Enlarge image

DR 0021X (08/06/20)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

*DO=NOT=SEND* Tax.Colorado.gov

2020 Amended Colorado Oil and Gas Severance

Tax Return

Instructions

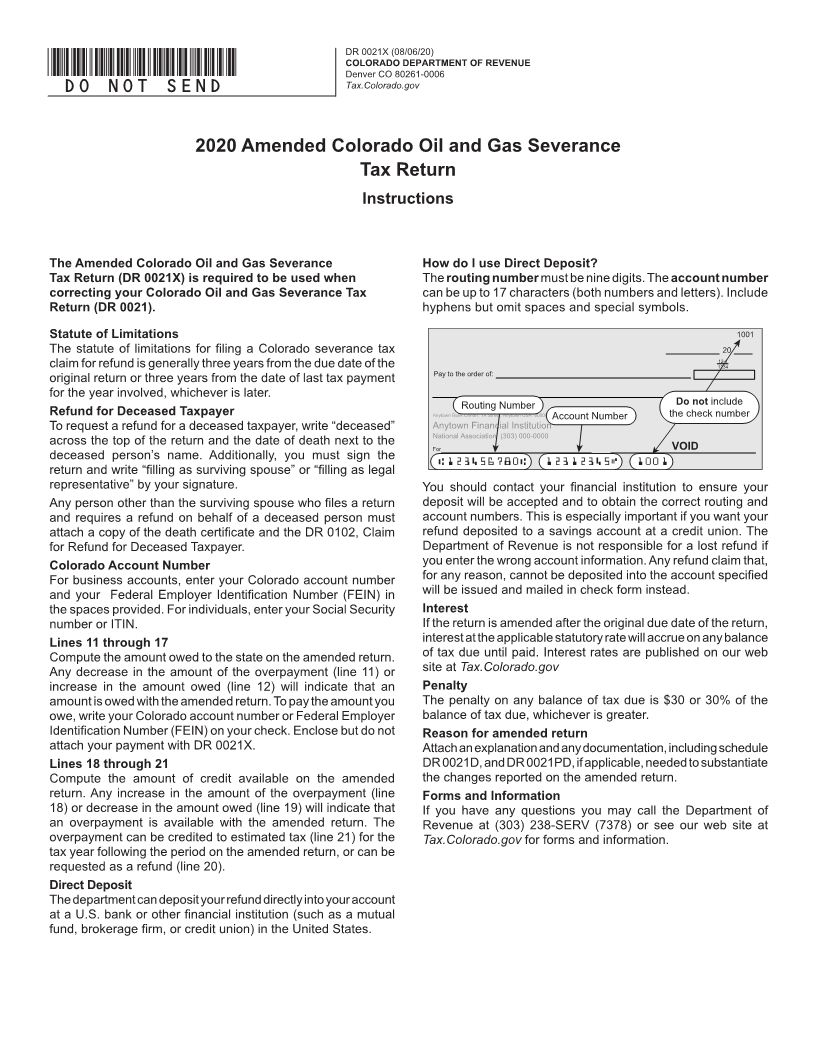

The Amended Colorado Oil and Gas Severance How do I use Direct Deposit?

Tax Return (DR 0021X) is required to be used when The routing number must be nine digits. The account number

correcting your Colorado Oil and Gas Severance Tax can be up to 17 characters (both numbers and letters). Include

Return (DR 0021). hyphens but omit spaces and special symbols.

Statute of Limitations

The statute of limitations for filing a Colorado severance tax

claim for refund is generally three years from the due date of the

original return or three years from the date of last tax payment

for the year involved, whichever is later.

Refund for Deceased Taxpayer

To request a refund for a deceased taxpayer, write “deceased”

across the top of the return and the date of death next to the

deceased person’s name. Additionally, you must sign the

return and write “filling as surviving spouse” or “filling as legal

representative” by your signature. You should contact your financial institution to ensure your

Any person other than the surviving spouse who files a return deposit will be accepted and to obtain the correct routing and

and requires a refund on behalf of a deceased person must account numbers. This is especially important if you want your

attach a copy of the death certificate and the DR 0102, Claim refund deposited to a savings account at a credit union. The

for Refund for Deceased Taxpayer. Department of Revenue is not responsible for a lost refund if

Colorado Account Number you enter the wrong account information. Any refund claim that,

For business accounts, enter your Colorado account number for any reason, cannot be deposited into the account specified

and your Federal Employer Identification Number (FEIN) in will be issued and mailed in check form instead.

the spaces provided. For individuals, enter your Social Security Interest

number or ITIN. If the return is amended after the original due date of the return,

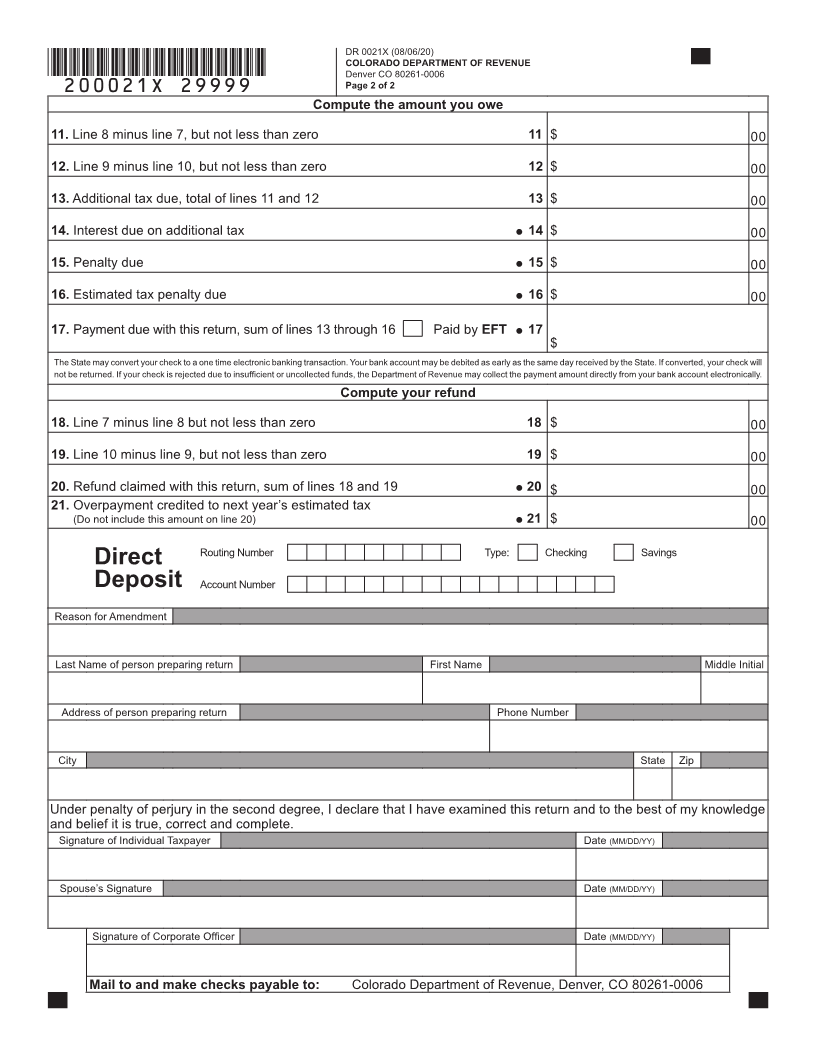

Lines 11 through 17 interest at the applicable statutory rate will accrue on any balance

Compute the amount owed to the state on the amended return. of tax due until paid. Interest rates are published on our web

Any decrease in the amount of the overpayment (line 11) or site at Tax.Colorado.gov

increase in the amount owed (line 12) will indicate that an Penalty

amount is owed with the amended return. To pay the amount you The penalty on any balance of tax due is $30 or 30% of the

owe, write your Colorado account number or Federal Employer balance of tax due, whichever is greater.

Identification Number (FEIN) on your check. Enclose but do not Reason for amended return

attach your payment with DR 0021X. Attach an explanation and any documentation, including schedule

Lines 18 through 21 DR 0021D, and DR 0021PD, if applicable, needed to substantiate

Compute the amount of credit available on the amended the changes reported on the amended return.

return. Any increase in the amount of the overpayment (line Forms and Information

18) or decrease in the amount owed (line 19) will indicate that If you have any questions you may call the Department of

an overpayment is available with the amended return. The Revenue at (303) 238-SERV (7378) or see our web site at

overpayment can be credited to estimated tax (line 21) for the Tax.Colorado.gov for forms and information.

tax year following the period on the amended return, or can be

requested as a refund (line 20).

Direct Deposit

The department can deposit your refund directly into your account

at a U.S. bank or other financial institution (such as a mutual

fund, brokerage firm, or credit union) in the United States.