Enlarge image

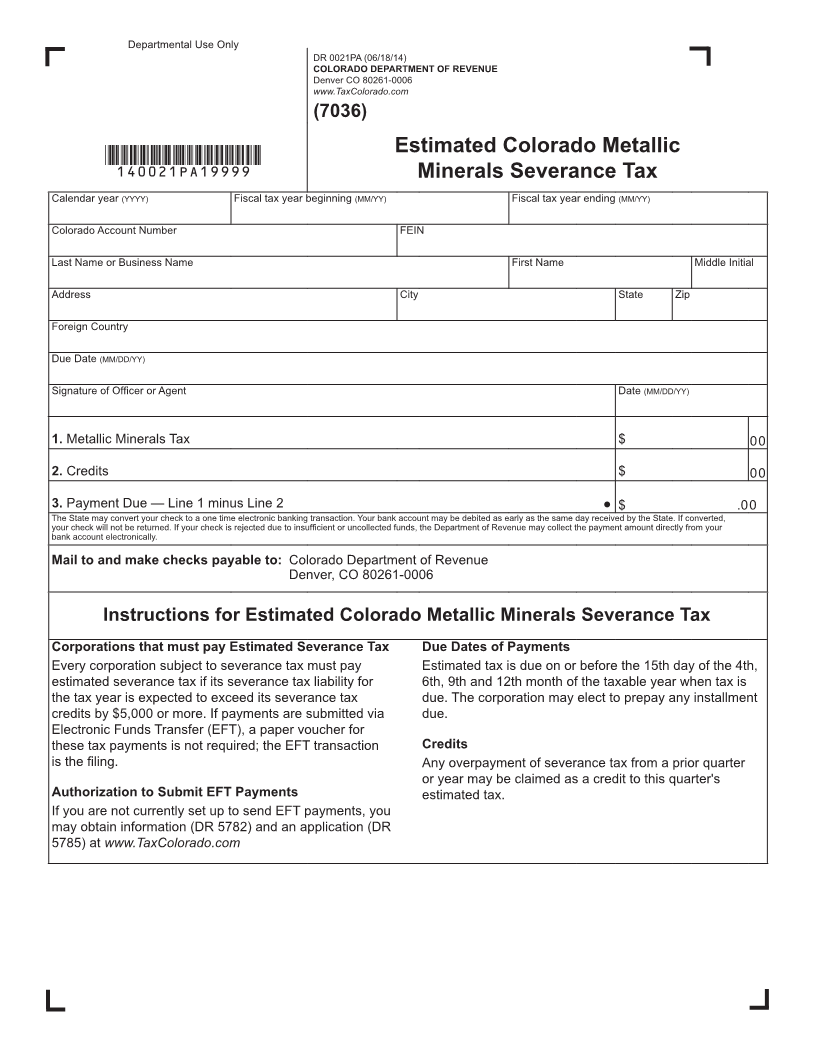

Departmental Use Only

DR 0021PA (06/18/14)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

www.TaxColorado.com

(7036)

Estimated Colorado Metallic

*140021PA19999*

Minerals Severance Tax

Calendar year (YYYY) Fiscal tax year beginning (MM/YY) Fiscal tax year ending (MM/YY)

Colorado Account Number FEIN

Last Name or Business Name First Name Middle Initial

Address City State Zip

Foreign Country

Due Date (MM/DD/YY)

Signature of Officer or Agent Date (MM/DD/YY)

1. Metallic Minerals Tax $ 0 0

2. Credits $ 0 0

3. Payment Due — Line 1 minus Line 2 $ .0 0

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted,

your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your

bank account electronically.

Mail to and make checks payable to: Colorado Department of Revenue

Denver, CO 80261-0006

Instructions for Estimated Colorado Metallic Minerals Severance Tax

Corporations that must pay Estimated Severance Tax Due Dates of Payments

Every corporation subject to severance tax must pay Estimated tax is due on or before the 15th day of the 4th,

estimated severance tax if its severance tax liability for 6th, 9th and 12th month of the taxable year when tax is

the tax year is expected to exceed its severance tax due. The corporation may elect to prepay any installment

credits by $5,000 or more. If payments are submitted via due.

Electronic Funds Transfer (EFT), a paper voucher for

these tax payments is not required; the EFT transaction Credits

is the filing. Any overpayment of severance tax from a prior quarter

or year may be claimed as a credit to this quarter's

Authorization to Submit EFT Payments estimated tax.

If you are not currently set up to send EFT payments, you

may obtain information (DR 5782) and an application (DR

5785) at www.TaxColorado.com