Enlarge image

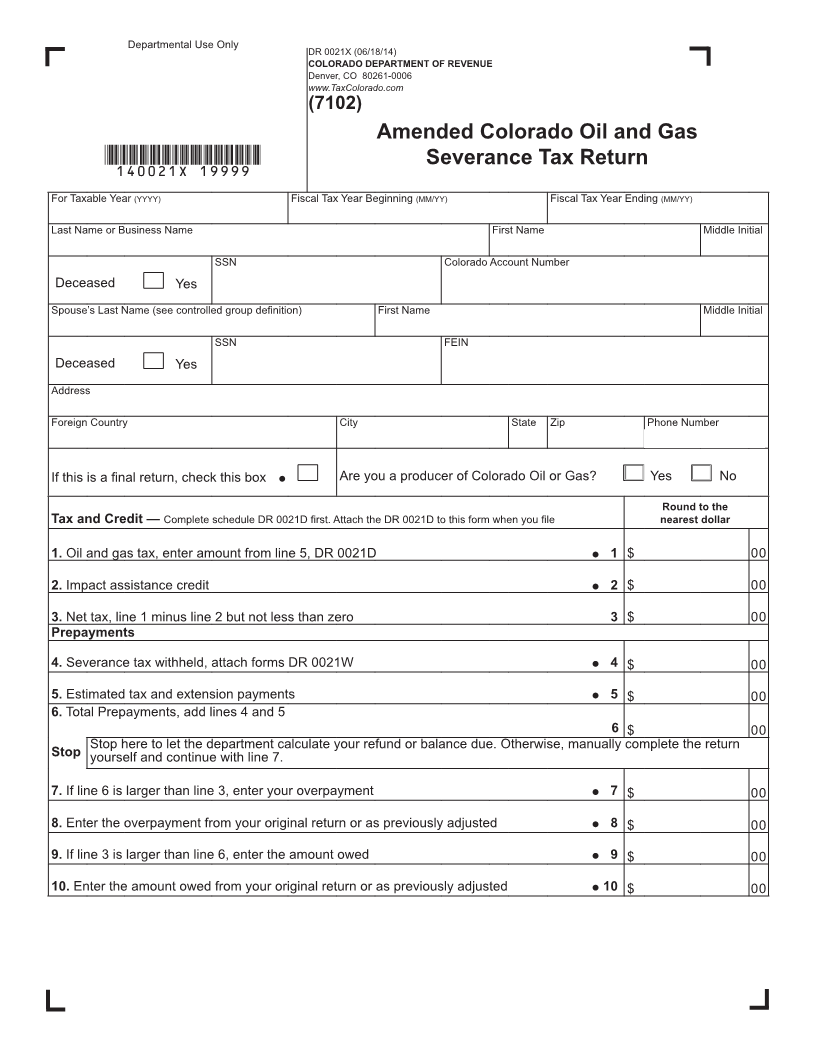

Departmental Use Only DR 0021X (06/18/14)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0006

www.TaxColorado.com

(7102)

Amended Colorado Oil and Gas

*140021X=19999* Severance Tax Return

For Taxable Year (YYYY) Fiscal Tax Year Beginning (MM/YY) Fiscal Tax Year Ending (MM/YY)

Last Name or Business Name First Name Middle Initial

SSN Colorado Account Number

Deceased Yes

Spouse’s Last Name (see controlled group definition) First Name Middle Initial

SSN FEIN

Deceased Yes

Address

Foreign Country City State Zip Phone Number

( )

If this is a final return, check this box Are you a producer of Colorado Oil or Gas? Yes No

Round to the

Tax and Credit — Complete schedule DR 0021D first. Attach the DR 0021D to this form when you file nearest dollar

1. Oil and gas tax, enter amount from line 5, DR 0021D 1 $ 00

2. Impact assistance credit 2 $ 00

3. Net tax, line 1 minus line 2 but not less than zero 3 $ 00

Prepayments

4. Severance tax withheld, attach forms DR 0021W 4 $ 00

5. Estimated tax and extension payments 5 $ 00

6. Total Prepayments, add lines 4 and 5

6 $ 00

Stop here to let the department calculate your refund or balance due. Otherwise, manually complete the return

Stop yourself and continue with line 7.

7. If line 6 is larger than line 3, enter your overpayment 7 $ 00

8. Enter the overpayment from your original return or as previously adjusted 8 $ 00

9. If line 3 is larger than line 6, enter the amount owed 9 $ 00

10. Enter the amount owed from your original return or as previously adjusted 10 $ 00