Enlarge image

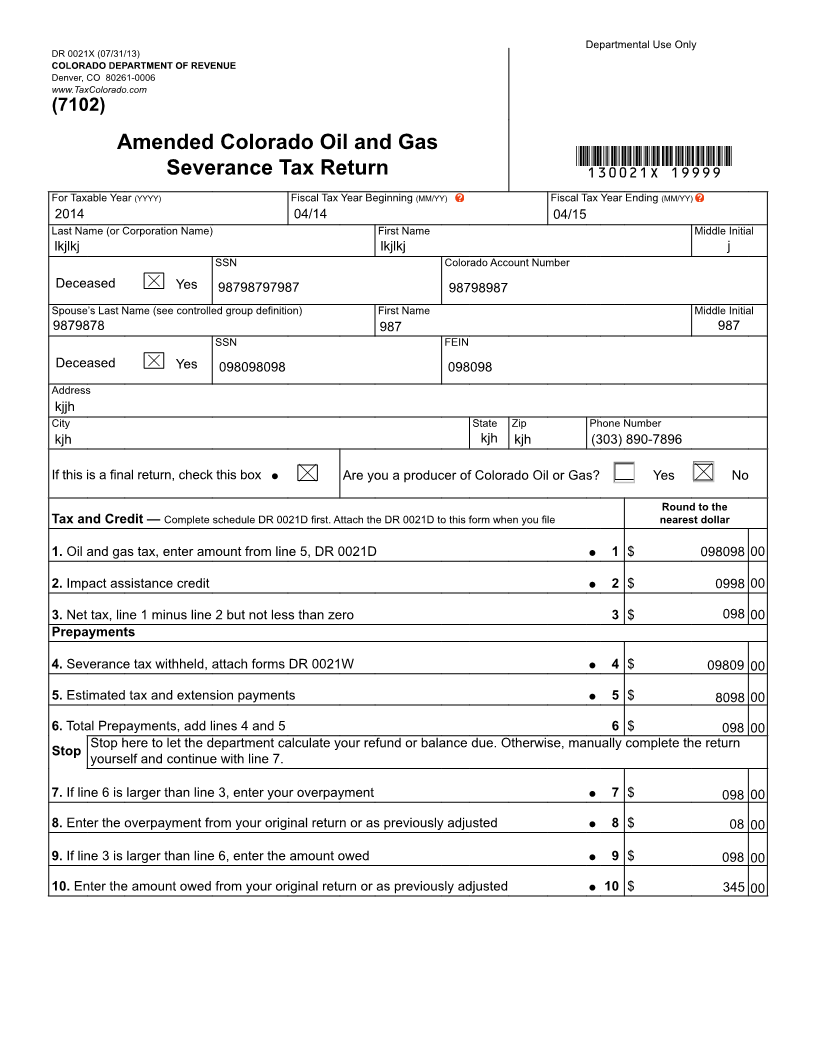

Departmental Use Only

DR 0021X (07/31/13)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0006

www.TaxColorado.com

(7102)

Amended Colorado Oil and Gas

*130021X=19999*

Severance Tax Return

For Taxable Year (YYYY) Fiscal Tax Year Beginning (MM/YY) Fiscal Tax Year Ending (MM/YY)

2014 04/14 04/15

Last Name (or Corporation Name) First Name Middle Initial

lkjlkj lkjlkj j

SSN Colorado Account Number

Deceased Yes 98798797987 98798987

Spouse’s Last Name (see controlled group definition) First Name Middle Initial

9879878 987 987

SSN FEIN

Deceased Yes 098098098 098098

Address

kjjh

City State Zip Phone Number

kjh kjh kjh ((303) 890-7896)

If this is a final return, check this box Are you a producer of Colorado Oil or Gas? Yes No

Round to the

Tax and Credit — Complete schedule DR 0021D first. Attach the DR 0021D to this form when you file nearest dollar

1. Oil and gas tax, enter amount from line 5, DR 0021D 1 $ 098098 00

2. Impact assistance credit 2 $ 0998 00

3. Net tax, line 1 minus line 2 but not less than zero 3 $ 098 00

Prepayments

4. Severance tax withheld, attach forms DR 0021W 4 $ 09809 00

5. Estimated tax and extension payments 5 $ 8098 00

6. Total Prepayments, add lines 4 and 5 6 $ 098 00

Stop here to let the department calculate your refund or balance due. Otherwise, manually complete the return

Stop

yourself and continue with line 7.

7. If line 6 is larger than line 3, enter your overpayment 7 $ 098 00

8. Enter the overpayment from your original return or as previously adjusted 8 $ 08 00

9. If line 3 is larger than line 6, enter the amount owed 9 $ 098 00

10. Enter the amount owed from your original return or as previously adjusted 10 $ 345 00