Enlarge image

DR 5714 (05/20/16)

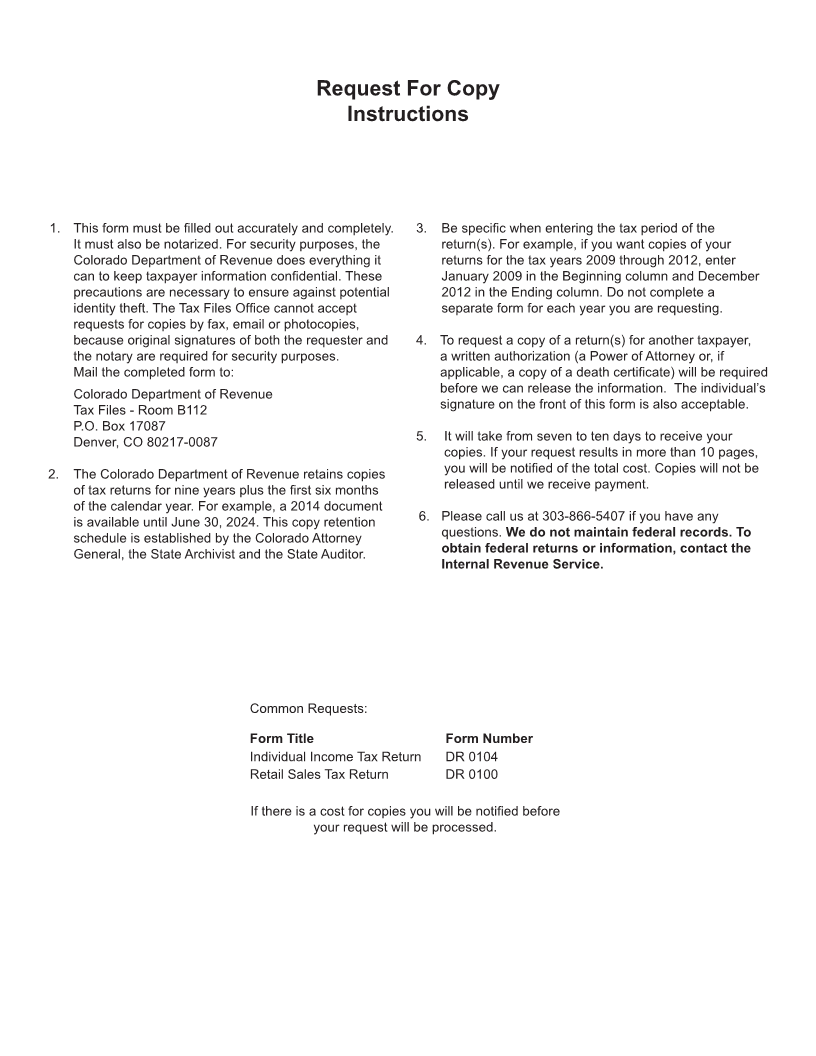

COLORADO DEPARTMENT OF REVENUE

Tax Files - Room B112

P.O. Box 17087 Request For Copy of Tax Returns

Denver, CO 80217-0087

(See Instruction Sheet For Important Information)

MAIL COPIES TO:

Name

Department Use Only

________________________________________________________________ Processed By

Address

________________________________________________________________ Section

City/State/ZIP

________________________________________________________________ Date Processed (MM/DD/YY)

In Accordance With The Provisions of C.R.S. 39-21-113, I Hereby Request That The Department of Revenue Prepare:

For Tax Period

Tax Return (Form Number) Beginning Tax Period Ending

A Copy of:

(For Personal or Non-Legal Use)

A Certified Copy of:

(If Required for Legal Use or

Medical Marijuana Red Card)

Proof of Filing Return for DL,

ID or Permit (CO-RCSA SB251)

Refund Amount For Tax Year

A Copy of a Cashed Refund Check

Taxpayer Last Name First Name Middle Initial

Current Address City State Zip

Social Security, Account Number or ITIN Number Phone Number

Signature and Notarization Required To Process Request

I declare under the Penalty of perjury in the second degree that I subscribed and filed said tax return(s) either for myself or

for the taxpayer named above as an officer of the company or an authorized representative thereof and that the signature

which appears on the tax return and the one that appears below are both my signatures.

Signature of Requester Spouse’s Signature (if joint) Date (MM/DD/YY)

Subscribed and sworn to or affirmed before me this _____Day of ________________________________,20______In the County of

___________________ State of_______________________.

Signature of Notary My Commission Expires

SEAL

Please do not remit any payment with this request. The first 10 pages will be provided free of charge. Subsequent pages

cost $0.25 per page. If payment is required you will be notified prior to your request being processed.