from line 7 that you wish to have

principal taxpaying corporation. DR 0021AS, available at refunded. The Department can deposit your refund

www.TaxColorado.com must be attached. directly in to your account at a U.S. bank or other financial

Joint Returns institution (such as a mutual fund, brokerage firm, or credit

A married couple must file a joint return even if there is no union) in the United States.

income reportable by one of the spouses. A family (man and/ Line 9 Refund Applied to Future Period

or woman with minor children), when more than one member Enter on line 9 the amount of overpayment, if any, you wish

of the family is subject to the severance tax, must compute the credited to estimated severance tax payment for next year.

severance tax on one combined return filed under the parent(s)

Social Security number. Note: parties to a Civil Union should Line 10 Tax You Owe

refer to federal tax law to determine the correct filing status. If line 3 is more than line 6, you have additional tax to pay.

Subtract line 6 from line 3 and enter the difference on

Social Security or Colorado Account Number line 10. This is the amount you owe. Attach to your return

Individuals must use a Social Security number as the a check or money order in this amount payable to the

Colorado account number. Business entities must Colorado Department of Revenue. Be sure to write your

provide the Colorado account number and the Federal Social Security number or Colorado account number

Employer Identification Number (FEIN). Whether you are on your check or money order to ensure credit for

an individual or a business entity, once you have been

your payment.

assigned a Colorado account number by the Colorado

Department of Revenue, use the Colorado account number Line 11 Interest

on all returns and correspondence submitted to the If the return is filed after the due date, interest at the

Department. For Privacy Act Notice, see FYI General 2. current statutory rate will accrue on any balance of tax due

until paid. The interest rate is 6% per year if we bill you and

Tax and Credit your payment is made more than 30 days after you receive

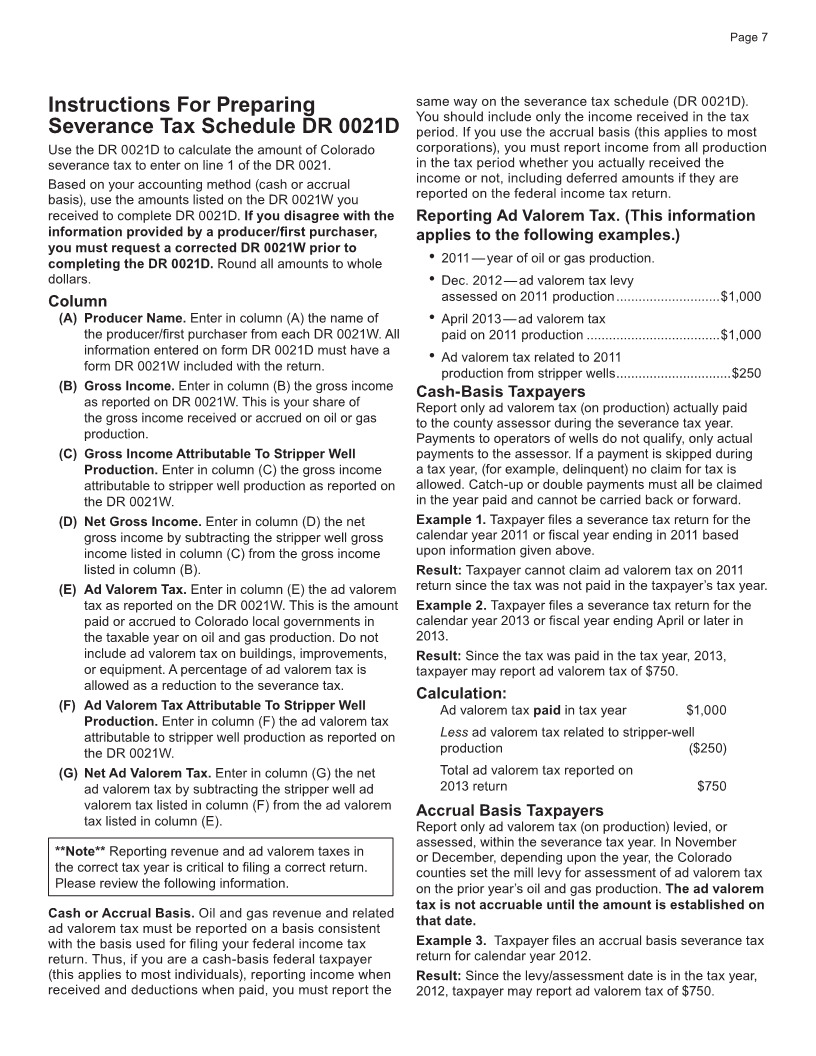

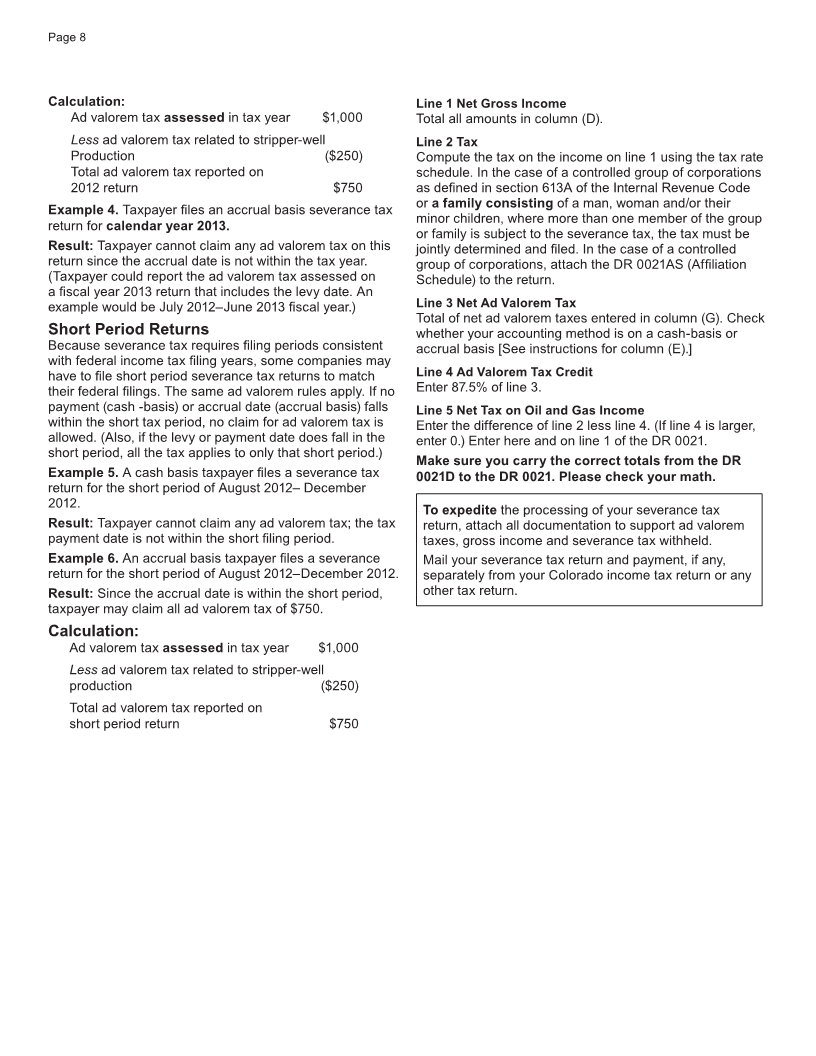

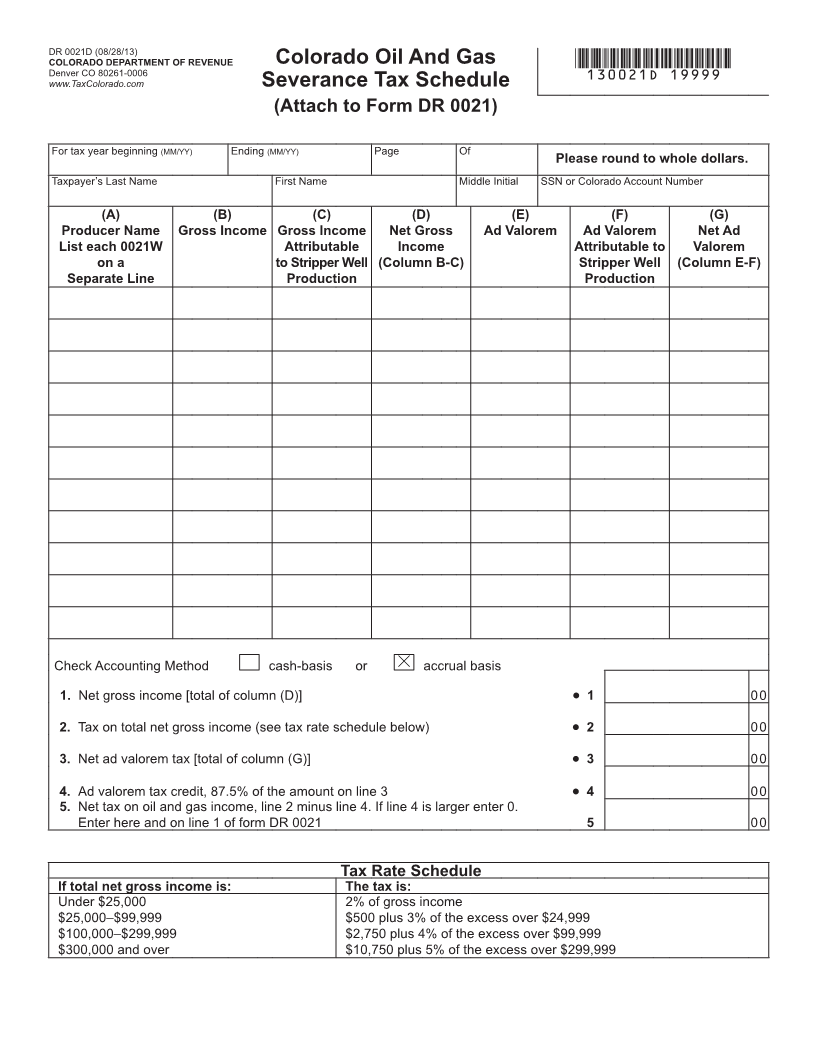

First, complete schedule DR 0021D to calculate your your bill. If you pay your tax with your return or within 30

severance tax. days of receiving a bill, the interest rate is 3% per year.

Enter the amount of late filing interest on line 11.

Line 1 Oil and Gas Severance Tax

Enter your net tax from line 5 of schedule DR 0021D. Line 12 Penalty

The penalty on any late filed return with a balance of tax

Line 2 Impact Assistance Credit due is $30 or 30% of the balance of tax due, whichever is

A credit against the severance tax is allowed with respect

greater. Enter the amount of late filing penalty on line 12.

to contributions to local government that are deemed to be

necessary because of a new severance operation or the Line 13 Estimated Tax Penalty

increase in production at an existing operation. The amount Corporations that underpay the estimated tax must enter

of the credit must be certified by the Executive Director the penalty due from the DR 0206.

of the Department of Local Affairs. Enter your impact

assistance credit for the year on line 2. Be sure to sign your return! If filing a joint return, both

spouses must sign.

Line 3 Net Tax

Subtract line 2 from line 1, and enter the difference on line To ensure proper processing, please include your

account number on the return.

3. If line 2 is larger than line 1, enter zero.

|