Enlarge image

DR 0020C (07/18/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

*DO=NOT=SEND* Tax.Colorado.gov

Instructions for Coal Severance Tax Return

DR 0020C

Definitions Tax Index under Severance Tax, Coal Tax Rates at

Coal — coal which has been processed into the form Tax.Colorado.gov

in which it is sold or otherwise used. Such processing

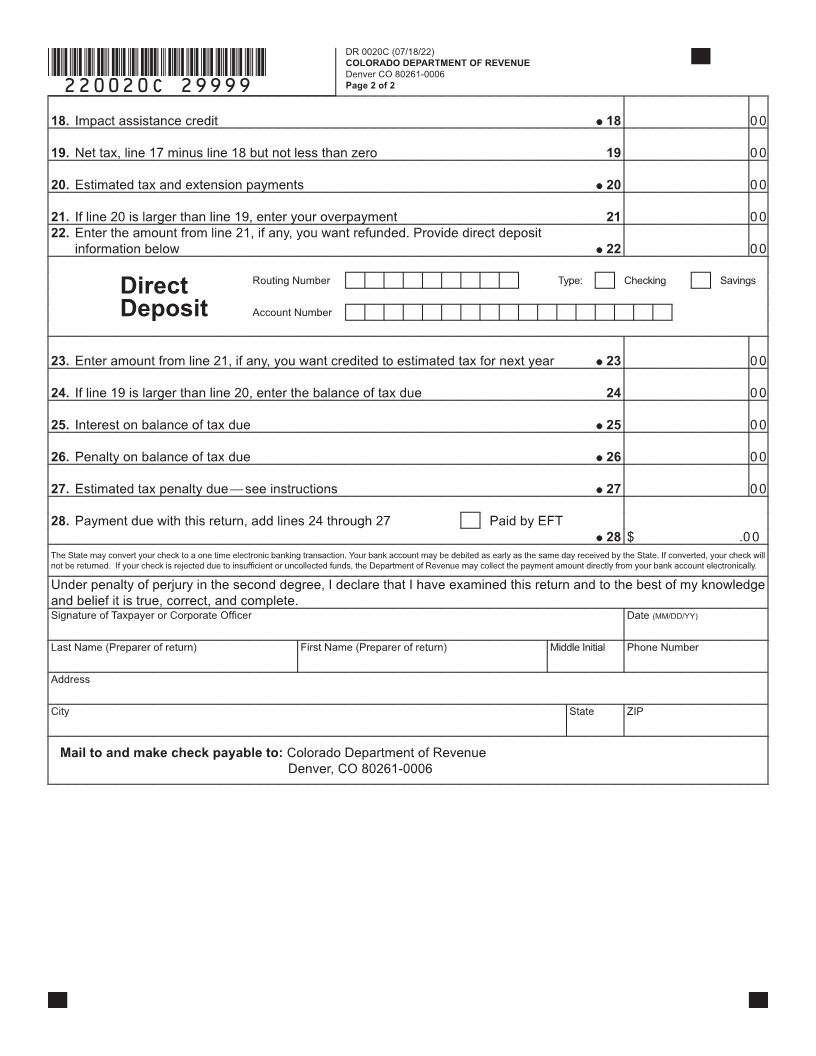

includes, but is not limited to, cleaning and washing. Impact Assistance Credit

A credit against the severance tax is allowed with respect

Taxpayer — any person engaged in the severance of coal. to contributions of property or money to units of local

Filing Requirements government. The amount of the credit must be certified by

the executive director of the Department of Local Affairs.

Every individual, corporation, business trust, partner

in a partnership, association, estate, trust or any other Estimated Tax

legal entity liable for the payment of Colorado severance Every corporation subject to Colorado severance tax

tax must file a severance tax return. This return must must file a declaration of estimated tax (DR 0021PC)

be made for the same tax year used for federal income if its severance tax liability for the current tax year

tax purposes and is due on or before the 15th day of the can reasonably be expected to exceed its Colorado

fourth month following the end of the taxable year. severance tax credits by $5,000 or more.

Controlled Group Interest and penalty

In case of a controlled group of corporations as defined If the return is filed after the due date, interest at the

in section 613A of the Internal Revenue Code or of a current statutory rate is due on any balance of tax due

family (an individual, the individual's spouse, and their until paid. A penalty of the larger of $30 or 30% of the

minor children) where more than one member of the balance of tax due is due on any delinquently filed return.

group or family are subject to the severance tax, the tax A corporation that underpays its estimated tax may owe

must be jointly computed and the severance tax return an estimated tax penalty.

must be jointly filed under the name of the principal

taxpaying corporation, the married couple or the single Extension of Time for Filing

adult. The DR 0021AS, available upon request from An automatic six-month extension of time for filing the

the Department, must be included in the case of a severance tax return is allowed. This is an extension of

controlled group of corporations. time for filing your severance tax return, not an extension

of time for paying your tax. If you owe additional tax, use

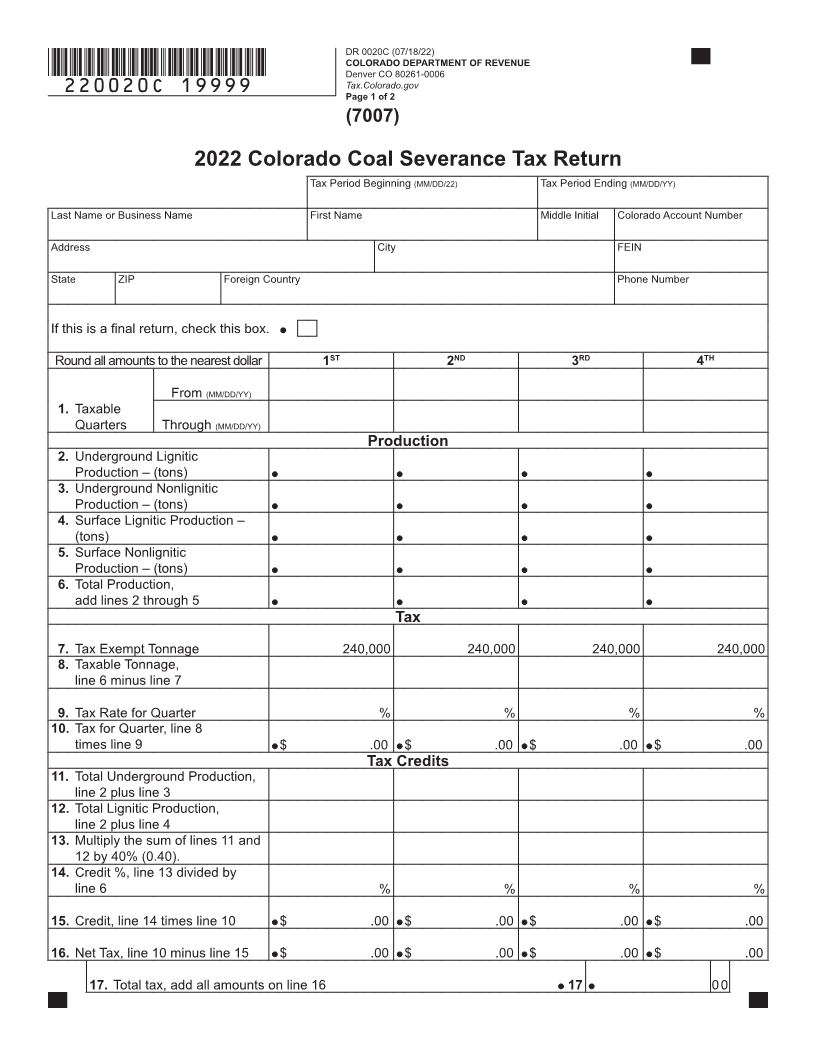

Taxable Quarters

the DR 0021SC to submit an extension payment.

The coal severance tax liability for the year is the sum of

the tax computed for each of four quarters. Divide your tax Amended Return

year into four quarters. If you find it necessary to amend your Colorado severance

tax return, you are required to file the DR 0020CX.

Production

Report on lines 2 through 5, your total tonnage of Information

coal production per quarter in accordance with the Forms and additional information can be accessed on the

classifications given. Report your total quarterly coal Web site at Tax.Colorado.gov or by telephone at

production on line 6. 303-238-SERV (7378).

Computation of Tax

Severance coal tax rate charts are available in the