Enlarge image

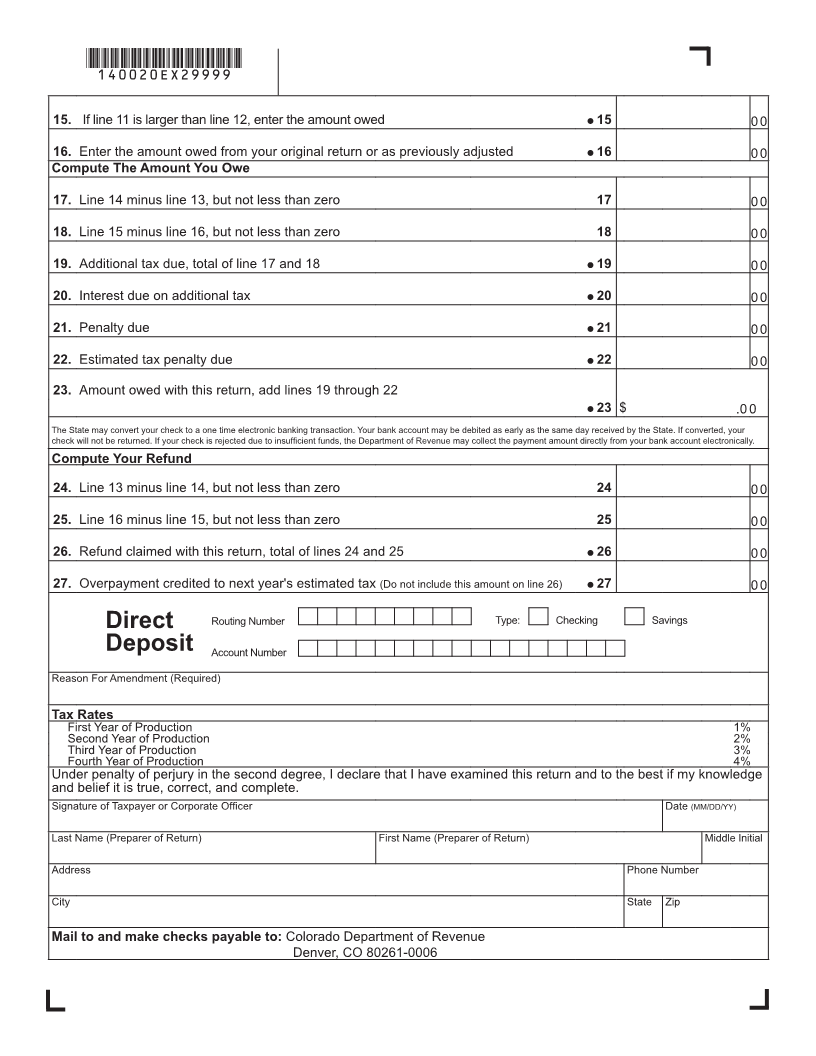

Departmental Use Only

DR 0020EX (07/09/14)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

www.TaxColorado.com

(7106)

Amended Colorado Oil Shale

*140020EX19999* Facility Severance Tax Return

Taxable Year Beginning (MM/DD/YY) Taxable Year Ending (MM/DD/YY)

Last Name or Business Name First Name Middle Initial Colorado Account Number

Address FEIN

City State Zip Phone Number

( )

Foreign Country

If this is a final return, check this box.

•

Name of facility as identified with the Colorado Department of Natural Resources

County or counties in which operation is located

Round to the Nearest Dollar

1. Total sales price of shale oil 1 0 0

Less direct and indirect expenditures for:

2. Equipment and machinery 2 0 0

3. Fragmenting, crushing, conveying, beneficiating, pyrolysis, retorting, refining and

transporting 3 0 0

4. Royalty payments 4 0 0

5. Total of lines 2,3 and 4 5 0 0

6. Gross proceeds, line 1 minus line 5 6 0 0

7. Enter the sales price of shale oil from the production of the first 15,000 tons

per day of oil shale or 10,000 barrels per day of shale oil, whichever is greater 7 0 0

8. Taxable gross proceeds, line 6 minus line 7 8 0 0

9. Tax on taxable gross proceeds. Use the tax rate schedule in the instructions 9 0 0

10. Impact assistance credit 10 0 0

11. Net tax, line 9 minus line 10 but not less than zero 11 0 0

12. Estimated tax and extension payments 12 0 0

Stop here to let the Department calculate your refund or balance due. Otherwise, manually complete the return

Stop yourself and continue with line 13

13. If line 12 is larger than line 11, enter your overpayment 13 0 0

14. Enter the overpayment from your original return or as previously adjusted 14 0 0